The United States has implemented significant tariff increases in late 2024 and early 2025, reshaping cost structures across multiple industries. The Biden administration’s Section 301 tariffs, finalized in September and December 2024, raised duties on Chinese imports such as electric vehicles (100%), EV batteries (25%), and steel (25%). On February 4, 2025, President Trump introduced broader tariffs: 25% on all imports from Canada and Mexico (10% on Canadian energy resources) and 10% on all Chinese imports.

These policies, aimed at protecting domestic industries and addressing trade imbalances, increase import costs, directly impacting revenue growth management (RGM) and pricing strategies. This article delves into the hardest-hit industries and their implications, while addressing emerging revenue growth management (RGM) and pricing obstacles.

Table of Contents

Tariffs will Stay in Place

These recent tariffs build on earlier U.S. trade policies that remain active, reflecting a sustained push to reshape global commerce. In 2018, tariffs targeting Chinese electronics and machinery were introduced to counter perceived unfair trade practices and protect American manufacturers, driving up costs for imported tech goods. Around the same time, duties on steel and aluminum from various countries aimed to revive domestic production and address national security concerns. These measures, still in effect, have shifted supply chains and heightened costs across industries, amplifying the impact of the current tariff wave on an already pressured economy.

The Dual Impact of Tariffs: Challenges and Opportunities

Historically, tariffs have not only created challenges but also fueled innovation, driving cost reductions and market diversification as companies adapt to trade barriers. Past duties on imported autos prompted Toyota to establish manufacturing plants in the U.S., such as its Kentucky facility opened in 1988, reducing reliance on Japanese imports while optimizing production costs and tailoring offerings to American consumers. Similarly, tariffs on Chinese goods pushed tech firms like Apple to explore assembly in India and Vietnam, diversifying their client base and cutting costs through localized supply chains.

Moreover, tariffs on Chinese goods prompted manufacturers to expand exports to Latin America and Africa, seeking new clients as U.S. markets tightened—companies like Huawei has pivoted to these regions for tech sales. Canadian softwood lumber firms, facing U.S. tariffs, increased exports to China, Japan, and Europe, with companies like Canfor ramping up shipments to Asia to offset North American losses.

These examples highlight how tariffs can spark strategic shifts, encouraging firms to innovate processes and expand into new markets to maintain competitiveness.

Pricing Challenges due to Tariffs

Tariffs disrupt RGM—the optimization of revenue via pricing, volume, and mix—and complicate pricing decisions:

Automotive

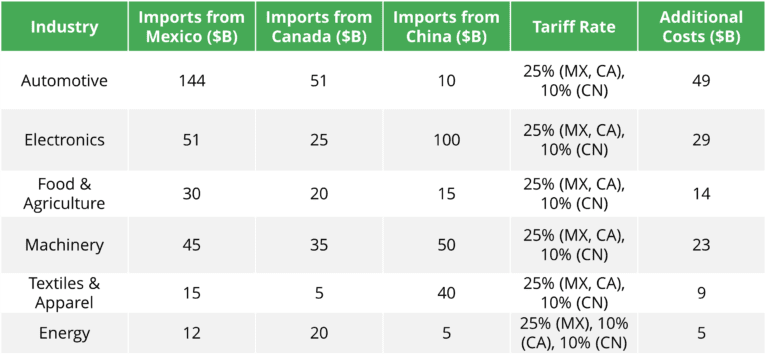

Exposure & Implications: Imports from Mexico ($144 billion) and Canada ($51 billion) face a 25% tariff, adding ~$48 billion; China’s $10 billion incurs 10% ($1 billion).

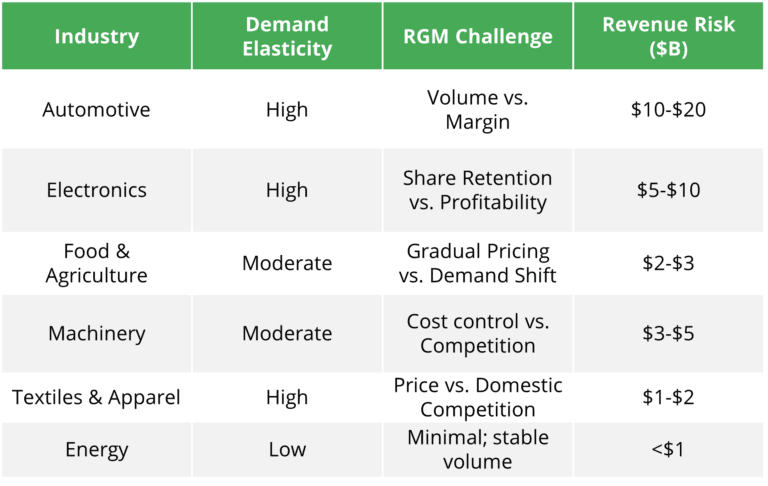

Vehicle and parts costs spike—e.g., a $30,000 car absorbs $7,500 more. Elastic demand could cut sales 6-12% per 5% price rise, jeopardizing $10-20 billion in revenue. Domestic firms may benefit, but importers like General Motors (GM) face intensified competition.

RGM Issue: Balancing volume and profitability is a tightrope—overpricing alienates price-sensitive buyers, while underpricing erodes financial stability. RGM struggles to predict demand shifts accurately, as consumer sentiment varies by region and brand loyalty wanes under cost pressures. Promotions to maintain sales risk diluting per-unit revenue, complicating long-term growth targets.

Electronics

Exposure & Implications: China’s $100 billion (10%, $10 billion) and Mexico/Canada’s $76 billion (25%, $19 billion) yield $29 billion in costs, atop existing Section 301 tariffs (e.g., 25% on chips).

$500 smartphone’s components rise $15-$35, with high elasticity risking 4-10% volume drops and $5-10 billion in lost sales. Domestic rivals could gain traction, squeezing importers’ market share.

RGM Issue: Preserving market share in a cutthroat sector pits higher prices against budget-conscious customers, while absorbing costs stifles funds for R&D. RGM faces the hurdle of aligning pricing with fast-evolving consumer trends, as tariff costs disrupt competitive parity. Volume-focused strategies may erode brand value, challenging revenue forecasts and growth ambitions.

Food & Agriculture

Exposure & Implications: Mexico ($30 billion) and Canada ($20 billion) at 25% add $12.5 billion; China’s $15 billion (10%) adds $1.5 billion.

Prices for items like avocados climb 10-20% (e.g., $0.40 more per $2), with moderate elasticity limiting volume loss to 5-10%. Still, $2-3 billion in sales may shift to local producers, pressuring importers.

RGM Issue: Revenue stability hinges on gradual price increases, but excessive hikes can shift demand to local substitutes undermining import-reliant firms. RGM must navigate unpredictable low-income consumer behavior, where price sensitivity spikes under economic strain. Balancing volume with margin preservation is tough, as promotional efforts to retain customers can shrink profits and complicate revenue planning.

Table 1: Potential Additional Costs from Trump’s Tariffs (2025)

Table 2: Elasticity & RGM Challenges by Industry

Strategies to Address Tariff Changes

Pricing new markets correctly requires understanding customer needs and competitive dynamics, ensuring tariffs don’t derail expansion. In a tariff-heavy environment, businesses can turn challenges into strengths with strategic actions that secure revenue and margins.

Dynamic Pricing:

One powerful approach is adopting dynamic pricing and promotions, which can preserve $5-10 billion in revenue across affected sectors by softening demand shocks. For instance, gradual price increases of 3-5%—paired with targeted offers like 0% financing for cars or bulk discounts on food—keep customers engaged without triggering steep volume drops. This method leverages real-time analytics to stay within elasticity limits (e.g., ~5% in electronics), ensuring revenue stability while maintaining market presence, a critical edge in volatile times.

Cost Optimization:

Equally impactful is cost optimization, which can safeguard $3-7 billion in margins without forcing price hikes that risk losing customers. By trimming operational expenses—say, 2-5% through renegotiated supplier contracts or automation—firms in electronics and machinery can offset 10-15% of tariff costs, per industry standards. This approach not only protects profitability but also buys time to adapt, making it a lifeline for companies facing squeezed margins, especially smaller players who can’t easily absorb losses.

Supply Chain Diversification:

Another game-changer is supply chain diversification, offering long-term relief by cutting tariff exposure 20-30% and boosting annual revenue growth by 3-5%. Relocating sourcing to tariff-free regions like Vietnam or India, though requiring $5-10 billion upfront and 6-12 months to execute, positions firms ahead of slower competitors. This stability allows consistent pricing, reduces reliance on volatile import markets, and opens new growth avenues—a strategic win for industries like automotive and textiles facing steep cost hikes.

Assortment Optimization:

Adjusting the product mix also holds promise, potentially lifting revenue 2-4% by shifting focus to premium or domestic offerings. Emphasizing luxury vehicles or US-grown produce reduces import dependence, sidestepping tariff pressures while appealing to higher-margin segments. With savvy marketing, this tactic sustains profitability without broad price increases, offering a buffer against demand shifts and enhancing RGM outcomes across sectors like food and automotive.

Short-Term Quick Hits

- Building price increases into the core product or service—embedding a 3-5% hike into offerings like enhanced vehicle features or device upgrades—ensures customers face minimal pushback.

- Maintaining a competitive price position means matching price increases of tariff-hit rivals, even if not directly affected, to align with market shifts and reset expectations.

Must Not Do

- Avoid passing cost savings back to customers; instead, leverage efficiencies from innovation or manufacturing adjustments to widen margins as customer expectations reset around higher market rates.

Conclusion

Recent US tariffs hit automotive (~$49 billion in costs) and electronics (~$29 billion) hardest, threatening revenue and competitiveness. RGM and pricing challenges—balancing hikes, absorption, and volume—demand strategic finesse, with automotive facing the steepest risks. Yet, opportunities like dynamic pricing, cost cuts, and supply chain shifts offer pathways to mitigate impacts, stabilize revenue, and even gain market edge.

If you would like Revenue Management Labs to help you craft a winning pricing strategy and product mix, get in touch today!