Trade headlines are once again dominating the news, bringing renewed uncertainty for North American manufacturers. Just in the past week, the U.S. has taken a firmer stance with China, with reports that former President Trump is unwilling to lift existing tariffs without significant concessions (CNBC, Fox News). Meanwhile, some reports suggest he may consider tariff reductions on certain goods (CNN), adding further confusion to the trade landscape.

Across the Atlantic, the European Union is preparing countermeasures in response to U.S. tariff actions (CNBC). Domestically, new threats have emerged, including a proposed 100% tariff on foreign-made films to support the struggling American film industry (PBS). In Canada, companies are already feeling the impact, with many being forced to pivot operations to the U.S. or explore new international markets (Reuters).

All of this reinforces what manufacturers already know: tariffs are no longer short-term policy levers. They are long-term business disruptors.

From cost pressures and supply chain instability to compressed margins and shifting customer expectations, the ripple effects of tariffs continue to spread. Many companies are reacting quickly, but reaction alone isn’t enough. Manufacturers need structured, forward-looking pricing strategies to navigate this volatility, and they need them now.

Table of Contents

What Manufacturers Should Expect

Tariffs, once imposed, tend to linger. History shows they often outlast the political disputes that created them. The 1964 U.S. tariff on imported light trucks, originally a response to European agricultural trade barriers, is still in effect more than six decades later. This persistence reshapes entire markets and calls for long-term strategic pricing plans, not temporary fixes.

We’re also seeing that companies not directly impacted by tariffs often adjust prices anyway. When tariffs raise price expectations across a category, competitors frequently follow suit. The 2018 washing machine tariffs are a prime example, where unaffected U.S. manufacturers still increased their prices to match the new consumer benchmarks.

Another consistent pattern is businesses restructuring their global operations to reduce tariff exposure. In 2018, Apple shifted more iPhone production to India and invested in a new U.S.-based chip facility, decisions driven largely by rising tensions with China. Similar moves are now underway across sectors as firms reconfigure supply chains to limit their risk.

Tariffs can also push companies to innovate. With the 2018 steel tariffs, aerospace companies accelerated investment in composite materials, aiming not only to reduce costs but also to improve performance, particularly fuel efficiency.

These examples point to a clear trend: tariffs don’t just increase costs. They influence competitive strategy, operational structure, and innovation at every level.

Avoiding the Common Pitfall

The instinctive response to rising costs is to raise prices. In theory, this passes tariff-related expenses along to the customer. In practice, it often does more harm than good.

Price hikes that aren’t grounded in customer willingness to pay can erode brand value, weaken loyalty, and open the door for more competitively positioned rivals. Rather than relying solely on a cost-plus approach, companies must understand the value perception and sensitivity of their customers.

A pricing strategy that’s informed by data, not just costs, will consistently outperform reactive markups.

How to Price Strategically in a Tariff-Driven Environment

To stay ahead, manufacturers should take the following actions:

Incorporate tariff-related costs directly into core pricing

Avoid treating them as temporary surcharges. This creates pricing stability and avoids customer confusion.

Align pricing decisions with market dynamics

Even if you aren’t directly affected, adjusting prices in line with competitors can help avoid leaving margin on the table or signaling lower value.

Anticipate how competitors may respond

Monitor changes in sourcing or production strategies to predict shifts in market pricing.

Price new markets with intention

When expanding to avoid tariffs, factor in local market expectations, competitor presence, and willingness to pay, not just cost structures.

Retain cost savings from operational efficiencies

If sourcing changes or innovation lead to cost reductions, avoid automatically passing those savings back. Instead, protect the margin to support long-term investment.

Just as important is how pricing changes are communicated. Sales teams need clear, consistent messaging that explains the rationale behind pricing decisions, reinforces value, and builds confidence at the customer level.

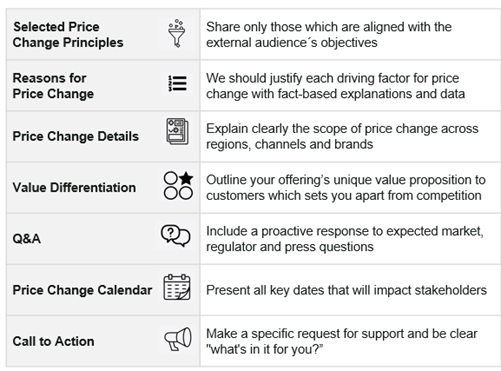

Best practices in delivering pricing communication

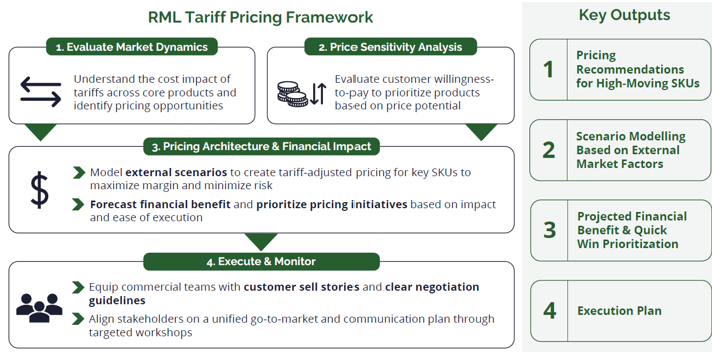

Revenue Management Labs Tariff Framework

Final Thoughts

Tariffs are complex, but they don’t have to be chaotic. For manufacturers willing to take a structured, data-driven approach, pricing can become a lever for margin expansion rather than just damage control.

The key lies in embedding tariff costs into core pricing, forecasting competitive responses, and using pricing strategy to support broader business shifts such as sourcing innovation, market entry, or customer retention.

At Revenue Management Labs, we work with manufacturers to turn complexity into opportunity. We help teams align pricing with strategy, empower sales with clarity, and protect margins in even the most uncertain trade environments.