Last updated: 30 April 2024

Competitive pricing is a common strategy that helps maximize your margins and prevent market share losses. Many organizations also use the business insights they receive and the dynamic competitor data to make strategic long-term decisions that drive sustainable growth.

Competitor insights are fundamental for competitive pricing strategies but there is more to it than simply matching price tags. Customers evaluate price when deciding on purchases, but they also weigh real and perceived value when choosing between you and a competitor.

In this article we go over how to build and execute a complete competitive pricing strategy that gives you an edge in the market:

Article Contents

What is Competitive Pricing?

Why Competitive Pricing

Advantages of Competitive Pricing

A competitive pricing strategy is an easy-to-understand tool used by many large and small businesses offering a wide range of goods and services. The strategy fosters better understanding of your competitor landscape and allows for faster price changes, ensuring you match customer willingness to pay.

Almost every company implements competitive pricing to some degree; here are some reasons why you should as well:

Simple Framework

The framework for setting up competitive pricing is straightforward. Steps you can take to set up your competitive pricing strategy are:

- Identify your key competition

- Determine their price position and strategy

- Find the values they offer across key customer segments

- Price your offerings compared to competition based on the values you offer

Finding competitive data may be challenging, but it will help you better understand your customer base and who customers view as your competitors when making a purchase.

Low Risk and High Success Rate of Competitive Pricing

With a competitive pricing strategy, you identify the prices that customers are willing to pay given that these are already being charged in the market. You don’t have to worry that you’re leaving money on the table by undercutting your prices. Neither do you have to fear creating unrealistic offers above what the market will accept.

Pricing Strategies Synergy

By incorporating competitive pricing analysis with other pricing strategies like cost-plus and value-based, you can gain insights from multiple perspectives.

By using competitive pricing alongside other strategies, we can judge:

- The value we offer our customer segment vs the competition

- The price that translates to the value being offered

- The price that optimizes our margins

Dynamic Pricing

One of the biggest competitive pricing advantages is the ability to adjust your pricing immediately in a dynamic fashion, which makes it versatile and responsive to competitor changes.

Dynamic pricing can be especially helpful for online sellers. On storefronts like Amazon, competitive prices can change in a matter of minutes.

Disadvantages of Competitive Pricing

Competitive pricing strategies can improve your profit margins and your bottom line. But a poorly designed strategy can cost your business significant revenue and leave you chasing after the wrong customers.

Competitive pricing usually falls short when it comes to the quality of the information you have on your competitors. For heavily regulated industries or commodities, most organizations have little trouble acquiring competitor insights. But with more unique products or services, identifying the competition and relative prices can be challenging. Here are some issues to watch out for:

Unsustainable Price Point in the Long Term

Incomparable Products or Services

A Ferrari dealer will soon go broke if they try competing with a Honda dealer on price. Identifying your competitors and comparable items will help you understand what your customer needs are and what they are willing to pay. Selling diamonds for the price of coal is unsustainable and will inevitably lead to bankruptcy or reorganization.

Indistinguishable Products and Services

Lack of Quality Data on Competitors

Industries like consumer packaged goods have readily accessible market data that makes competitive pricing analysis easier. In other industries, especially B2B, data can be harder to find. In those cases, a solid source of data often emerges through conversations with customers and sales reps who help determine your key competitors, their purchase journey, and relative price position.

Competitive Pricing Strategies

- Premium pricing: charging more than your competitors

- Equal/Line Pricing: charging the same price as your competitors

- Discount Pricing: charging less than your competitors

- Your target customer segment

- The value attributes they find important when making a purchasing decision.

- The other competitors they consider when deciding on a purchase

- Your ranking against your competition across those key value attributes

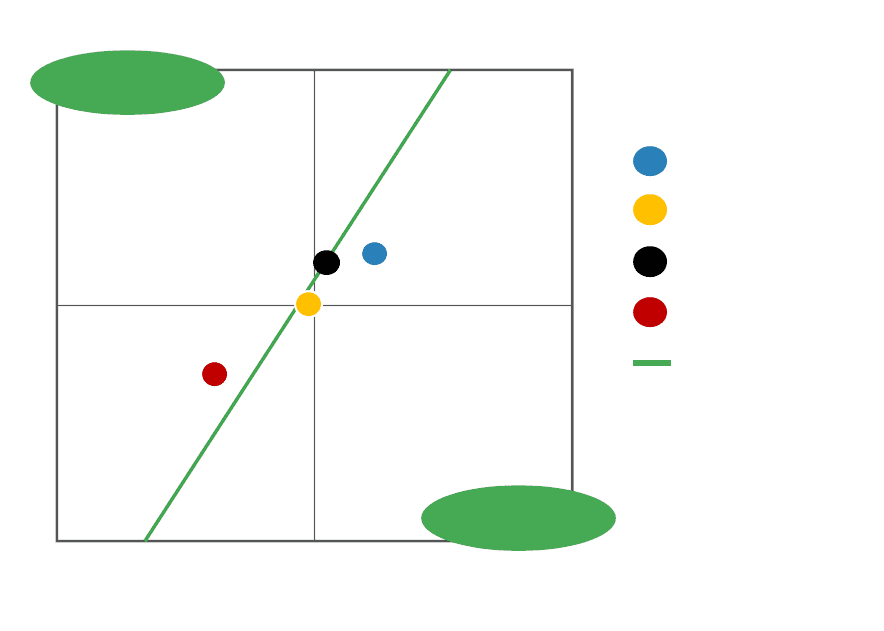

- Your price value (advantaged or disadvantaged) vs your competition

Premium Pricing

When It Works

A premium pricing strategy works if consumers see your offering or product as more valuable than the competition. For products or offerings that are commoditized, your value options are limited, and you will have to primarily compete on price.

Case Study: Competitive-based Pricing Strategy for an RV Parts Manufacturer

In 2019 Revenue Management Labs built a competitive-based pricing strategy for an RV parts manufacturer who wanted to price their RV parts in accordance with the market.

After studying industry data and competitive price intelligence, we determined that our client offered more value than their competition due to their superior reliability, fit, variety, and customer service.

Revenue Management Labs uncovered that our client’s product justified higher prices, and the market agreed. Our client received a hefty 350% ROI, using our services.

Increasing Profitability through Adjusting Volume Mix

Client Story Increasing Profitability through Adjusting Volume Mix for a Premier Recreational Vehicle Parts Manufacturer Identifying the factors eroding margins and gaining alignment with the

When It Doesn’t Work

Premium pricing doesn’t work when there are no added value attributes for competitor differentiation. An example of this would be commodities or basic necessities like milk. But beware, even commodities create value through brand, features (2%, homo, filtered, etc.), and customer service.

Equal Pricing

Case Study: Competitor Price Analysis for a Large Consumer Packaged Goods Company

In 2022 a large company in a mature sector of the CPG industry hired Revenue Management Labs for a competitor price analysis.

We encouraged our client to use a Price Match strategy on wider portion of the portfolio to ensure there was no price gap with competition. We recommended this because there is very little differentiation amongst them and their main competitor.

Since our client and their competitor owned roughly 95% of the market, there was little room to compete on price. As a result, our client’s portfolio of products has seen a stable growth in demand, consistent with overall market trends, without taking on any additional unnecessary risk by increasing their price gap as compared to their competition.

Price matching a competing product or service is your best approach in situations where you and your competitors have very similar offerings. In this example of competitive pricing, you focus on ways to communicate your added value rather than undercutting your competitor in a price war.

When It Works

Luxury goods keep their product prices in line with their competitors to communicate equal value. This competitive-based pricing strategy ensures these offerings retain their perceived value with their target market.

Equal pricing also occurs in mature markets where there is little to no competitive differentiation between products. Milk, bread, and eggs are examples of equally priced commodities.

When It Doesn’t Work

Equal pricing doesn’t work when there are different value attributes associated with the products being purchased. You need to understand what sets your product apart from the competition and what makes customers choose your offerings.

Discount Pricing

When It Works

A penetration pricing strategy works when you are able to match your competition on the price-to-value ratio. Using penetration prices on sticky products with high customer retention can generate long-term revenue and grow your customer base.

Case Study: Phone Maker Leverages Reputation for High Value-to-Price Ratio

On April 23, 2014, phone maker OnePlus introduced the OnePlus One, a smartphone with specs comparable to higher-end Samsung models at a much lower price.

OnePlus phones became popular with budget-minded computers and OnePlus established itself as a serious contender in the highly competitive smartphone market.

After making its name in the budget market, One Plus leveraged its reputation for a high value-to-price ratio to market phones catering to multiple customer segments. The brand still continues to grow.

When It Doesn’t Work

While lowering your prices may work in the short term, it can also lead to a loss of brand value. This is especially true of premium or luxury offerings.

When you set a very low price, you may encounter pushback from customers who become attached to that price. Or you may start a price war that leads to lower margins across the entire category.

Competition by Industry

You can apply a competition-based pricing strategy in almost all industries. But competitive mapping can be more challenging in certain industries.

For example, B2B SaaS companies frequently offer unique feature bundles to customers. Without their own price intelligence, SaaS companies often have trouble determining which features to bundle and what price to set. Without this data, they wind up pricing their services blindly or making guesstimates that fail to match their company’s value.

By contrast, B2C e-commerce companies depend entirely on competitive pricing because every company directly competes with at least 15-20 others.

The key to effective competition-based pricing strategies is leveraging data to optimize profits instead of blindly following the crowd.

Competitive Pricing Analysis

A competitive pricing analysis defines who your competition is and how they’re pricing their products or services. Both direct competitors who have similar offerings and indirect competitors who offer the same functional benefits as your product or service can be considered here.

Armed with that information, you can assess the best prices relative to your competitors and the value they provide.

When to Conduct a Competitor Pricing Analysis

Depending on your industry’s business cycle, you should be rethinking your competitor pricing strategies every 3 to 12 months. Competitive pricing should be a continuous process where your team always has updated examples of competitive pricing strategies based on real-time events and changes.

Competitor Analysis Walkthrough

1

Identify Competitors

2

Identify Customer Segments

3

Identify Key Competition by Customer Segment

4

Gather Competitor Intelligence

5

Identify Gaps

6

Scenario Modelling

7

Price Setting

8

Integrate Process

Competitive price analysis can be challenging. To help, we’ve provided a clear set of instructions that will help you compile the information you need, with suggestions as to how often it should be done.

Identify Your Competitors

You can’t create competition-based pricing strategies without identifying your competitors. Who are your established competitors and what new competitors have recently arrived in the market?

Instead of creating a long list of every possible competitor, concentrate on three or four of your strongest competitors.

To extract the most insight, combine qualitative methods like conversations and interviews with a data-driven quantitative analysis.

Qualitative Approach

A qualitative approach explores customer mindsets in detail. Through focus groups, interviews, and conversations you learn more about what is important to your target market and how you can best address their needs and concerns.

Quantitative Approach

A quantitative approach weighs, measures, and crunches data to find statistical meaning amidst all the information. Through examining large data sets and survey information, a quantitative analysis lets you conduct share decomposition and measure cross-price elasticity so you can respond quickly to trends you might otherwise miss.

Identify Customer Segment & Value Attributes They Care About

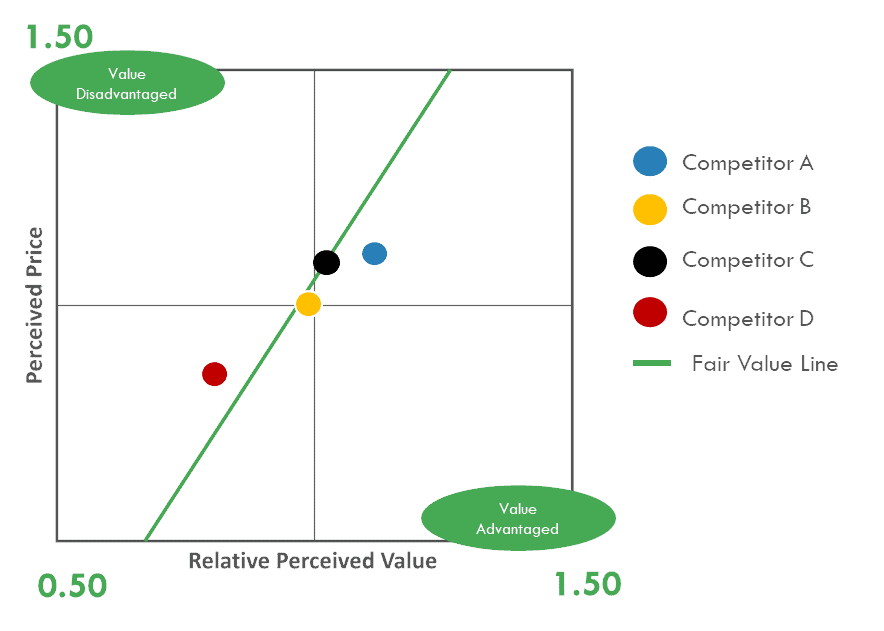

Customer segmentation helps you better understand your target market. By sorting and grouping your customers, you can get a better idea of why different competitors are winning their purchasing dollars.

Main Types of Customer Segmentation

Customer segmentation separates your customers into groups based on shared traits. Two of these segments that we’ll use for our competitor analysis are:

- Behavioral: How the user interacts with your brand.

- Demographic: The users age, gender, income, family structure, etc.

This information is crucial to understanding and predicting buying behaviors – giving you insight into how your target demographic will respond to a product and its pricing. The table below summarizes additional types of buckets to segment customers; for a more detailed breakdown, click the following link: Customer Segmentation: The Who, Where, How, and Why (revenueml.com)

Types of Customer Segmentation

| Geographic | Demographic | Behavioural | Psychographic | |

|---|---|---|---|---|

| Segmented by | Location:

| Characteristics:

| Actions:

| Personality:

|

| Benefits | Quick and cost effective to implement | Easy data collection via software like Google Analytics, etc. | Helps identify most profitable customers | Develops brand loyalty and allows targeted marketing |

| Challenges | Generalizes by geography, difficult to set area limits | Does not consider behaviour or perception | Difficult and costly to acquire reliable data | Difficult and costly to acquire reliable data or measure |

How to Identify Customer Value Attributes

Your customers may have several different motivations for buying your product or for choosing someone else’s. Here are some common motivations:

- Functional: The customer values your offering for its function and utility. “I buy your product because it improves my bottom line.”

- Social: The customer was inspired to buy your offering because of social ties. “I bought this jacket because all my friends are wearing it.”

- Conditional: The customer has a need for your product. “I need a new jacket for my friend’s wedding.”

Identify Key Competition by Customer Segment

Your salespeople may be able to identify 15 or 16 competitors. Most customers choose between 3-4 competing businesses when making their purchasing decisions. Through segmentation, you can determine which competitors are targeting different customer groups and can build your pricing and promotional campaigns accordingly.

To understand where you lose buyers on the path to closing the deal, you must understand the buyer’s journey and how your prospective customer narrows down the competition.

Gather Competitor Intelligence Based on Key Competition by Segment

Undertake market research and conduct a data analysis to understand what the competitive prices are for similar offerings and any discounting strategies being used.

Identify Gaps/Opportunities

Losing to the Competition

Identify how you may be losing to the competition:

- Price – If your competitor offers a lower price, adjust your prices or offer your customers more value than the competition.

- Distribution – If they have more successful distribution efforts, supplement your advertising with material aimed at reaching new customers.

- Promotion Strategy – If they have a superior promotion strategy, compare their ads to your own and see where you need to aim your promotions.

- Greater Assortment of Products – If your competitor has more to offer, make sure your smaller selection focuses on quality and value.

Winning Over the Competition

- Price – If you offer a lower price, consider adjusting your prices to avoid underselling your product.

- Distribution – If you have more successful distribution efforts, maintaining relationships, monitoring them regularly, and knowing your market and customers supports continued success.

- Promotion Strategy – If you have a strong promotion strategy, keeping an eye on your customers lets you shift your focus as needed and prevent complacency.

- Greater Assortment of Products – If you have more to offer, make sure your customers are aware of your wide variety.

Scenario Modeling: Business Case

- A price matching competitive strategy

- A price premium competitive strategy

- A price discounting competitive strategy, including loss leader pricing

After we run these different scenarios, you can select the strategy that brings you the highest benefit and has the best impact on your bottom line.

Price Setting and Offer Adjustment

Integrate Process (Conduct Periodically)

A competitor’s price analysis should be conducted on a periodic basis (quarterly, bi-annually, annually etc.), depending on what the business cycle looks like for your industry. You should strive to make sure that your team always has the most recent and up-to-date information available on competitor portfolios and pricing strategies.

How Revenue Management Labs Can Help You Succeed

Revenue Management Labs has worked with multiple companies in many different industries to create competitor landscapes and improve their competitor pricing framework. We understand the nuances between different sectors. Instead of a one-size-fits-all solution, we create a customized competitive pricing strategy unique to your company. Contact Revenue Management Labs to help you gain an edge over your competitors and increase your market share!

Frequently Asked Questions

What is Competitive Based Pricing?

A competitive pricing policy sets your prices based on the price your competitors charge for comparable products. Competitive-based pricing helps you set your products’ prices at the level that best reflects their value to the consumer and sell at the highest possible profit margin.

How to Get Competitive Pricing

A competition-based pricing strategy requires information about your competitors and your prospective customers. You need to know who your competitors are and what prices they charge. But you also need to determine what your customers value most about your products and what drives their choice between you and your competition.

How Does Competition Affect Prices?

Unlike a cost-plus or value-based pricing strategy, competition-based pricing focuses on the prices charged by competing services for similar offerings. By studying what current customers are willing to pay, competition-based pricing strategies let you base your prices on what the market will bear.

Is Premium Pricing Right for My Product?

A premium pricing strategy works best for products which have a higher real or perceived value than their competition. A competitive pricing analysis can help you determine your product’s value to your customers and establish the best price for the market.

ABOUT THE AUTHOR

Avy Punwasee is a Partner at Revenue Management Labs. Revenue Management Labs help companies develop and execute practical solutions to maximize long-term revenue and profitability. Connect with Avy at apunwasee@revenueml.com