I have been in the Pricing and Revenue Management space for many years now and consistently see organizations fail to meet their growth targets or scale their teams, forcing them to accept mediocre results. In fact, 60% of organizations that try to implement a Revenue Management initiative will fail within the first 24 months. Even worse? Teams often get cut or disbanded due to the lackluster return on investment as organizations pursue other revenue-generating ideas.

There are many reasons Revenue Management initiatives fail to get off the ground, but the most common one I come across is a fundamental knowledge gap. Now, when I talk about a “knowledge gap” I don’t mean fundamental academic theory. It isn’t the case that people have trouble adding or multiplying. The knowledge gap I am talking about is the lack of understanding of what analysis needs to be done to appease all stakeholders in the organization, the lack of knowledge on how detailed analysis needs to be to drive results and finally the inability to execute a strategy in the market. For simplicity, I refer to these gaps as:

- Stakeholder Management

- Granularity

- Execution

Many organizations fall victim to the notion that hiring someone with ten to fifteen years of Pricing and Revenue Management experience will be enough to successfully execute initiatives. This is simply untrue. Although experience is a great asset, it is important to ensure Revenue Management teams and leaders know how to manage the three largest hurdles to success.

Whether you are in the process of building a Revenue Management function or looking to improve the teams’ capabilities here are some tips on how to close these gaps to preempt any challenges that may arise.

1. Stakeholder Management: A Balanced Approach

There are many approaches one can take when tackling Revenue Management and Pricing challenges. Much like any other business function, a newcomer might approach the problem differently than a seasoned veteran (with the latter having a more sophisticated approach). Now, one is not necessarily better than the other, they are just different. A simple approach might be a good way to get your feet wet, while a more sophisticated approach can sharpen margin / revenue to an existing process. The key differentiator between the two pieces of analysis is how much value they can provide for the organization. What is important to remember is that it is not the exact type of analysis that you do (for example: build a price curve, price waterfall, or even a price value map), but rather the balance in the approach.

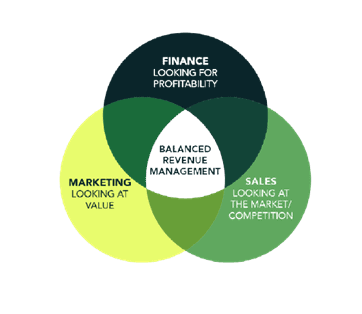

Revenue Management strategies need a balanced approach and most initiatives I see fail to account for this balanced approach. The Balanced Revenue Management Framework helps ensure that the decisions being made are supported by the right balance of analysis that takes into perspective the needs and viewpoints of the entire organization.

Market and Competitive Insights (Sales), Value Analysis (Marketing), and Financial Performance (Finance) need to be incorporated and balanced in any Revenue Management initiative. Companies that use the Framework outperform individual pricing strategies by as much as 70%.

Balanced Revenue Management Framework

2. Granularity: A Practical Approach

Many organizations lack granular analysis. This can result in missed opportunities, incomplete strategies, and money left on the table. A high-level strategy is great, but not very practical when pricing and promotional initiatives are set at an individual customer and product level. An analysis that is too high level makes getting internal buy-in very difficult and usually falls apart during execution because expectations are not met, and the value is not delivered.

To close this gap, your analysis must be at the same granularity at which you execute and make decisions. For example, if pricing decisions are made at the intersection of customer and SKU, then the analysis should also be at the customer and SKU level. Alternatively, if the decision is made on the product category and promoted product group (PPG) level then every analysis needs to have that viewpoint.

Often, I see pushback because added granularity means additional resources and time spent getting to an output. Combing through tens of thousands of customer and product combinations is time-consuming, sometimes monotonous, and can be tough to get through. But in my experience, the added level of diligence and insight can have vast improvements not only to the bottom line of the P&L but also to the success of executing a strategy both internally and externally. A worthwhile endeavor for sure.

3. Execution: A Change in Mindset

As I alluded to earlier, even great analysis can fall apart during execution. This is not to say the strategy was bad, rather that even a great strategy is worthless without the ability to execute. Closing stakeholder and granularity issues can help tremendously, but without execution, they cannot deliver results.

Let’s face it. No salesperson, buyer, or customer wakes up and is enthusiastic about executing a Revenue Management and Pricing initiative. The conversation is usually uncomfortable, as the discussion is focused on financials or behavioral change (and people are naturally resistant to change). I have only seen a select few salespeople go out and have these uncomfortable conversations with ease, and they are almost always the top percentile of salespeople.

That means the vast majority push back and give excuses about why the strategy will not work or why it’s wrong without providing any evidence other than “gut”. What inevitably happens in most cases is that the Revenue Management teams cave in and change the recommendation based on the pushback that is not based on anything other than emotion, leading to money being left on the table. Now, I am not saying that getting input from the sales team is bad, but if the analysis is balanced and conducted at the right granularity then the viewpoints from the sales, marketing, and finance teams should already be incorporated and based on data. Remember that a fact-based story and analysis that is well thought out is much stronger than the “gut feeling” of any individual.

To successfully execute your Revenue Management initiatives, your messaging needs to be clear enough to explain to your team why it is important and complete enough to address any internal objections. To help you get internal buy-in, check out our article on how to overcome common objections from your sales team. Lastly, your Revenue Management team needs to stand firm on its recommendations and not cave to the pressure from other groups. The most successful Revenue Management teams that I see are those that are not well-liked in the organization because others know that they cannot be persuaded as their conclusions are strongly backed up by facts.

Final Thoughts

Successfully executing your Revenue Management initiatives requires teams to manage stakeholders, provide the right granularity, and execute with purpose. Many of our clients who have failed with Revenue Management initiatives never understand these core issues. These by no means are the only gaps that exist, but closing these core three gaps can drive substantial benefit and growth.

If you would like Revenue Management Labs to help you execute your Revenue Management initiatives, get in touch today! You may also be interested in our Revenue Management as a Service (RMaaS) if you do not have a Revenue Management capability in place.

ABOUT THE AUTHOR Michael Stanisz is a Partner at Revenue Management Labs. Revenue Management Labs help companies develop and execute practical solutions to maximize long-term revenue and profitability. Connect with Michael at mstanisz@revenueml.com