While most price increase objections come from the customer, your internal sales force may also have certain hesitations about the proposed price change. With the many hurdles your sales team already faces, it is not surprising they do not want to add another. But raising prices is sometimes inevitable, especially in the current hyperinflated economy. Ignoring this and not changing the price would be a fatal mistake to your margins. To ease your sales force’s worries, we have identified the common objections to price increases and how to address them. Follow these methods and your next price increase will get less pushback.

1. Objection: “If You Do This, We Will Put The Business At Risk”

Solution: Focus On Your Value

A higher price tag only makes the sales process more difficult for your sales team if customers do not gain commensurate value from your offer. To quote Warren Buffett, “Price is what you pay, value is what you get”. There are two ways to assess value – perceived and financial. Recall from last week’s article 4 Steps to Increase Price Without Upsetting Customers that perceived value is how customers feel about your offer while financial value is the business case justifying the use of your offers versus the next best alternative. Your sales force must also understand the perceived and financial value gained from your offering to accept the price increase, and be ready to reinforce that with customers.

2. Objection: “The Sales Team Knows The Customer Best. You Need To Trust Our Insights”

Solution: Focus On The Facts

The sales team interacts with customers daily, which gives them confidence that they know customers better than anyone else. While mostly true, personal dynamics and factual data may paint two different pictures. Data gives you an unambiguous and deeper understanding of how customers behave and what their preferences are. While personal dynamics may change from person to person, data is process-driven and repeatable. Even if your sales team’s gut feeling is correct, using data to support that feeling is vital as it will consider different perspectives. Multiple sources of data exist to enable teams to paint a picture of their business. At RML, we use 4 types of data:

- Internal (e.g. historical sales and costs, etc.)

- Competitive (e.g. annual reports, competitive pricing, etc.)

- Market (e.g. Syndicated, Research, etc.)

- Customer (e.g. Survey, Reviews, etc.)

For example, your sales force may engage with the customers to determine how demand may change with your proposed price increase, but remember what customers say and do are two different things. Conducting an elasticity analysis will confirm (or reject) what your sales force suggests to be true.

3. Objection: “We Tried This Before And It Didn’t Work”

Solution: Identify What’s Different

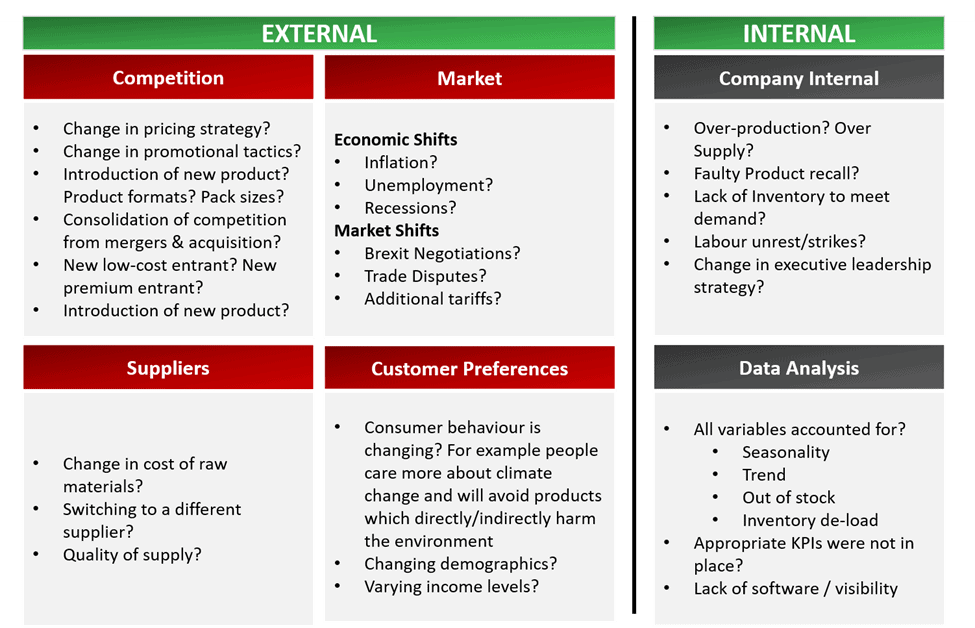

What does your sales force mean when they say past price increases didn’t work? It means you need to go deeper and explore the root cause of the problem to identify what needs to be done differently. Past failures can be attributed to two types of factors – External and Internal. To address this objection, you want to conduct a historic price increase analysis based on the relevant factors to see how volumes have changed over time. Based on the results, you can better understand the price sensitivity across your customer segments. Some examples of internal and external factors are described below:

4. Objection: “We Are Locked In With This Customer And Cannot Change The Structure Until Later”

Solution: Validate & Identify Alternatives

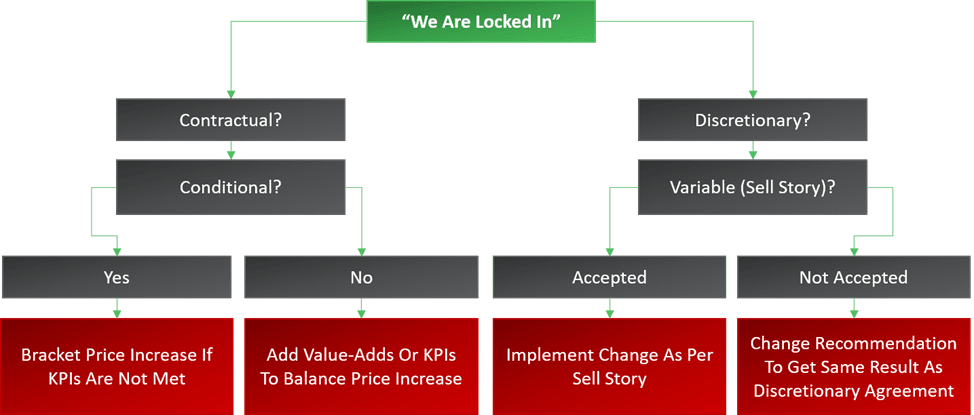

There are two factors to consider with this objection – Contractual vs Discretionary and Conditional vs Variable. Before you can formulate a proper response to this objection, you must understand these factors.

First, consider whether your relationship with the customer is contractual (facts) or discretionary (emotions). Contractual relationships often involve written agreements that dictate a set price for your offering while discretionary relationships are often verbal.

Next, explore how your price brackets will change under each scenario. If you determined that your relationship is contractual, ask yourself if the contract is conditional or not. A conditional contract clearly outlines what customers pay if set KPIs are met. If the customer is fulfilling the KPIs, there is nothing you can do to change the price and instead must wait until the end of the contract to renegotiate or explore exit clauses. If KPIs are missed, the customer can be moved to a higher price. If the contract is not conditional, you can propose a new deal that introduces additional value-adds that balance the price increase.

Alternatively, if the relationship is discretionary, you must build a sell story to convince your customer of the price increase. If the customer buys into your sell story, then you can implement it. However, if the sell story is rejected, then you can change the recommendation to result in the same outcome as the discretionary agreement. For example, if your price increase is 10%, you can change the rebate program to achieve the same 10% without touching price.

5. Objection: “The Data Is Wrong”

Solution: Define Worst Case Scenario

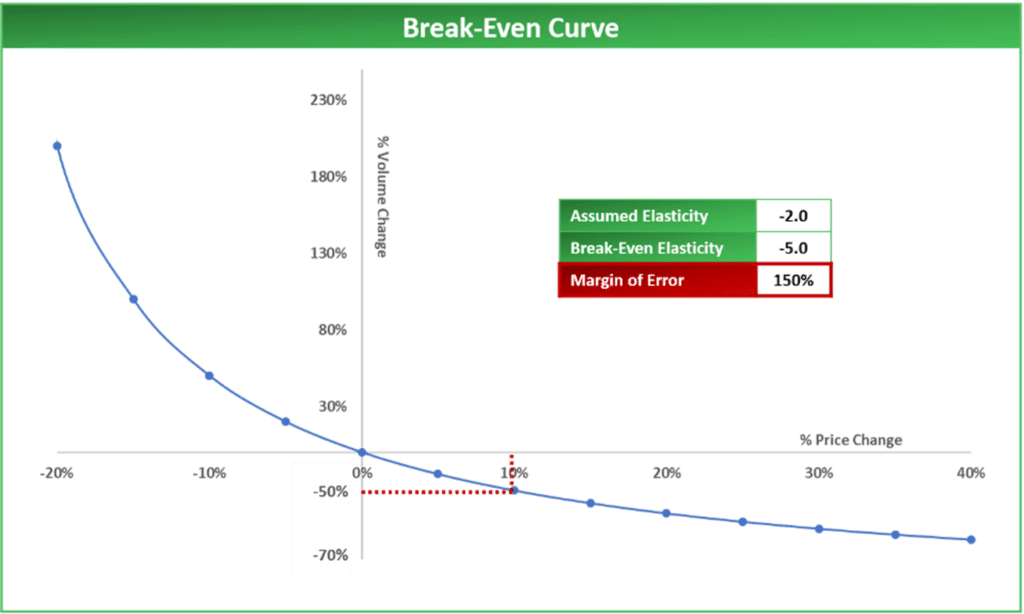

Last but certainly not least, wrong data is one of the most painful objections to come across, especially if you have taken time and effort in conducting analysis and building recommendations based on it. In a best-case scenario, you would clean up the data to ensure proper analysis. However, if cleaning the data takes too long or is impossible to do, you may miss your window of opportunity. What are the risks of having wrong data?

To answer this question, consider your worst-case scenario. If you were wrong, how wrong would you have to be before the company starts to lose money? How wide is that margin of error and can we be comfortable with that corporately?

A financial break-even analysis allows you to answer these questions. Essentially, calculating a break-even will let you know how much sales you can afford to lose before you start losing money. You should compare this calculation against what you are forecasting. If you have a wide margin of error, it will make you more confident in your assumptions, despite the data issues, however, if your forecast is very close to break-even you should exercise more caution.

Final Thoughts

Just because your sales force worries about price increases does not mean that you should abandon or water down the recommendation. Instead, address their fears by having a data & analytics system in place to support your decisions. Your sales force must believe in your price increase to convince the customer. If you would like Revenue Management Labs to help you with your price increase initiatives, get in touch today!

ABOUT THE AUTHOR Avy Punwasee is a Partner at Revenue Management Labs. Revenue Management Labs help companies develop and execute practical solutions to maximize long-term revenue and profitability. Connect with Avy at apunwasee@revenueml.com