- Introduction

- Price Segmentation

- Impacts of Price Segmentation

- Types of Price Segmentation

- Implementing Price segmentation

- Segmentation

- Step 1: Data and Research

- Step 2: Cluster Creation

- Researching Value Propositions

- Running segmentation

- Step 3: Cluster Importance

- Segment Size

- Willingness to Pay

- Price mechanism

- Price-value Match

- Price Fence

- Price Segmentation Watchouts

- Final Thoughts

Introduction

A common mistake many companies make is believing that they are the ones who dictate the value of their products, when it is their customers who decide what an offering is worth and whether they are willing to purchase it. Like snowflakes, every one of your customers is unlike any other. However, also like snowflakes, many are very similar. This is where price segmentation comes in.

One of the first uses of price segmentation was in the airline industry during the early 1980s. It was used during a mild recession and when a brand-new airline deregulation act had been recently introduced that posed a substantial threat to American Airlines and the larger airline industry. With these challenges, many American Airlines flights had a surplus of empty seats, and industry demand was shifting to low-cost, low-fare airlines, as American Airlines was failing to adequately demonstrate the greater value it was providing.

To mitigate this problem, Robert Crandall, who was chairman and CEO of American Airlines at the time, helped pioneer the use of a variable pricing strategy, which was focused on maximizing revenue based on anticipating consumer behaviour. Crandall created a system that would specifically target varying discounts to flights that were flying empty on a day-by-day basis. As a result of this implementation, Crandall was able to unlock multiple streams of revenue and incremental margin for the business, resulting in an additional $500 million in revenue and a 48% increase in profits compared to the previous year.

Using this strategy, the production of American Airlines analysts also increased by 30%, as they were better equipped to make sound revenue decisions. This one change was not only able to generate additional bottom-line growth, but it increased the efficiency and effectiveness of the analyst team. Over the years, variable pricing has become almost exclusively automated, and many additional features have been introduced.

With the successes that were seen in the airline industry using price segmentation, many other industries with capacity constraints followed. Marriott was one of the first hotels to implement this pricing strategy and was able to generate a $200 million increase in annual revenue. Over the next 40-plus years, many more companies and industries have leveraged price segmentation to drive incremental dollars in revenue and margin.

What Is Price Segmentation

Have you ever wondered if you are charging the right price for your products? Are you worried that customers are walking away from your products due to the price? Do you feel that you are not maximizing your revenue because your price is not based on your customer willingness-to-pay? If you have asked yourself any of the above, then you should consider price segmentation.

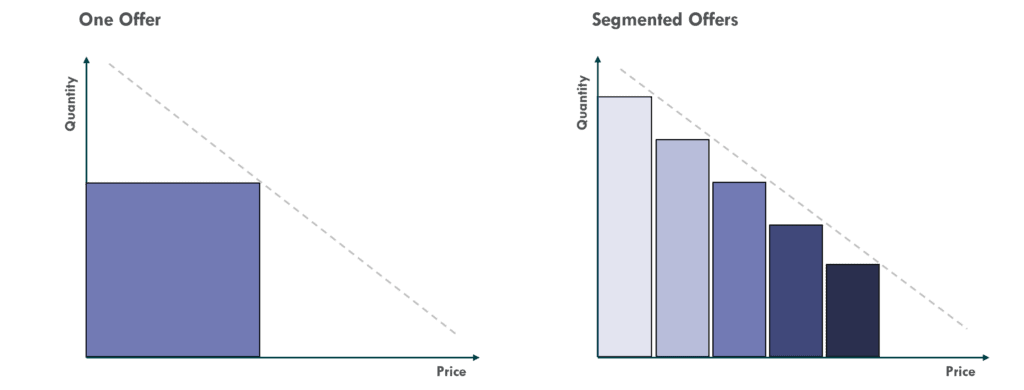

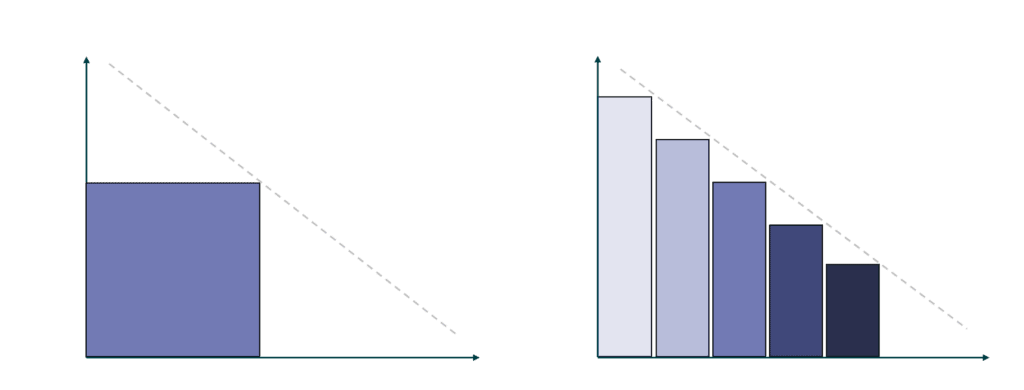

Price segmentation is a pricing strategy that involves setting different prices for the same product or service to different market segments based on the customers ability and willingness-to-pay. This strategy has been proven to increase revenue and overall profitability. A key factor that can be used to capture that white space is the price sensitivity of each customer group, as seen in Figure 1. For instance, someone traveling for work will have a lower sensitivity to price when it comes to purchasing business class seats, whereas an occasional travel would likely exhibit a much higher sensitivity. With price segmentation, you can reap the higher profits from customers willing to pay premium prices, whilst still capturing profit from the price sensitive customers.

Impacts of Price Segmentation

There are examples of price segmentation everywhere: from student prices at the cinema to senior membership prices at the gym to fluctuating hotel room rates during the holidays. The airline industry is widely acclaimed as the king of price segmentation, as two passengers on the same flight very rarely pay the same rate. The practice of price segmentation has evolved and spread across many different industries throughout the years.

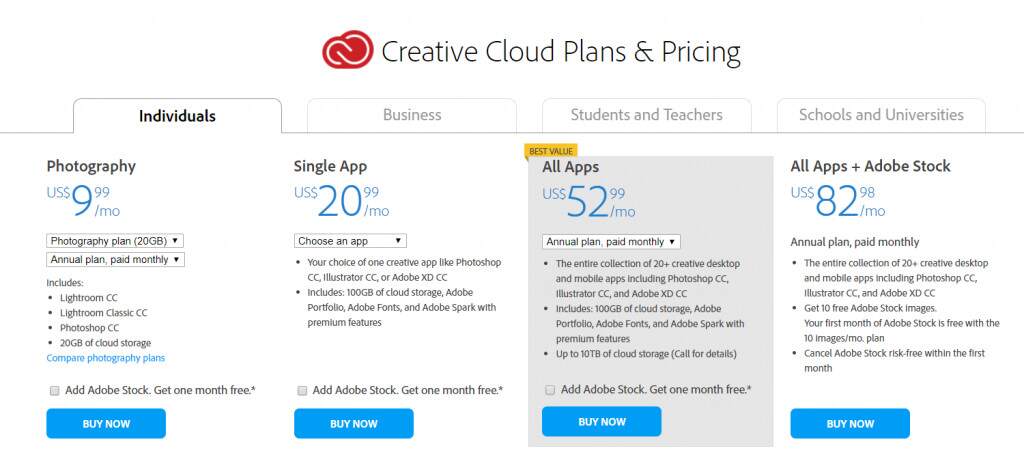

In April 2013, Adobe did something most companies would be afraid to do. It completely switched its revenue model from its iconic traditional boxed suite to a cloud-based online subscription service that made customers pay monthly to access the suite online. This switch was met with thousands of enraged customers early on, however, the service quickly gained traction and it grew the business substantially. With the switch to a cloud-based product, Adobe was able to go from an 18-month launch cycle to on-going launches, which allowed the company to shape efforts for different market segments. Within a year of launching the suite, customers grew by 244% and revenue grew by 50%. The new framework was able to provide an interactive business model, which allowed Adobe to act quickly and innovate continuously by investing in emerging technologies.

Currently, Adobe offers products for four different market segments: individuals, businesses, students and teachers, and schools and universities. Then if you decide to purchase a plan, there is more price segmentation based on the frequency of the payments and the duration of the subscription, as seen in Figure 2.

Price segmentation is a powerful tool that benefits any company that has customers with a diverse set of needs and is especially useful in industries with high fixed cost expenditures, such as auto manufacturing, pharmaceutical, and airline industries. Identifying segments, isolating needs within those segments and catering to those needs through pricing can help your company increase its reach and have a broader appeal to different target markets, ultimately leading to a higher growth potential. It helps the business focus its efforts and extract more profit from each customer.

Types of Price Segmentation

Price segmentation can be utilized by applying various methods. Here are some examples of segmented pricing:

Volume offers based on a customer purchasing above a certain threshold to access a specific discount.

Pricing can change significantly based on when the product is purchased, especially in industries that experience seasonality. Despite the product being the exact same, the value of the product varies based on when it is sold.

For example, skiers may choose to purchase a season pass with an early bird discount before the winter season and save a considerable amount by avoiding the high costs during the season. With the early bird purchase, the customer is saving money and the ski resort is securing early sales by fostering a sense of urgency in those who are contemplating whether to purchase tickets.

Segmenting by attribute is similar to “services offered,” but it is based on an attribute or component that provides additional functionality or quality to a product.

The location where a product is being sold can affect the value that customers attribute to the same product.

For example, products on the Target website are offered at a lower price because customers have the ability to cross-shop easily and the cost to serve them is cheaper compared to a customer that walks into the retail store. In the online channel, Target is able to meet customer needs with fewer operational expenses and has the ability to pass some of those savings on to the customer.

The geographical proximity of a product to the inherent value it is providing can impact pricing as well.

For example, this type of pricing is very common in the gasoline industry. Gasoline prices are based on a complex mix of factors like average traffic flow, number of vehicles, transportation corridors and competing gas stations. A Circle K gas station located directly across the street from a Costco location will be priced lower than another Circle K location that is only 10 minutes away.

Implementing price segmentation

Now after reading about all the benefits and examples, you might be curious about how to implement price segmentation in your organization. Let’s walk through two major components of implementing price segmentation to develop a comprehensive picture of how exactly you can do it and what resources or techniques you will need to equip your team with.

Segmentation

Segmentation might seem to be a daunting process, but we can further break it down into 3 steps.

Step 1: Data and Research

If you have never interacted with customer or transaction data before, but do not worry, there are multiple ways to accomplish it and various analytical tools to be leveraged in the process.

For example, a common way of segmenting customers is based on demographic and geographic dimensions, like using age, gender, and location to classify customers into different groups, as discussed in the examples above. The benefits of leveraging demographic and geographic data include:

- Data is generally available and ready for use

- The classification is easy to understand and implement

- The segments are MECE (mutually exclusive and collectively exhaustive)

However, these objective dimensions alone cannot accurately measure critical differences in people’s purchase decisions if subjective attributes are not taken into consideration, such as what customers value including convenience, quality, or service.

Step 2: Cluster Creation

It is key to remember that segmentation is all about understanding differences and allocating the right product to the right customer segment at the optimal price. Therefore, to start you need to understand your customers to build the foundation for a successful price segmentation. This leads us to understanding customers’ value propositions.

Researching Value Propositions

What are the attributes or concerns at the forefront of your customers’ minds when they make purchase decisions? This may include price, quality, service, or timeliness, among other things, depending on what product or service you provide.

- Availability

- Convenience

- Low price/promotion

- High value

- High quality

- Fuel efficiency

- Safety

- Low price

- Suitability for everyday use

- High quality

- Low price

- High quality

- Product features

- Ease of use

- Product reviews

Furthermore, different customer groups have different priorities, so you need to dive into the differences between customer groups. Then by gauging these differences, you will be able to identify where and how you can deliver value and accordingly set up pricing tiers for different customer groups.

There are various types of research methods that you can utilize to locate different group interests, including surveys (conjoint analysis, MaxDiff), focus groups and interviews. Once you understand the differences between the customer groups you serve, you can decide which metrics need to be used for effective and efficient customer segmentation.

Now after obtaining the most important and influential metrics to be used in segmentation from market research, you can run some technical analysis to generate customer segmentation.

Running Segmentation

After incorporating the top-ranking value propositions into segmentation criteria, your next step is to run cluster analysis (e.g., K-means and CART) to segment customers into homogenous groups. Customers within a segment share similar characteristics and an identical willingness to pay (WTP), also called price sensitivity or price elasticity.

Step 3: Cluster Importance

Perfect customer segmentation (different prices for different individual customers) is impossible; instead, our aim is to allocate resources to maximize WTP in the most efficient way possible.

Identifying Segment Size

To this end, you want to focus on the biggest customer group and the top priorities in their purchase decision-making. By understanding the market size of each customer segment, you can get a high-level estimate on how much revenue and margin you will be able to improve by applying price segmentation.

Maximizing Willingness to Pay

After obtaining the most importance customer segments, it is time to quantify the willingness-to-pay of each segment, also known as price sensitivity or price elasticity.

You can gauge willingness-to-pay using different types of analysis. To name a few of the most common ones:

- Regression: derive price elasticity from historical transaction data

- Van Westendorp pricing model: derive WTP on select price points from a survey

- Conjoint analysis: derive WTP on different price-attributes combination from a survey

At this step, you will analyze each segments price sensitivity. For a less price sensitive segment, there is space for charging more for added value, while for a more price sensitive segment, you might want to be cautious about potential impacts of any price increase.

Price mechanism

Setting up a viable price mechanism is equally important as understanding your customer segments, because customers are the ones who make the final decisions and often feel motivated to arbitrage any price gaps available. For example, for a segment with a high willingness-to-pay, it does not necessarily guarantee that you can charge the customers a higher price for the same product or service if customers can work around buying at a lower price.

Thus, a rigorous and actionable price mechanism that fences different segments and prevents misuse is critical during implementation. This is generally where you would like to get the help of our pricing experts at Revenue Management Labs, because the design of a price mechanism requires abundant commercial insights and hands-on experience.

Matching Price-value

To allocate the right product at the optimal price to your customer segments, you should think from the perspective of customers; try to answer three main questions:

- What are the key features that each segment is looking for?

- How does your product or service meet the demand?

- Do you have the capacity to differentiate in each segment?

If the answer to the above questions is that your product can provide differentiated value that meets the top demand of your customer segments, your chance of getting customers’ buy-in on segmented prices is promising.

Fencing Prices

The last critical piece is setting up price fences for your pricing so that everything will work out as planned.

What is a price fence? A price fence is a set of rules that makes one segment independent of another. A simple example is using student ID to differentiate the student from the public so that only students can enjoy student discounts in cinemas, transit or grocery stores. Price fences can be in other forms, for example time of purchase in airlines, premium versus regular fuel, different product versions, efforts needed to get coupons or discounts and so on.

Since the price fence is used to enforce segmented prices, its design should be aligned with your segmentation criteria. Here are some examples of price fences:

Products sold online directly to customers are usually cheaper than ones sold offline because online customers seek the lowest price and therefore are more price sensitive.

Refer to Target example introduced above.

Prices of newly released models are higher than old models because customers who like to utilize the benefits of the latest products as early as possible are willing to pay a higher price.

Prices for late booking are generally higher than prices for early booking because business-oriented customers typically book only weeks or days before departure, while leisure-oriented customers plan early to stay within their small budget.

Drugs with the same compositions are priced differently because they are branded differently or used to treat different indications.

Price Segmentation Watchouts

Price Dilution/Cannibalization

Under segmented pricing, customers in a high price segment have a strong motivation to find their way to purchase at the lower prices. If this situation occurs, your prices will be diluted to the lower level and sales will be mainly coming from the low-price segment, eliminating the benefits of price segmentation. To prevent this cannibalization, you need to set up effective price fences for your customer segments so that customers in different segments can only buy at the price they are supposed to use.

Stagnation

As customer behaviour and market conditions evolve, the thoughtfully designed segmented prices might soon become invalid. Be sure to iterate your price mechanism periodically or dynamically and keep your prices competitive in the market.

Backlash

Customers who pay more might feel that they are being taken advantage of if they are aware of anyone paying less for the same product or service, which is likely to cause brand image damage and erosion of your customer base. Price segmentation is a combination of science and art in the sense that it is critical to design and phrase your offers to cater to customers’ demand and perceived value.

Internal confusion

As price segmentation adds a complex layer to your pricing structure, your employees can be confused by when and how to apply different prices, and to whom, if they do not understand your pricing logic. Get your segmented pricing methodology trickled down to your sales team or frontier staff to deliver the right prices to your customers.

Inequality & Distrust

It has always been controversial whether price segmentation is unfair to some customer groups, especially in retailing. Instead of setting up different prices for different groups directly, you can adopt a more subtle version of price segmentation – couponing and self-selection.

For example, the list price is the same for all customers, and coupons are available but require some effort. As a result, customers who are less price-sensitive will purchase at the list price, and customers more price-sensitive will take time to get coupons and buy off discounts. Under this price mechanism, customers make their choices about which price to use, and you enjoy the benefits of price segmentation. Win-Win!

One-size-fits-all

Price segmentation requires granularity on customer purchase behaviours and ideally should be supported by detailed transaction data and rigorous data analysis. Act now to accumulate and utilize transaction and customer data. If you have no idea where to start, consult with our pricing professionals at Revenue Management Labs to boost your revenue and margin with price segmentation.

Final Thoughts

Simply put, price segmentation is a pricing strategy where largely similar or identical goods are sold at different prices to different market segments based on how those customers value the product. By implanting a successful price segmentation strategy, your company can extract a greater portion of the consumer surplus in the form of untapped revenue and profits.

Does all this sound too complicated? Well, do not worry because price segmentation is a challenging strategy to implement, and many companies do not know where to start. At Revenue Management Labs, our team of pricing experts can help you set an optimal pricing strategy that works for you and your customer base to maximize revenue and ensure you are not leaving any money on the table.

Click here to see how Revenue Management Labs can help you substantially grow your revenue through the division of your customers into price segments based on extensive data analysis to evaluate different price responses and willingness-to-pay.

ABOUT THE AUTHOR

Avy Punwasee is a Partner at Revenue Management Labs. Revenue Management Labs help companies develop and execute practical solutions to maximize long-term revenue and profitability. Connect with Avy at apunwasee@revenueml.com