When it comes to private equity, the playbook often revolves around synergies and cost reduction, and rarely around pricing and revenue management. Most people in private equity know that pricing can have a great return on investment, but it is an area of discomfort for many, leading to a lack of time spent on improving the capability. Like Finance, Sales, Marketing, and other business functions, Revenue Management is a necessity for every organization trying to create value. Though it is a difficult skill to master, a strong Revenue Management process can exponentially enhance the value of portfolios.

Why Pricing Should Be Part Of Your Deals

We are all aware of the “synergies” that private equity deals promise. Cost reduction and process optimization are two “go-to” benefits PE firms are known to pull out of their toolbox. Very few go to Revenue Management – but they should. Why?

1. Size

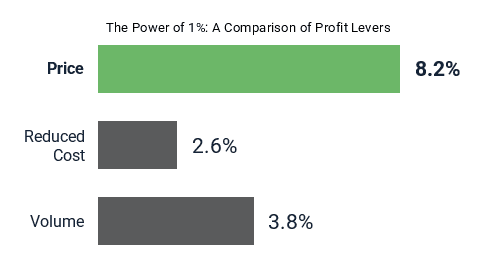

For the average mid-sized organization, a 1% increase in price results in a profit increase of 8.2% on average. Similarly, a 1% reduction in costs increases the bottom-line by approximately 2.6% and a 1% increase in sales volume increases profits by 3.8%. We can see that focusing on price has 3.2x as much impact on profit than cost reductions and 2.2x more than volume growth.

We know growth and cost reduction are staples of the private equity industry, and a lot of time is spent with procurement, engineering, and sales teams to reduce costs and drive incremental sales. Yet, very little time is spent on pricing and optimizing existing revenue streams, a missed opportunity given the leverage pricing has. The size of the prize is too large to ignore!

2. Speed

In a highly competitive industry like PE, speed matters. I constantly hear executives pushing their teams to realize synergies from their deals faster, but integration takes a long time. Knowledge transfer and general business processes often get in the way, making value realization an afterthought rather than an immediate one.

This is where revenue management really shines. Unlike traditional processes, focusing on price can provide value faster. In most cases, this involves picking the low-hanging fruit such as:

- Adjusting the price to align with the value

- Removing low ROI investments

- Shifting mix by changing price architecture

Further, these changes can be easily implemented within the first one hundred days. However, keep in mind that even though price and revenue management can deliver value quickly, you still need to consider the long-term strategy. Quick wins are great, but make sure you do not fall into the quick win fallacy trap.

3. Certainty

For any initiative, from sales to revenue management to cost-cutting, there is always a level of uncertainty and risk (this is especially true when you ask the sales team about pricing). The nice thing about pricing and revenue management initiatives is that they are often built on a strong foundation consisting of data and statistical models – meaning there is more certainty when capturing value.

For example, price increase opportunities may exist to provide quick value to an organization, but how can we be certain? A blanket approach lacks data and factual backing, making it risky, but a targeted approach based on elasticity and margin calculations will mitigate that risk. By targeting low elasticity, high margin items, the break-even elasticity (the amount of volume lost to break-even on margin) will be higher. In many cases, we see break-even elasticities five to ten times higher than those observed in the market. Modeling would need to be incorrect by 500% to lose money, so we can be more certain about improved margins.

Understanding the importance of pricing and revenue management in private equity, let us explore how to leverage it to increase returns and create value.

How to Integrate Pricing & Revenue Management In Your Deal Cycle

Revenue Management as a stand-alone capability is easy to understand, but the benefits are less clear in the context of private equity. I often get private equity partners asking me how we can help them create value, get a better return on investments, and more. What might make sense is to structure an example based on each stage of the deal lifecycle.

1. Buy Stage:

During acquisition and due diligence, there is a lot of analysis around market sizing, market share capture, cost synergies, etc. but they are usually done at a very high level with many assumptions made. Further, the focus is usually on volume potential growth and cost savings. What is often overlooked are the hidden value opportunities that are quick wins for the company, such as:

-

- Increasing price with minimal volume impact

-

- Cutting ineffective spending on initiatives that generate poor returns

-

- Renegotiating structure terms and deals based on market conditions

Now, the goal is not necessarily to share these insights and pay for them, but rather to have a line of sight into the value available outside of the purchase price. Take, for example, a 3x valuation multiple on revenue (which is not too far from the general market average). A conservative benchmark for quick pricing initiatives would be a 2.5% improvement in revenue – for a $200M, company this could easily translate into opportunities worth $5M. Identifying $5M worth of pricing opportunities gives an additional $15M to the valuation that would otherwise be left out. Even better, the $5M can be realized within the first 100 days of acquisition!

2. Build Stage:

There are two key considerations when driving value enhancement from a pricing and revenue management perspective during the build stage. The first is building the revenue management fundamentals that create consistent price and margin growth, such as:

-

- Customer discount optimization

-

- Annual price reviews

-

- Price/mix whitespace identification

-

- Transitioning to value-based pricing models

These revenue management fundamentals focus on gaining control of the company’s capabilities while putting out margin eroding ‘fires’. The second consideration is how to supercharge growth and margin enhancement throughout the organization once control is in place. These activities include optimizing portfolio assortment and mix, creating value through innovation, and enhancing joint business planning/partnership arrangements. These activities will require more time and resources to execute but can have game-changing implications on the financials when achieved.

3. Exit Stage:

When it comes to exiting, one of the most important decisions to make is what metric to optimize. It is common practice for pricing and revenue management initiatives to maximize bottom-line margin, but there are many other situations where these initiatives can be utilized. Strategies can be developed to maximize volume, market share, and margin dollars or percentages. Depending on the exit strategy, pricing and revenue management initiatives can be adjusted to maximize the chosen metric.

Remember when we talked about finding additional value and taking advantage of it during the buying stage? When exiting, the same level of analysis needs to take place to make sure value is not left on the table. For instance, adjusting the price on low ROI investments shortly before exiting can help bolster the value of an organization.

Final Thoughts

Private equity firms are always looking for a company that is the diamond in the rough. In a similar fashion, pricing is the hidden gem to unlocking value creation. While PE has historically not focused on pricing, now is the time for the revolution. Firms must embrace pricing as a primary way to create value to stay competitive in the saturated market. Despite where your portfolio companies are in the deal lifecycle, there are actions that can be taken to uncover additional value.

ABOUT THE AUTHOR Michael Stanisz is a Partner at Revenue Management Labs. Revenue Management Labs help companies develop and execute practical solutions to maximize long-term revenue and profitability. Connect with Michael at mstanisz@revenueml.com