Have you ever asked why prices end in 99, 98, or 97 instead of 00? Known as the Left-Digit Effect, individuals read prices from left to right which impacts the perception of the price. For example, $9.99 is perceived as $9 even though it’s only one cent different from $10.00. Perhaps this explains why 60 percent of prices in stores end in 9. Recent studies have also shown prices ending in 9 realize as much as an 8% increase in sales volume – the power of 1 cent indeed!

The left-digit effect is one of many psychological pricing techniques used to make prices more attractive to customers. It stresses the importance of price setting – a key factor in product success and illustrates how irrational customers can be when making a purchase. Here are four more psychological pricing strategies to guide customer purchase behavior:

1. The Endowment Effect

Customers are more willing to pay for products and services they already own than for those they have to obtain. In one experiment, one group of customers were asked to add toppings to a $5 cup of ice cream for $0.50 each. Another group was given a cup of ice cream with all 5 toppings for $7.50 and given the option to remove toppings for $0.50 each. The group that had to “lose” their toppings was less inclined to do so and spent more on toppings than the other group. Customers increase their willingness to pay to prevent the feeling of loss.

Example: Car manufacturers usually offer buyers standard packages for vehicles. These packages include features that the buyers would never have purchased if given the option. Yet, when they are included in packages, the buyers are willing to buy to prevent the feeling of loss, even if the features go unused. Research indicates that at least 20 percent of new-vehicle owners have never used 16 of the 33 features measured.

2. The Compromise Effect

When presented with three similar items at different price points (low, medium, and high), most people tend to choose the middle option, especially when the item at hand is not essential. Customers view the middle option as the “safe” choice that gets the job done. This effect helps inform choice architecture which can nudge customers toward the middle/moderate offers. The more extreme the options, the more the compromise effect works.

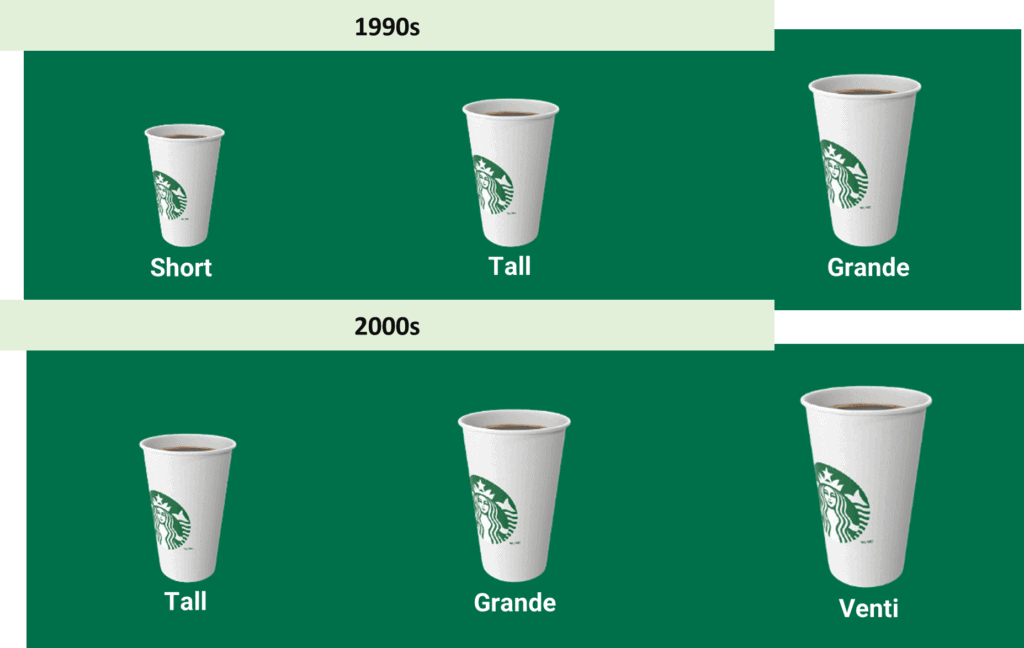

Example: Up until the mid-1990s, Starbucks offered three different drink sizes: Short, Tall, and Grande. Most people avoided the extremes and ordered Tall drinks. Soon after Starbucks removed the Short size and added the larger Venti size, the Grande option was pushed down to the middle (and soon became the most common order size).

3. The Decoy Effect

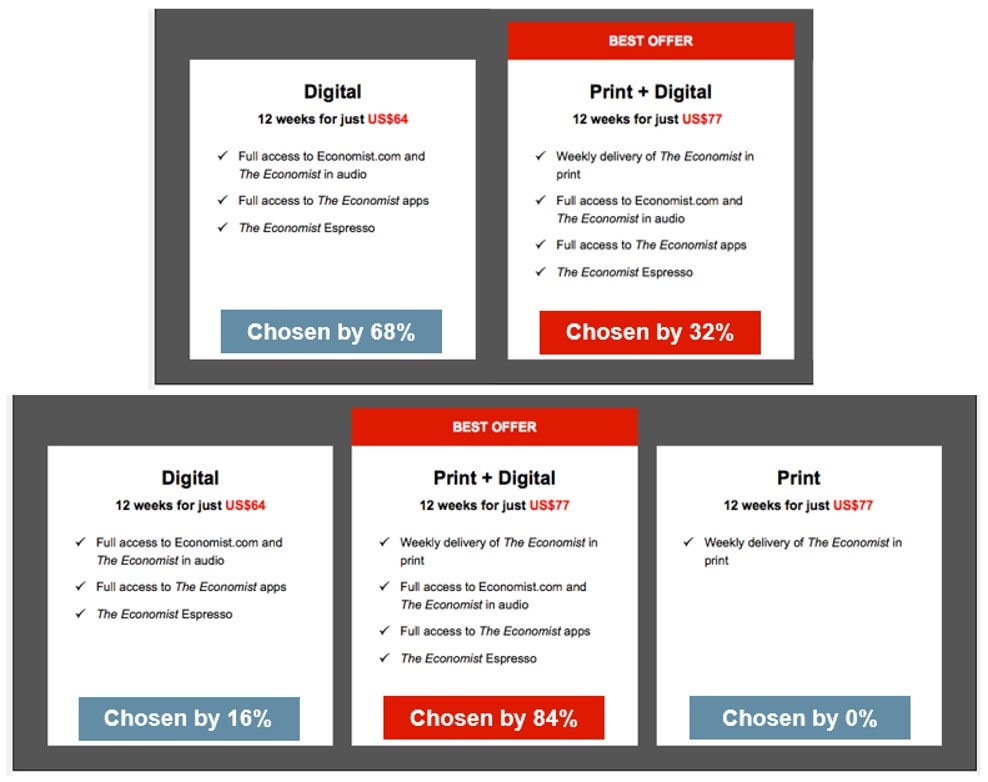

How do you get people to buy something? A popular strategy is to offer another similar product that no one wants to buy. This is called the Decoy effect and is very effective in selling bundle options. When customers face two options, adding a third, less attractive option (the decoy) changes their perceptions of the original two, making one appear more valuable. When one option clearly dominates another, it nudges the customer towards more easily choosing that option.

Example: Many newspaper companies like The Economist employ a decoy in their price strategies. Originally, The Economist had two offers – Print+Digital and Digital Only, with most customers opting for the latter (less valuable) option. With the introduction of the decoy – the Print Only option at the same price as the Print+Digital Option, the perception of value for the Print+Digital Option appeared to be more valuable and nudged customers towards purchasing it. If you can get the Print option for $77, why would you not get both Print and Digital for the same price?

4. The Anchoring Effect

For familiar products, customers usually have a certain price point in mind. For unfamiliar products, they need an anchor – a reference price that guides decision-making. Consider an experiment where a group of customers was asked if they were willing to pay for a $200.00 radio, in which most of the responses were no because the radio appeared to be overpriced. In another group, the offer was structured differently – an opportunity to buy a $500 radio with a 60% reduction (that would cost $200.00). Both offers involved paying $200 for the radio, but the group that received a discount was much more willing to purchase. With the anchor of $500, the $200 offer gave a perception of getting a good deal. This is known as the transaction utility theory, where price signals value for customers.

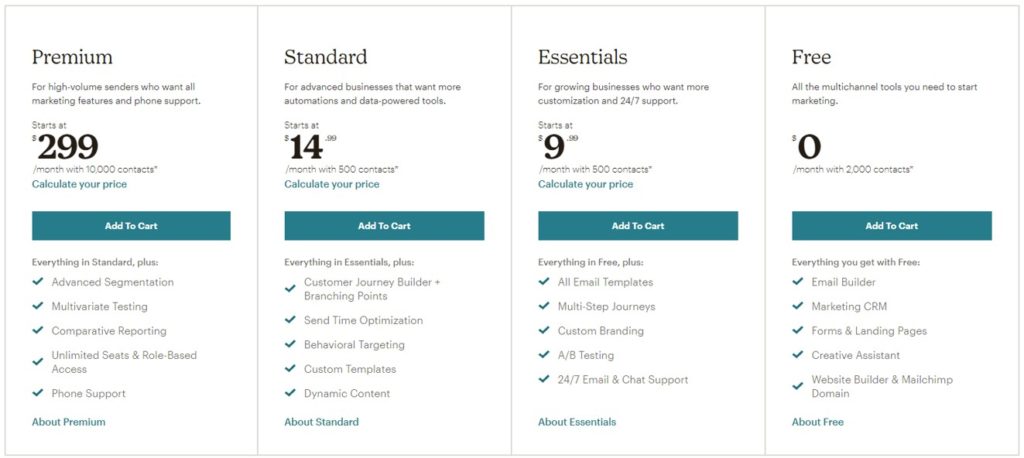

Example: Mailchimp knows customers read pricing from left to right, so they have anchored their most expensive plan first to make the other options more appealing in comparison. When a customer sees $299, paying $14.99, $9.99, or nothing at all seems to appear more attractive.

Final Thoughts

Psychological pricing provides you with additional tools to your pricing toolkit that can help you guide customer purchase decisions. Setting prices for products and services should always be a value-based exercise to ensure alignment with market needs, however applying psychological pricing strategies help drive incremental benefit, helping you close the sale.

ABOUT THE AUTHOR Michael Stanisz is a Partner at Revenue Management Labs. Revenue Management Labs help companies develop and execute practical solutions to maximize long-term revenue and profitability. Connect with Michael at mstanisz@revenueml.com