This is the first in a series of articles we are publishing on emerging pricing trends and strategies, all pulled from our comprehensive executive survey conducted at the end of 2023. Throughout the series, we aim to highlight the evolving landscape of pricing while exploring the story behind the pricing benchmarks and performance over the past year. In this first article, we are looking at the 2023 benchmarks and discussing the implications for your organization.

About the Pricing Research behind the Insights

We commissioned the pricing survey in late 2023 and designed the survey questions to cover all areas of pricing necessary to improve performance. Over 500 executives responded in roles from CFOs to CEOs and chief revenue officers, all with a verified, direct hand in shaping pricing strategies and driving top-line revenue. The executives represented nine diverse industries – from consumer goods to medical technology – and there was an even regional split across North America and Europe.

Overall Pricing Benchmarks for 2023

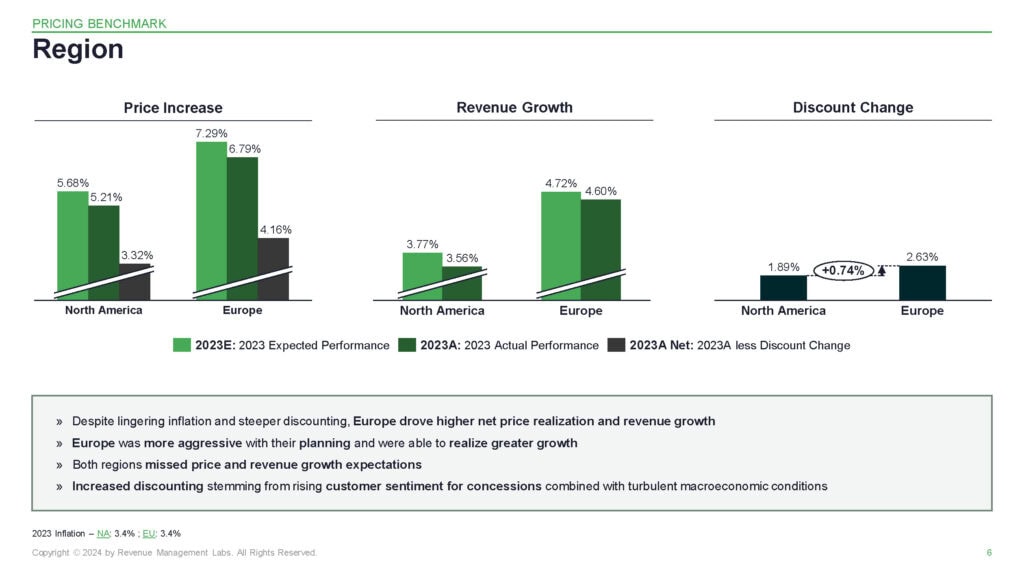

One piece of feedback we received from last year’s soft launch of the pricing survey concerned the regional differences. The European market requested pricing data specifically from companies operating within Europe with an eye to uncovering the regional nuances of Europe as compared to North America. In response to this feedback, we expanded the reach to include five major European countries including France, Germany, Italy, Spain, and the UK. Unsurprising, there were striking differences but also some similarities that emerged when we looked at this year’s the high-level pricing benchmarks of price increases, revenue growth, and discount change.

Both North America and Europe were very aggressive when it came to setting pricing targets for 2023. In North America, the targeted increase hovered just above 5.5%, while in Europe, they were more aggressive with their price increases, aiming for over 7%. Even with aggressive targets, both regions under delivered their targets in terms of actual performance.

What was shocking for us was that the actual realization of price came down drastically when we overlaid the discounts. In North America, although an average price increase of around 5% was achieved, the net price realization dwindled to just under 3.5%. What we are seeing are organizations struggling to meet their pricing targets because their discounts increased as well.

Yet, the picture was not completely dire. Despite underperforming, organizations experienced both volume expansion and customer acquisition when you examine total revenue growth. In North America, the expectation was just under 4% and in Europe, a bit more aggressive. So despite the variance in targeted expectations, the actual outcomes align remarkably closely.

Industry Pricing Benchmarks 2023

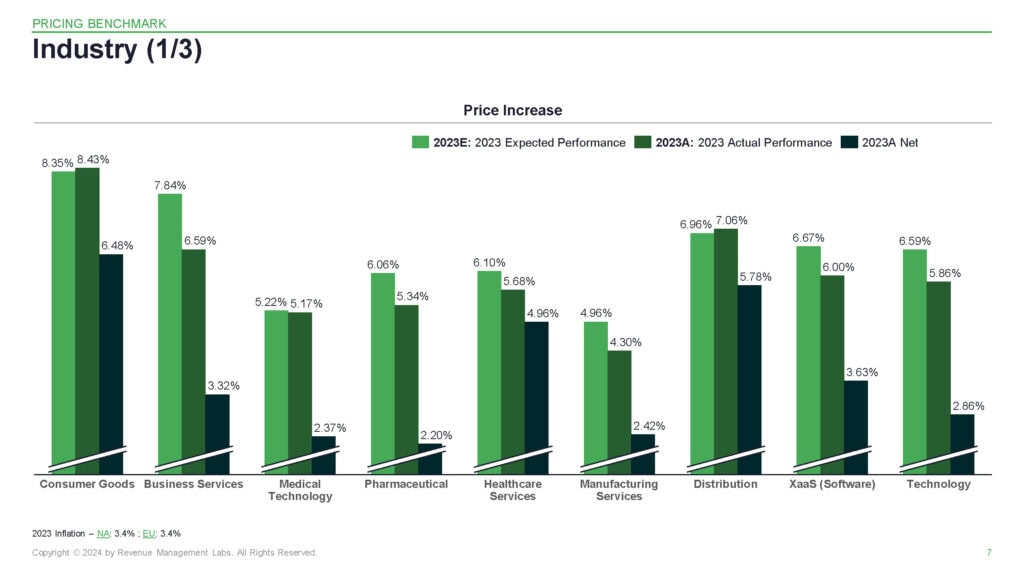

Moving to the industry cut of the data reveals fairly extreme variability across industries, where the interplay between price increases and discounts shapes outcomes significantly.

We saw a wide range of price increases across the market 2023, ranging from about 4% to 8%, but the largest by far was in consumer goods. Inflation was running at about 3.5% in 2023 in North America and Europe, so the consumer goods price increase well exceeded inflation. One reason for the aggressive price increases was to offset persistent cost headwinds over the past few years. Of note, this aggressive price setting is a marked departure from previous years and reflects a definitive stance in the context of some predictions of economic softening.

While certain sectors like distribution and consumer services tread closer to their pricing targets, others, notably pharmaceuticals and medical technology, grappled with challenges in passing through intended price hikes, often resorting to heightened discounting strategies. One intriguing aspect to note is the prevalence of longer-term contracts within these industries, which may pose obstacles to adapting to swiftly changing market dynamics. Long-term contract will slow any organization’s ability to adjust discounting structures in real-time. As we gear up for future iterations of our survey, we will be monitoring the lower performing industries to see if we see signs of improvement.

There is a lot more to discuss in the industry data than we’ve touched on here. We will be exploring the benchmarks in future articles. In the meantime, I recommend taking a moment to download the 2024 Executive Pricing Survey Report and read through the data. If you have any questions on the specific slides, simply reach out and we’re more than happy to discuss the research.

Future Industry Pricing Reports

The 2024 Executive Pricing Report is the first in a series of reports we will be releasing on pricing trends and business insights. In the coming weeks, we will be publishing pricing benchmark reports tailored to each industry, offering a deep dive on pricing insights specific to each of those industries and with unique best practices. Additionally, we are on the verge of launching a comprehensive dataset, enabling you to compare your organization’s performance against industry peers and chart a course for future pricing initiatives.