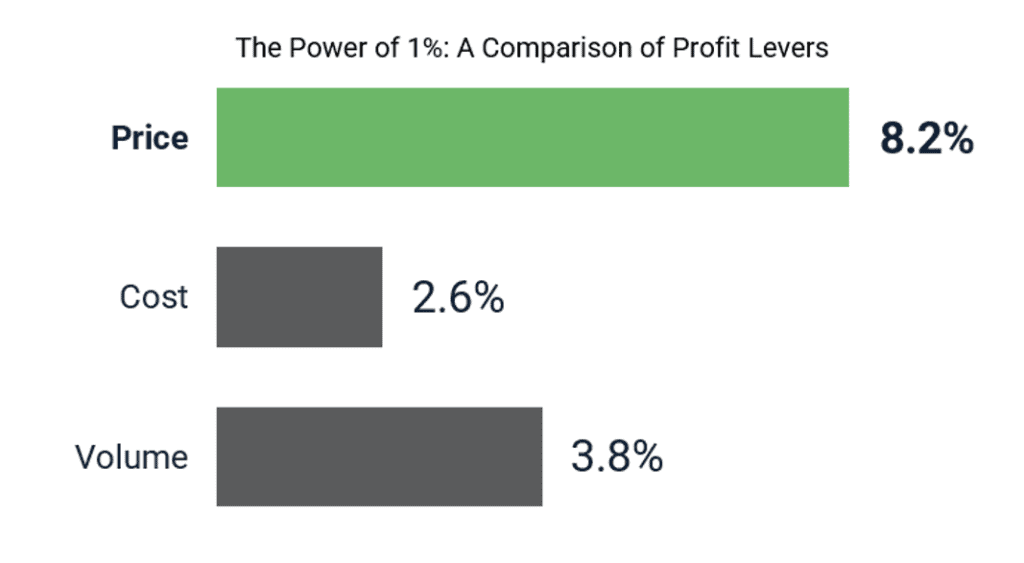

Pricing is the fastest and most effective way for companies to increase profit. Consider the average S&P 500 company – a successful pricing strategy can generate a 3:1 to 8:1 return on investment, being 3.2x more effective than cost reduction and 2.2x more effective than volume growth.

Unfortunately, pricing is not a priority for most service parts companies. Most of their capital, time, and labor are spent on costs (i.e., procurement, supply chain, outsourcing, etc.) and increasing volume (i.e., investing in sales and marketing). In fact, a recent study found that 70% of companies spend 10 hours or less annually on strategic parts pricing, often relying on cost-plus pricing or a pricing software with simplified pricing algorithms to get the job done.

Now, service parts companies aren’t completely to blame here. The current market presents many complexities that are difficult to overcome:

1. Managing High SKU Counts:

The average service parts portfolio has 1000+ SKUs that perform differently. To manage these large portfolios, service parts companies need to categorize and create groups of parts that can leverage different pricing strategies to maximize customer willingness to pay.

2. Identifying Relevant Competitors:

Identifying your competitors across channels and product categories can be difficult. Competition exists from Original Equipment Manufacturers (OEM), aftermarket suppliers (domestic and generic imports), and private label brands. Even deciding which competitors to track across your portfolio can be daunting.

3. Pricing for End-Users:

Multiple levels exist between manufacturers and end-users. As a result, even though end-users drive demand for aftermarket products, the manufacturer’s pricing strategy is usually focused further up the supply chain. Determining elasticity is also a challenge as pricing actions are obscured by the multiple levels.

4. Identifying Market Size:

Service parts companies usually have high-level category estimates for market size and market share but tend to find it difficult to estimate these metrics on a product category level or for specific parts. This is because part failure rates differ dramatically based on the installation machine as well as the frequency of machine operation.

Key Drivers To Optimize Parts Pricing

Despite the complexities above, in order to get service parts pricing right, the following 5 key competencies are essential:

1. Formal Tools & Processes That Align With Customer Needs:

As much as companies try to put customers first, it is easy to lose sight of the voice of the customer when it comes to pricing. Further, many are still employing outdated and often manual approaches that are more focused on margin targets than on customer needs and value. To optimize parts pricing, companies must develop tools and processes that align with customer needs.

2. Service Value Based on Contribution To Customer Business:

Most service parts companies do not consider customer-specific value drivers when setting prices. For example, a company that requires immediate parts replacement overnight may have a completely different willingness to pay and value perception than a company that requires parts for scheduled maintenance. Accounting for these value drivers will help parts companies capture and reflect customer needs in a structured way.

3. Pricing Based on Value Proposition & Market Intelligence:

Most companies make pricing decisions in the spur of the moment to serve whatever the short-term objective might be. Pricing based on value proposition and market intelligence helps organizations measure where they are price and value positioned versus the competition. This way, pricing goes beyond short-term objectives like meeting a sales quota or matching competitor prices.

4. Proper Choosing and Reporting of Key KPIs:

The success of your pricing strategy is determined by the consistency of results. KPI reporting helps track how well goals and targets are being met (or not). With so many KPIs to choose from, make sure to pick the ones that are aligned with organizational objectives. Do you want to increase revenue? Drive volume? Optimize portfolio mix? Manage price gaps? Ensure successful pricing pass through? By focusing on the right KPIs, you’ll be able to understand where you’re going wrong and, as a result, make changes that will help achieve objectives faster.

5. Ongoing Competitive Pricing Analysis:

To remain competitive in today’s fast-changing business landscape, pricing strategies need to be evaluated frequently. Often this requires a disciplined process to obtain an ongoing feed of competitor prices and ensure your part-level cross-references are kept up to date. The key is identifying the relevant competitors to track by determining the customer alternatives that they would buy from. Often we find companies are focusing on a long list of competitors, some of which have limited market presence, and not consistently updating competitive pricing audits. This leads to opportunity being left on the table.

Final Thoughts

Pricing can help service parts organizations embark on the road to profit maximization. But companies must develop a robust pricing strategy if they are to take advantage of this opportunity. When developing your service parts pricing strategy, be sure to keep in mind the 5-item checklist above to make sure you are covering all the necessary bases.

ABOUT THE AUTHOR Avy Punwasee is a Partner at Revenue Management Labs. Revenue Management Labs help companies develop and execute practical solutions to maximize long-term revenue and profitability. Connect with Avy at apunwasee@revenueml.com