Netflix boasts over 221 million subscribers worldwide, more than any other streaming platform including Disney+ and HBO Max. Yet Netflix CEO, Reed Hastings, has always been adamant that more growth is out there. He suggests that by factoring in account sharing, Netflix’s subscriber count would balloon. In fact, recent studies have estimated that almost 1/3 of Netflix subscribers share their account with others.

Regardless of what the total number of unauthorized sharing may be, it looks to have reached Netflix’s breaking point. Netflix recently introduced a new offer that allows Standard and Premium subscribers to add “sub accounts” for up to two people – each with their own profile, personalized recommendations, login and password. Although the offer is only being tested in Chile, Costa Rica and Peru, it could be expanded globally if it proves fruitful.

Let’s take a look at how Netflix arrived at this decision and explore the implications it might have on the company.

Netflix’s Price Structure

Like most streaming services, Netflix uses a tiered pricing strategy to optimize its revenue. Tiers are differentiated based on the needs of each customer segment (i.e., ads, billing frequency, content bundling, video quality, etc.), enabling companies to provide a variety of offerings that appeal to different customer segments. For Netflix, the key differentiator they chose to tier on is number of users. Tiered pricing makes upgrading easy, as customers can clearly see the benefits gained with more premium tier options. Plus, offering premium tiers is a great way to generate a higher out-of-pocket (OOP) transaction.

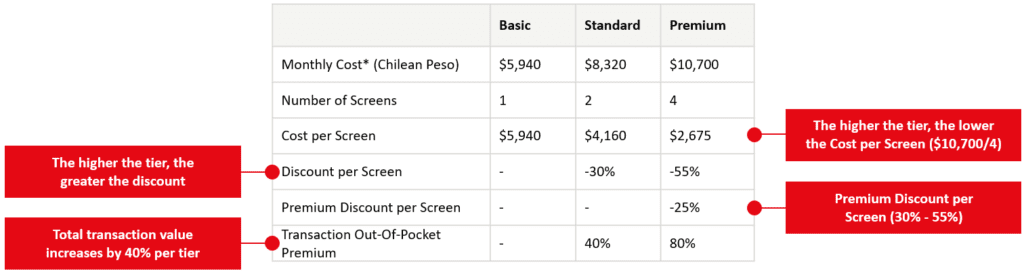

For example, in Chile, a Basic, Standard and Premium Netflix subscription costs $5,940, $8,320 and $10,700 CLP. Subscribers pay a higher OOP as they move toward higher tiers but gain access to more screens (among other benefits like more downloads, greater video quality, etc.) at a discounted price.

Previous Price Structure: Chile

How The New Offer Impacts Netflix’s Pricing Structure

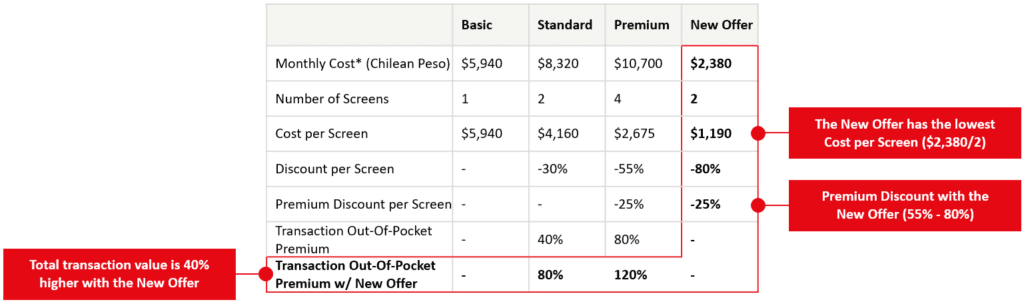

With the introduction of the new offer, Standard and Premium subscribers get an additional 2 screens for $2,380 CLP. My guess is that usage data revealed Standard and Premium subscribers were frequently reaching the usage limit and Netflix saw an opportunity to generate incremental revenue by charging for additional users. Subscribers who upgrade to higher tiers with the new offer will have to pay an even greater OOP, but gain access to 2 additional screens at a greater discount.

Current Price Structure: Chile

Key Considerations For Netflix

1. The discount for the new offer is exactly in-line with its core offerings (25%), meaning Netflix sets prices based on excel models rather than on customer insights. Customers rarely crunch numbers to figure out how much they save before making a purchase decision. Ideally, Netflix should be identifying the optimal price that a customer is willing to pay based on their value differential versus the next-best alternative. By having linear offerings, Netflix ignores the value of each option, leading to mispricing and money left on the table.

2. Not all press is good press. As Netflix’s new offer continues to trend worldwide, there is a good chance that more subscribers will start sharing their accounts as they discover and exploit the current loophole. Not only is this the opposite of what Netflix wants, the new offer could also reduce the number of new sign-ups, as customers opt for the cheaper, account sharing option.

3. Netflix needs to ensure the new price structure encourages top-line growth and is aligned with corporate objectives. Is focusing on the number of users the right way to grow revenue? How will the new offer impact new customer acquisition? These are some key questions that Netflix must explore as the offer will become the core of their customer conversion strategy.

Final Thoughts

Pricing structures play a fundamental role in how customers perceive the value of offerings and evaluate them. Thus, it is critical to structure prices around corporate objectives and customer needs to drive growth. If price structures ignore these considerations, it will be a drag.

Does Netflix have its pricing structure right? Only time will tell. But the success of the new offer will be a good gauge. It’s worth keeping an eye on in the next year to see if it gains momentum in testing and whether they expand the offer (or eliminate it).

ABOUT THE AUTHOR Avy Punwasee is a Partner at Revenue Management Labs. Revenue Management Labs help companies develop and execute practical solutions to maximize long-term revenue and profitability. Connect with Avy at apunwasee@revenueml.com