The beginning of 2020 seemed to hold so much promise; the economy was stable, stocks were up, and companies looked forward to a new decade of achieving their top-line goals. COVID-19 changed all that.

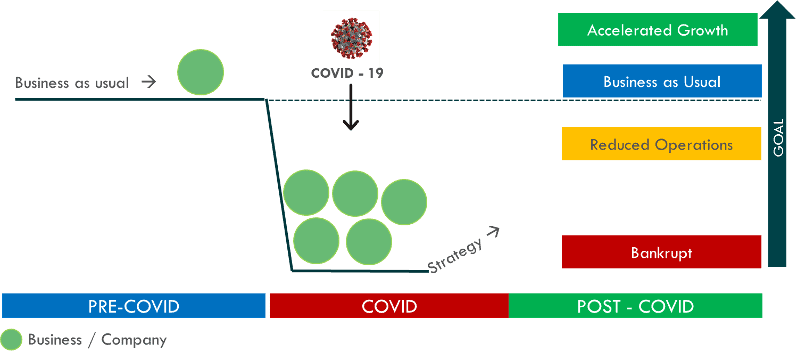

The worldwide lockdown resulted in decreased sales and the slowdown of whole industries, with the effects still being felt for months or even years into the future. Now, as the curve is starting to flatten and the economy begins to re-open, businesses are charting their recovery plan towards accelerated growth (Exhibit 1).

7 Major COVID-19 Trends

To understand what actions you should implement in your COVID-19 recovery plan, it is important to nail down on exactly what has changed in the last year.

- Customers are housebound, and companies must find ways to reach them

- Customers are likely to purchase cost-effective offerings, which will result in changes to the high/low ends of the market

- Increased focus on safety and reliability

- Rise in contactless services

- Companies are working on flexible payment options to minimize customer churn

- Remote/collaboration software like Slack, Zoom, Microsoft Teams are growing as employees adopt new ways of working from home

- Customers are adopting more e-commerce/online shopping solutions to purchase products and services including electronics, groceries, food and even cars

These major industry trends have impacted the top-line of a wide variety of companies. For many, new bookings, sales pipeline volume, and cash collections have declined and the sales cycle has become longer and more unpredictable. Unless companies act fast, they are positioning themselves for failure.

How to Accelerate Your Growth

Historically, companies that have rapidly adapted to societal shifts have succeeded in building market share and brand equity. For example, back in 2003, the SARS outbreak in China changed people’s attitude towards shopping, with many customers migrating to e-commerce platforms. Alibaba, which started primarily as a B2B marketplace, launched Taobao to facilitate customer to customer online retail in response to the shift in consumer behaviour. This strategy propelled Alibaba’s popularity, allowing the company to eventually dethrone eBay as the market leader.

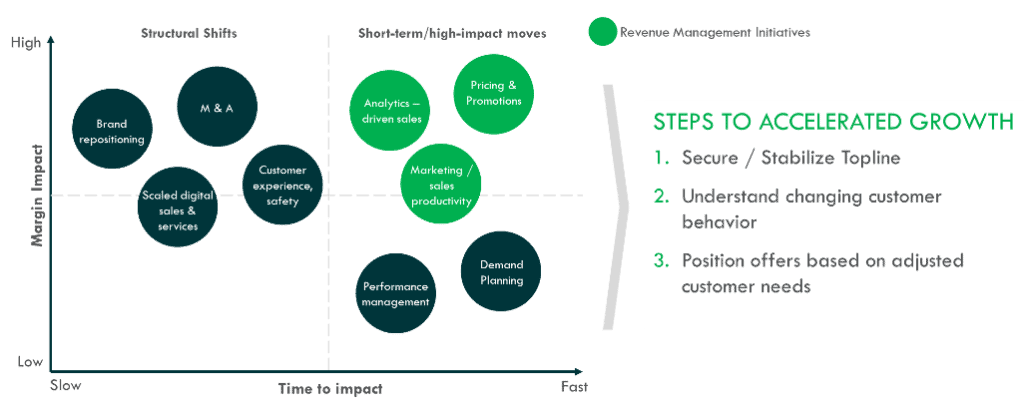

Alibaba’s response to the SARS outbreak was innovative, which is not always possible due to lack of time or resources. So, what actions can you take in the short-term to ensure a positive impact on top and bottom line? (Exhibit 2)

Given the above, Revenue Management has huge leverage. Thankfully there is a standard playbook.

Step 1: Secure / Stabilize Top-line

Companies cannot focus on their recovery without managing top-line risk:

- Secure renewals to maximize customer lifetime value by incentivizing increased term of renewals (e.g. initial contract 3 years, renewal 5 years)

- Accommodate customer requested payment terms to reduce churn by extending billing periods in the short-term to accommodate cash-crunched accounts

- Establish guidelines on customer requested price decreases to ensure the ability to bounce back prices during recovery and not peanut butter permanent price decreases

- Set-up a cross-functional team to support the execution of the actions outlined above in a timely manner

Step 2: Understand Changing Customer Behaviour

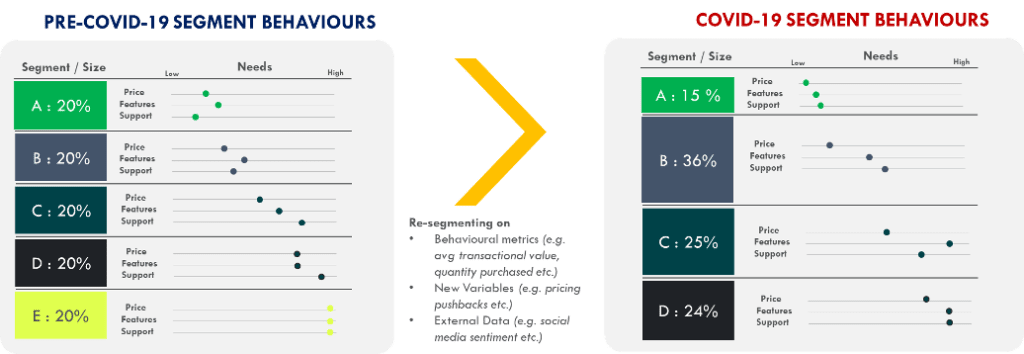

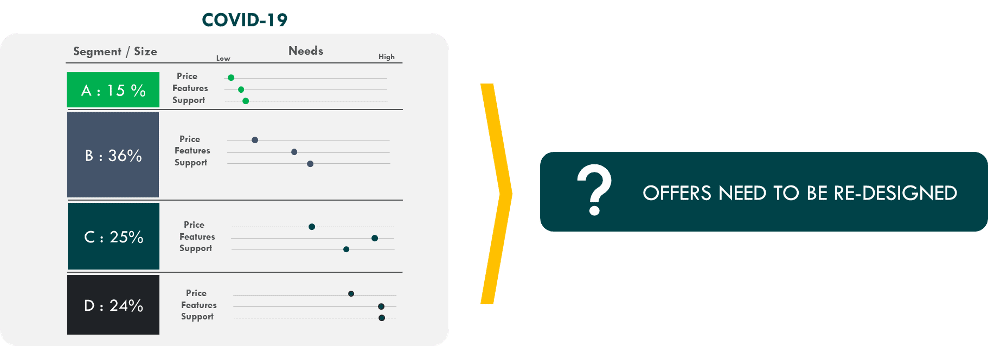

COVID-19 has changed customer purchasing patterns and as a result, it is important to re-segment customers to capture these changes (Exhibit 3). The major components to successfully understand changing customer behaviours are:

- Gather additional data to use as input to the re-segmentation process. The key factors to include are:

- New variables (e.g. pricing pushbacks, discount enquiries, payment terms etc.) to capture market realities

- External data (e.g. social media sentiment) to capture new customer trends

- Re-segment customers on behavioural metrics (average transactional value, quantity purchased, time of purchase etc.) including the new variables and external data to understand customer needs and purchase behaviour. It is preferable to use behavioural segmentation over other forms of segmentation (e.g. psychographic or demographic), as it allows you to group customers based on the actions they take during purchase.

The new segments will shed light on how customer behaviours have changed. For example, in the graphic above, segments A-E have become more price-sensitive due to COVID-19 and want more features for the same price.

In addition, it is important to analyze whether customers have migrated to a new segment. For example, all the customers belonging to segment E (Pre-COVID-19) have migrated to other segments, which changes the respective sizes of the segments. It is paramount for companies to understand these nuances and changes in customer behaviour so that you can plan on how to maintain relationships with your customers.

Step 3: Reposition Offers Based on Customer Needs

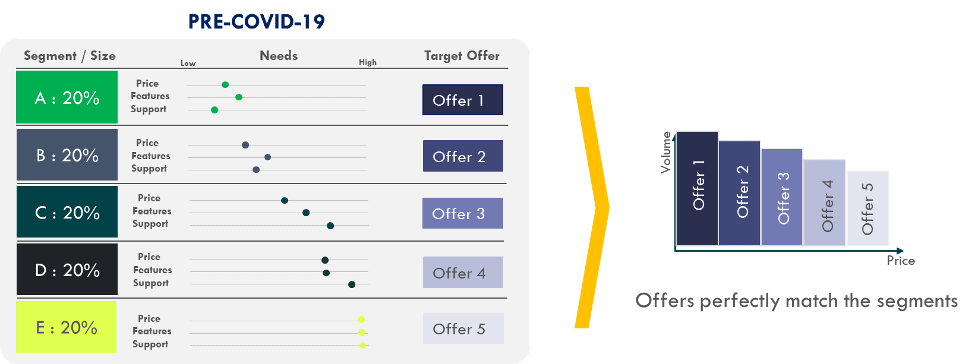

Prior to COVID-19, your offers would have ideally been matched to your customer segments (Exhibit 4). For example, Offer 5 would be positioned to target premium customers who wanted the most extensive set of features, whereas Offer 1 would be positioned to target your budget/value customers who were looking for more of a “bang for your buck” option.

Unfortunately, COVID-19 has changed customer behaviour drastically, and now most offers are obsolete. You cannot offer the same price for on-premise features to a customer who is now more price-sensitive and looking for remote features. The offers that were positioned for pre-COVID-19 segments need to be redesigned to meet new customer needs and expectations (Exhibit 5).

Companies are already starting to augment their offerings to set themselves up for success. For example, Monday.com introduced remote collaboration tools for the same price to meet the new needs of customers. In another example, Shopify extended the length of its trial from 15 to 90 days to incentivize new customers while also creating a platform to provide loans to stores.

While some businesses are trying to make the best of the situation and recover rapidly, others are more apprehensive, waiting for things to go back to normal.

When Will Things Go Back

to Normal?

To put it simply: nobody knows when things will go back to normal.

Hoping for things to go back to normal is like playing the Powerball, where the odds of winning are 1 in 292,201,338. Are you really going to bet on it and not prepare for an altered future? The best move now is to focus on recovering revenue by understanding changing customer needs and repositioning offers to lay the foundation for accelerated growth.

ABOUT THE AUTHOR Karthik Balaji is a Senior Consultant at Revenue Management Labs. Revenue Management Labs help companies develop and execute practical solutions to maximize long-term revenue and profitability. Connect with Karthik at kbalaji@revenueml.com