Updated January 8, 2024

Recessions are inevitable, difficult to predict and even difficult to diagnose. As a “when” not “if,” recession planning is a matter of course for any business. Those businesses with a well-thought-out recession plan react better to an economic downturn, and often come out the other side more resilient and set up for a period of revenue growth.

In this article, we will cover the fundamentals of recession planning, including the general causes and requirements of a recession, best practices of preparing for a recession, and how to build a pricing strategy that’s recession resilience.

General causes & requirements of a recession

What is a recession?

A quick rule of thumb for diagnosing a recession is the two-quarter rule, which defines a recession as two consecutive quarters of declining GDP. The National Bureau of Economic Research (NBER), however, defines a recession as “a significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production, and wholesale-retail sales.” The latter definition is less restrictive in what we can consider a recession and covers a wider range of past recessions.

How to Identify a Recession in Advance

These definitions, of course, are inherently lagging indicators; they can only help you identify a recession when you are already in one. To genuinely prepare for a recession, we need to understand the leading factors that signal a recession. Being aware of these factors, we can get a better indication when a recession might occur and thus have more time to prepare and react.

These factors range from black swan events and asset bubbles to excessive debt and out-of-control inflation. Below we go into more detail about some of the factors that can lead to a recession:

- Black Swan Events: Surprise economic events cause large uncertainties in the market leading to increased risk profiles that must be reduced/hedged; this results in large shifts across and within asset classes further destabilizing markets.

- Excessive Debt: When individuals and businesses can no longer afford to pay their debts, we get an increase in defaults and bankruptcies thereby decreasing access to capital which ultimately slows down the growth of the economy.

- Asset Bubbles: When the average price of an asset class continues to outpace the asset class’s utility and future expected value, we get a bubble. When bubbles start to deflate, investors pull out, causing a free fall in the market that ripples to other industries and markets, hence destabilizing the economy.

- Out-of-Control Inflation: Over time, the price of goods increases, consequently the value of a single dollar decreases. Inflation occurs for a variety of reasons such as increased demand, wages, material prices, paired with decreased supply and productivity. If this happens too quickly however, it seriously hinders consumer spending thereby depressing economic activity.

- Technological Advancements: When technological advancements outpace human labour, we often see unemployment rates increase in the affected industries. Unemployment leads to a decrease in consumer spending power which results in less economic growth.

To better understand the relationship between recessions and pricing strategy, it is helpful to review the triggers and other global factors. For our purposes, we consider the past few significant recessions in the United States, which were either primarily sparked by asset bubbles (such as the housing bubble and Dot Com bubble) or Black Swan Events (such as Covid-19 and the invasion of Kuwait). Below we go into more detail of the most recent recessions in the United States’ economy:

- The Covid-19 Recession (February 2020 – April 2020). The two-month recession has the unfortunate notoriety as the steepest recession but also the shortest of those in record. The Covid-19 virus was officially declared a pandemic in March 2020; the resulting travel, work and lifestyle restrictions caused unemployment to rise from 3.5% in February 2020 to 14.8% in April 2020. The US government invested $5T in relief spending, and The Federal Reserve expanded its balance sheet by an additional $4.9T for quantitative easing. As the country continued to endure the pandemic and its varied ramifications, inflation continued to rise causing the federal reserve to increase interest rates risking a recession.

Duration: Two months

GDP Decline: 32.9 annualized rate in Q2 2020

Peak Unemployment Rate: 14.8%

- The Great Recession (December 2007 to June 2009). The Great Recession was caused by a bubble in the US housing and real estate market due to risky mortgage underwriting. Some of the largest and most well-known financial institutions found themselves over exposed to subprime mortgages, debt with no chance of repayment. The effects rippled throughout the financial sector and beyond in the form of mortgage-backed securities, large scale bankruptcies and unemployment.

Duration: Eighteen months

GDP decline: 4.3%

Peak unemployment rate: 9.5%

- The Dot Com Recession (March 2001 to November 2001). The Dot Com recession was caused by a combination of The Dot Com Bubble, accounting scandals at companies like Enron, and the September 11 terrorist attacks. These events led the US to a mild recession at the turn of the millennium following the longest run of economic expansion in US history. To help end the recession, the Fed lowered fund rates from 5.00% in March 2001 to 2.00% in November of the same year.

Duration: Eight months

GDP decline: 0.3%

Peak unemployment rate: 5.5%

- The Gulf War Recession (July 1990 to March 1991). Spiking oil prices due to rising tensions, and the first Gulf War (where Iraq invaded Kuwait) caused a mild recession in the early 1990’s. Prior to the recession, the fund rates increased from 6.5% in 1988 to 9.75% in 1989 in order to contain inflation, which rose from 2.2% in 1986 to 3.9% in 1990.

Duration: Eight months

GDP decline: 1.5%

Peak unemployment rate: 6.8%

Click here for a timeline view of past US recessions: A Timeline of Past Recessions

Click here for a more in-depth discussion of past US recessions: A Review of Past Recessions

Although recessions may share certain economic realities, they are often triggered by a wide array of events ranging from highly contagious viruses and excessive exuberance in technological advancements, to unscrupulous financial instruments and major disruptions in oil supply chains. The wide variety in triggering events points to a large difference in diagnosing a recession and predicting one.

Understanding the current economic climate

What are some factors that you can use to predict the likelihood of a coming recession? The easiest is to monitor the New York Fed recession probability indicator, which uses a yield curve as a leading indicator. But historical analogies may be now less useful to forecast coming recessions. By many accounts, the economy cycles during the pandemic have been untypical, making it difficult to predict when the recession will occur from a yield curve. Where that leaves us is looking at several factors such as fed rate hikes, high mortgage rates, the resilience in the labor market, and persistent working from home. Here is the caveat, even understanding the factors that predict a recession, it is incredibly hard to accurately forecast one, let alone understand what is happening now.

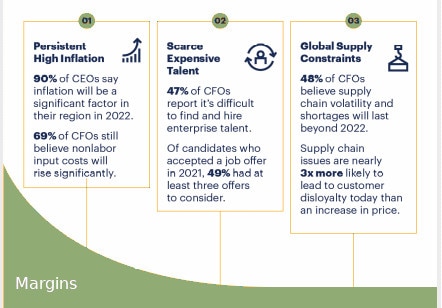

We have broken down the factors into three main categories: persistently high inflation, scarce, expensive talent, and most importantly, global supply chains with issues. Below we go into more detail in each of these reasons and how they may spark a recession.

A Unique Triple Squeeze of Compounding Pressures as Recession Threatens

1

Persistent High Inflation

90% of CEOs say inflation will be a significant factor in their region in 2022.

69% of CFOs still believe nonlabor input costs will rise significantly.

2

Scarce Expensive Talent

47% of CFOs report it’s difficult to find and hire enterprise talent.

Of candidates who accepted a job offer in 2021, 49% had at least three offers to consider

3

Global Supply Constraints

48% of CFOs believe supply chain volatility and shortages will last beyond 2022.

Supply chain issues are nearly 3x more likely to lead to customer disloyalty today than an increase in price.

Margins

High Inflation

The current economic reality is that inflation is not going away anytime soon (not very transitory as once speculated); as such, the fed must continue to increase interest rates pressuring the economy to contract. The past few recessions did not have the government printing more than $10T in relief spending and quantitative easing; this will likely result in a persistent inflation which was not present before.

Scarce Expensive Talent

Supply Chain Issues

The cost of goods has increased significantly in the COVID era due to a lack of preparedness; not many countries and businesses were prepared for the increase in consumer demand, factory and border shutdowns, and congested freights. The result of this shifted the supply-demand curve towards a lack of supply, thus causing an increase in the price of everyday goods, and hence leaving family households with less purchasing power.

These compounding challenges mixed with rising global tensions and overall slowing economy may be the unique conditions causing the next recession. The most important question now is what your company can do to prepare.

THE IMPORTANCE OF PREPARING FOR A RECESSION

Winning companies will surgically restructure costs before the downturn. They put their financial house in order and look for opportunities to reinvest for competitive outperformance. The best prepared companies begin with a realistic assessment followed by a practical action plan.

Losing companies, however, fail to prepare and remain sitting ducks while their pro-active competitors gain market share. Without any pre-recession preparation, companies will lose any competitive advantages they hold in the market, and in the worst-case scenario, may face bankruptcy.

Preparation guide

In the sections below, we have outlined the key steps to take in preparation for a recession and which revenue management tactics work best. We begin by analyzing your current position in the market, and then follow it with two ways of controlling your revenue: managing budgets and expanding market share.

I. Understanding your Position

The foundation of successful strategic planning in the pre-recession period is to understand where you stand, both from an internal and external perspective. Ask yourself these questions:

- Internally, what are your current cost management practices? More simply, this means asking questions such as, “how is your organization spending its money?”, “which departments and/or projects are most crucial to your success”, and “which departments and/or projects can be scaled at a later point in time?” During a recession, your company will likely have a tighter budget. After slicing your company by department, product/service line, project, strategic area, etc., ask yourself, “Where can we afford to reallocate resources to best weather the storm?” Your answers may be bucketed into the following:

- Cuts already made

- Cuts made and more likely to continue

- No cuts planned; Business as usual

- Looking to invest more

- Uncertain

- Externally, what are your revenue-generating measures? More simply, this means asking questions such as “how does your organization make its money?”, “which products or services are driving your growth?”, and “which products or services are staggering your growth?”. During a recession, your company will have less disposable income and demand. As a company, you will need to understand how limited discretionary spending power affects your customer’s purchasing decisions? Or how other clients’ restructured budgets may impact your existing relationship? To gain insight into the shifting landscape, ask yourself the following questions:

- How is your customer behavior changing?

- Are your goods/services meet the new customer’s needs?

- Are your pricing model covers all new customer segments?

II. Managing Your Costs

In the short term, using a cost cutting strategy enables immediate reductions in the outflow of cash. The following practices can be used to implement cost cutting most effectively:

- Eliminating unnecessary resources (People, systems, property, etc.)

- Rationing value positions (reducing quality/quantity)

- Renegotiating offerings

In the long term, reinvesting your cost savings allows you to implement mid-to-long term structured projects improving your internal practices and/or external offerings such as:

- Automating process

- Outsourcing task flows

- Accelerating digital projects

III. Managing Your Revenue

During the pre-recession period, inflation will force many companies to increase prices to address rising operational costs, and many other companies may go the opposite way running more promotions to maintain customer loyalty. It is difficult, in any period, to determine how much companies should trade-off between addressing increased costs and brand equity, but this is even more so difficult during a recession when customer behaviours change dramatically. As a result, companies need to get a lot more sophisticated regarding how they approach pricing.

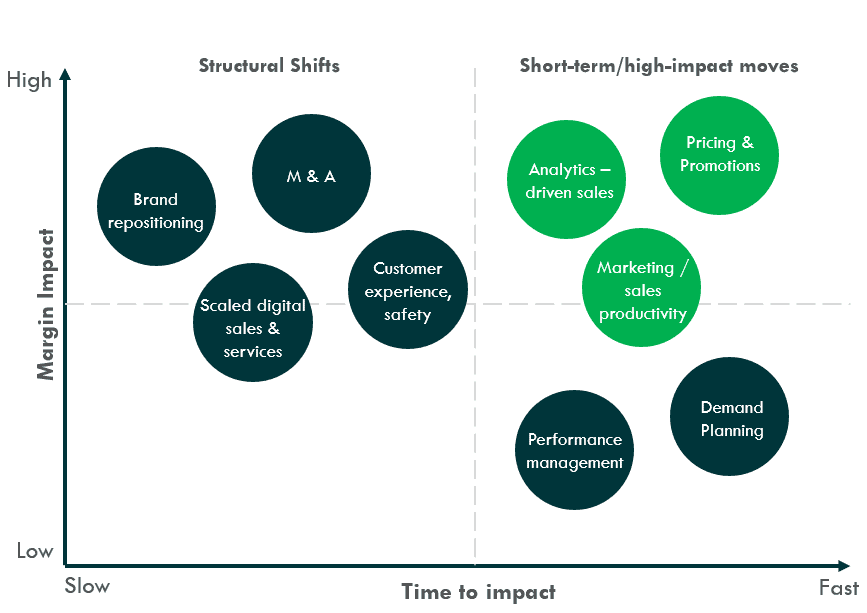

IV. Preparing Price Wise

The most significant change in a recession is the customer’s willingness to pay (WTP). To be prepared, companies must focus on their pricing model and product tier to close any potentially forming gaps between customer expectations and actual offerings.

Unlike many other strategic initiatives, preparing price wise allows for a high-margin impact with a quick turn-around time making it ideal when preparing for a recession within a limited time frame.

repositioning

sales &

services

experience,

safety

driven sales

Promotions

sales

productivity

management

Planning

To ensure proper pre-recession preparation, we will go over seven actions that can help your company stabilize its top line, understand changing customer behavior, reposition offers based on customers’ needs, and emphasize quick turnaround times for pricing strategies.

How to prepare for pricing during recession

We have explored the value of cost management and revenue generation, and how it is imperative to plan for changes in these areas to weather a recession. Next, we will dive into some key strategies which take these concepts further.

- Stem Revenue Leaks

- Secure and Stabilize Top Line

- Re-Segment Customers Based on Changing Needs

- Re-Position Offerings to Meet Customer Needs

- Focus on High ROI Promotions

- Build Capabilities

- Execute and Communicate Price and Offering Changes

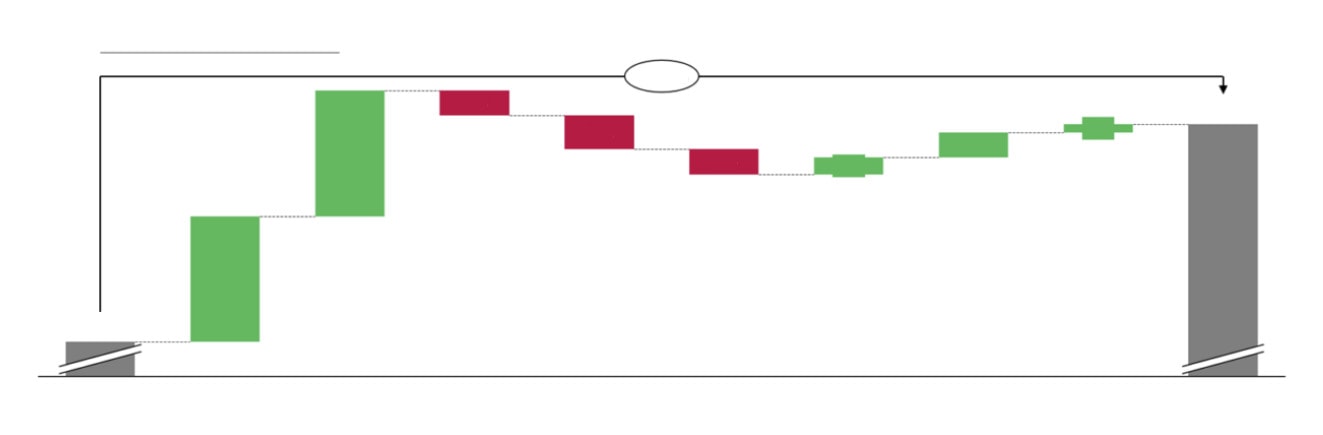

STEP 1: Stem Revenue Leaks – Price Waterfall

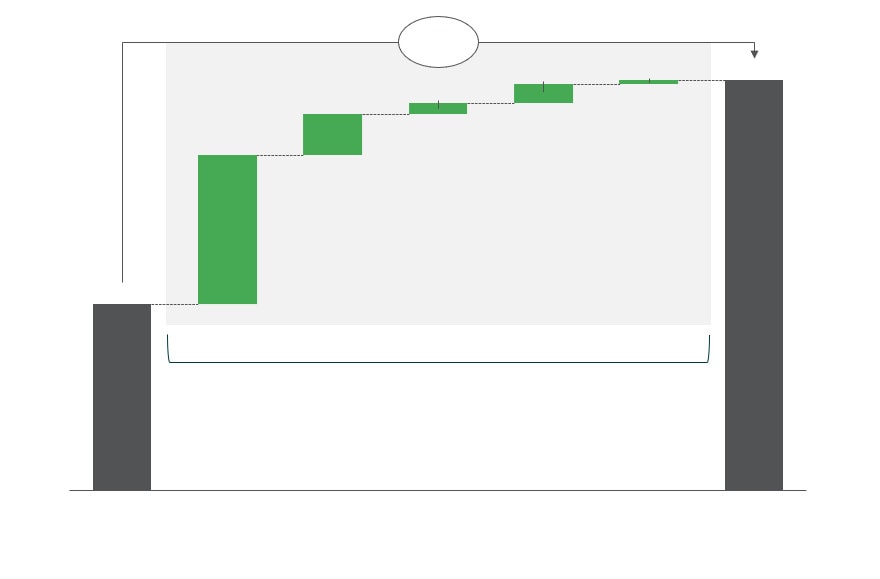

A key aspect of pricing is understanding how the final price translates into net revenue dollars. Net revenue measures the price realized on a product or service after accounting for all discounts, promotions and other costs of doing business. While this is important during periods of economic growth, it becomes even more important during market downturns when the focus shifts from simply growth alone to growth and savings.

A good way to identify net revenue leakages is using a visual tool called Pricing Waterfall. In essence a pricing waterfall (shown below) allows us to decompose all the factors involved in going from the list gross revenue to net revenue, while giving visibility on factors which might be detrimental to the corporate goals. A pricing waterfall is ideally built at the lowest level of granularity (ex. customer and product combination) but can be built at an aggregated level as well.

Mix

Mix

Mix

Mix

Pricing Waterfalls can be used to answer some key questions:

Are the discounts being applied correctly, and in the manner, they were intended?

From experience, we have consistently seen discounts being applied to customers who are not eligible for it. A primary driver of this but the not the sole one are sales teams who are looking to drive up the number of sales.

Which discounts and allowances are most effective?

Here we analyze the discounts and allowances to understand which ones influence the customers’ purchasing decisions the most. This allows us to optimize discounting to eliminate those that are leaking margin and keep those that are driving sales volume.

What combination of products, services and customer segments are the most profitable?

We analyze several factors that can influence margin and profitability. We ask which combination of products and services impacts margin growth the most? Which products and services are least and most profitable? And we examine customer segments for profitability as well.

How have actual prices evolved due to changes in deductions?

Heavy discounting can drive down the list price when customers have lowered their set expectation of what they should be paying.

The goal of all analysis is

being able to translate the pricing insights into clear actions you can take to

drive revenue growth and defend your bottom line against erosion in the face of

recession.

STEP 2: Secure And Stabilize Topline

Companies cannot weather the storm without a strong financial foundation and a few key factors go into ensuring you have a solid base heading into a recession:

Incentivizing increased term of renewals (e.g. initial 3 year contract renewed to 5 years by extending discounts or adding features) will give you more predictable revenue streams during a recession.

Extending billing periods in the short term will help accommodate cash-crunched accounts without losing customers and support a positive brand experience.

Clear guidelines and a discounting strategy will to ensure the ability to bounce back prices during recovery and not peanut butter (to make sticky) price decreases and freezes.

STEP 3: Re-segment Customers Based on Changing Needs

Now that we have closed our leaks and reinforced our foundation, it is important we use the recessionary period to adapt and grow. Recessions bring changes in how customers spend, and these can vary depending on the customer or the product being purchased.

It is important to quantify these changes in customer preference for two reasons:

- It will dictate how the product or service offerings need to be modified to meet changing demand (e.g. introducing a more budget friendly product/service by stripping unnecessary features)

- Some of the changes can be there for the long term, and capitalizing on that early will lead to competitive advantage in the future

We can do two things to better understand the afore mentioned change in behaviors:

- Gather additional data for the re-segmentation process. The key factors to include are:

- New variables (e.g. pricing pushbacks, discount enquiries, payment terms etc.) to capture market realities

- External data (e.g. social media sentiment) to capture new customer trends

- Re-segment customers on behavioral metrics (average transactional value, quantity purchased, time of purchase etc.). Including the new variables and external data to understand customer needs and purchase behavior in your re-segmentation. It is preferable to use behavioral segmentation over other forms of segmentation (e.g. psychographic or demographic), as it allows you to group customers based on the actions they take during purchase.

Re-segmenting on

- Behavioural metrics (e.g. avg transactional value, quantity purchased etc.)

- New Variables (e.g. pricing pushbacks etc.)

- External Data (e.g. social media sentiment etc.)

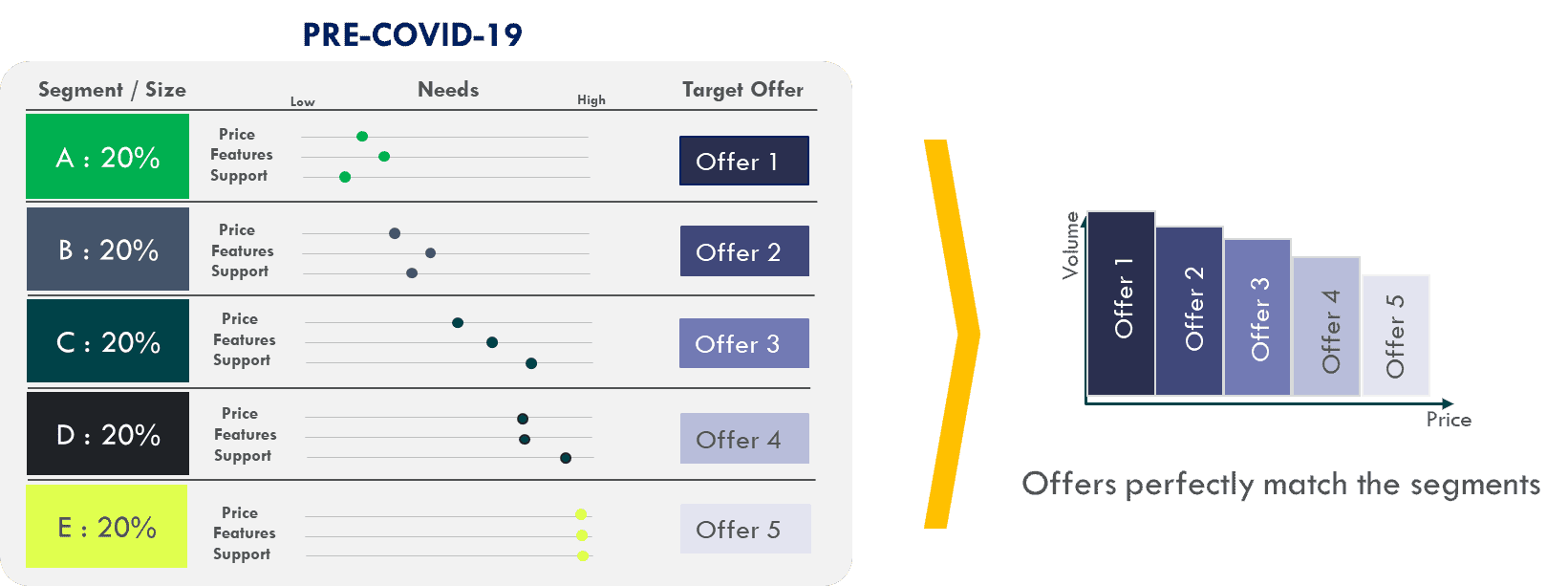

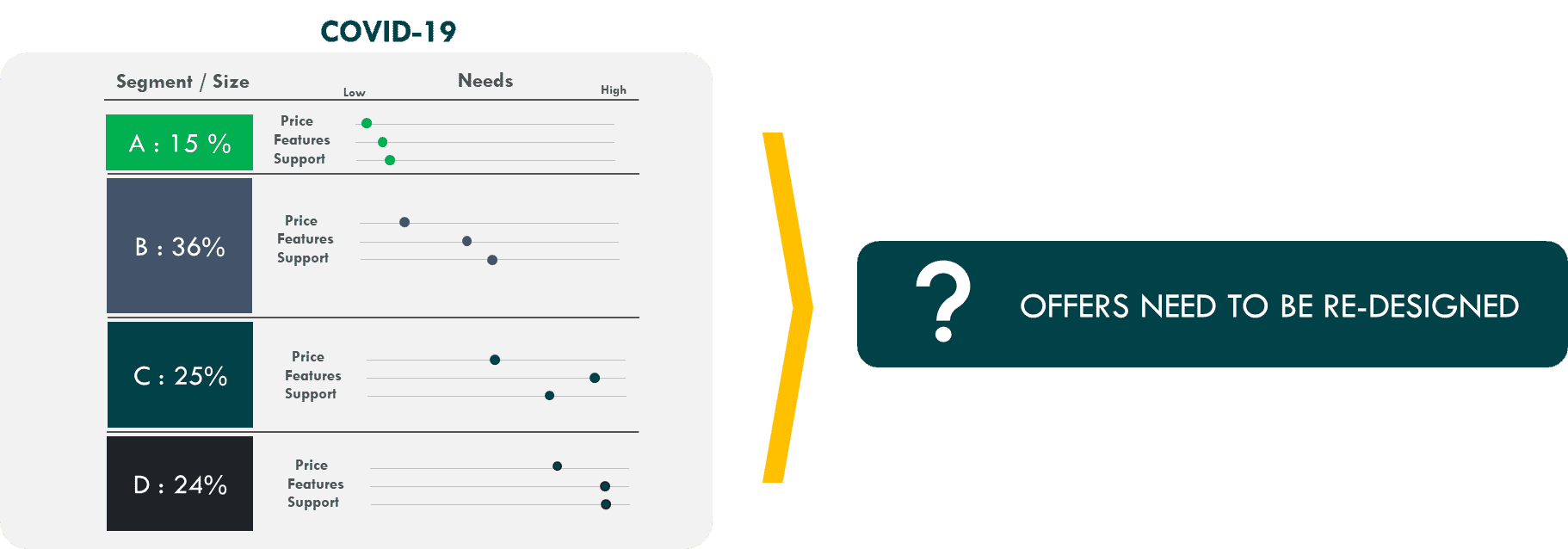

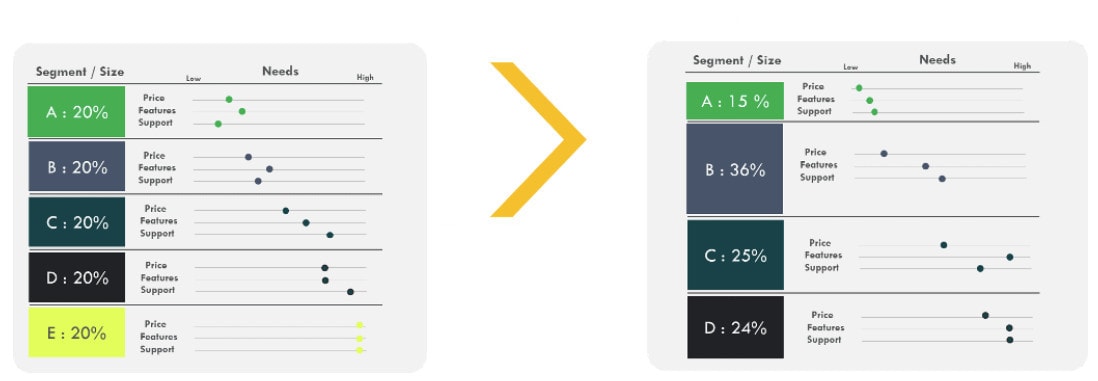

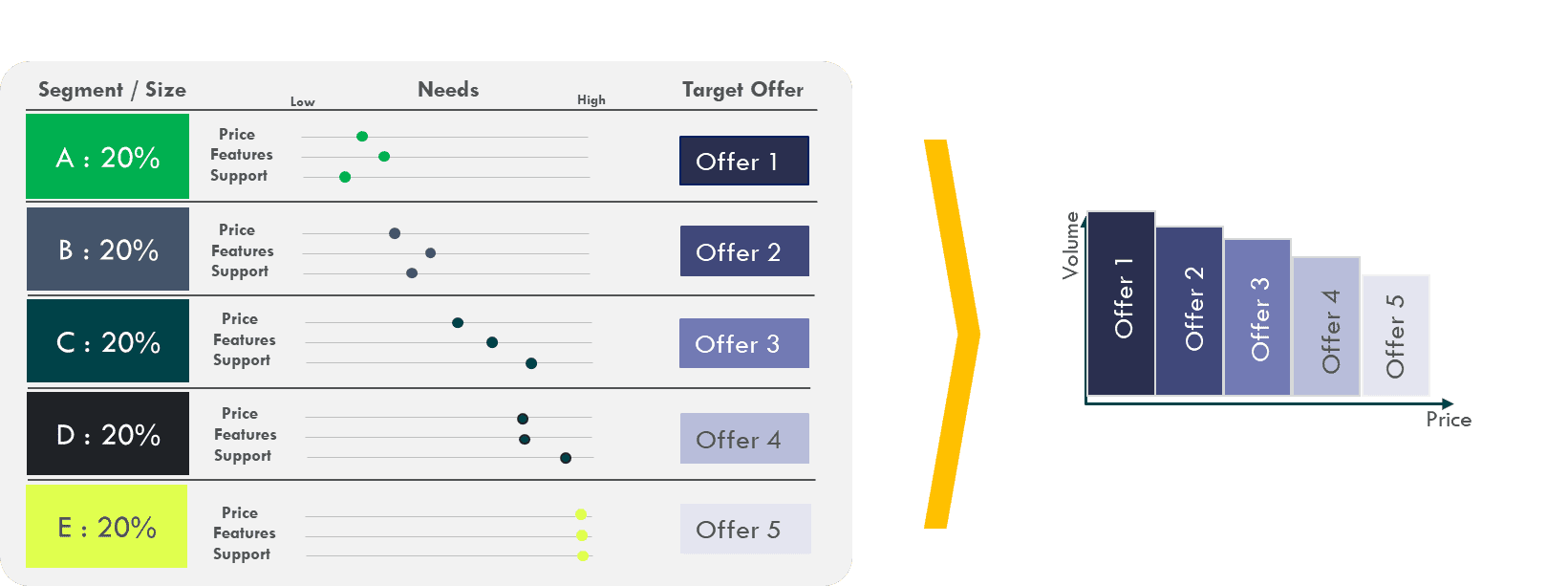

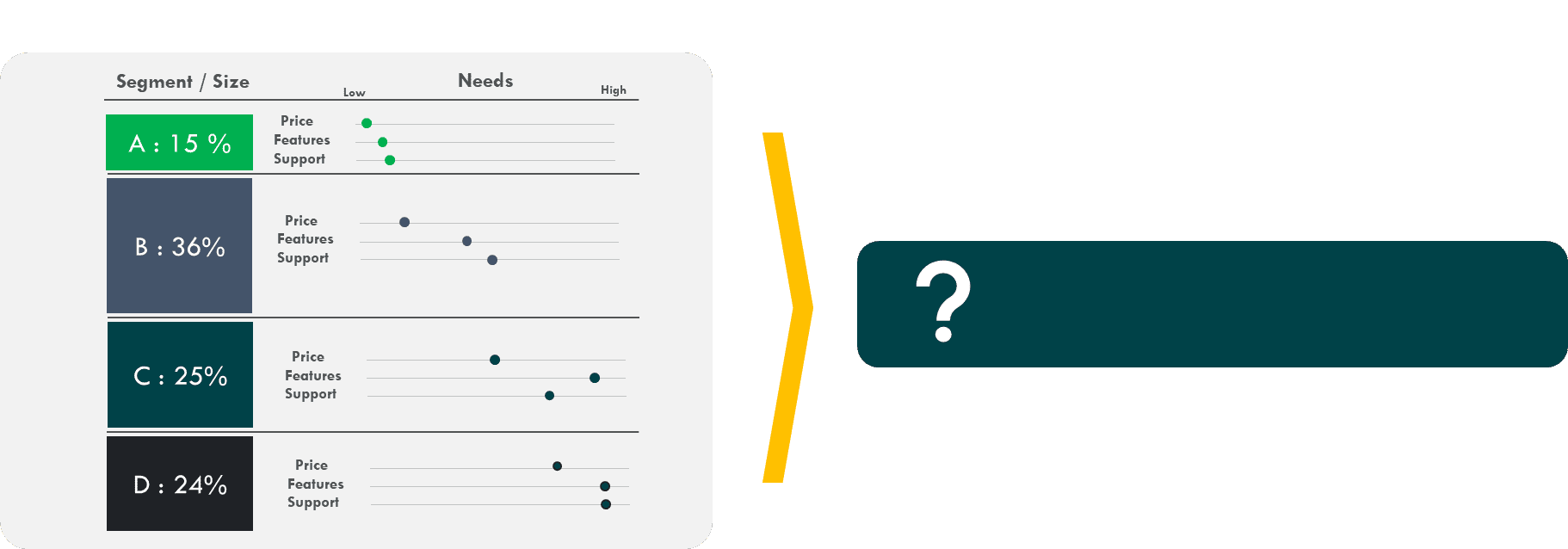

The new segments will shed light on how customer behaviours have changed in a recessionary period. For example, in the graphic above, segments A-E have become more price-sensitive due to COVID-19 and want more features for the same price.

In addition, it is important to analyze whether customers have migrated to a new segment. For example, all the customers belonging to segment E (Pre-COVID-19) have migrated to other segments, which changes the respective sizes of the segments. It is paramount for companies to understand these nuances and changes in customer behaviour so that you can plan on how to maintain relationships with your customers.

STEP 4: Re-Position Offerings to Meet Customer Needs

Prior to the market downturn, your offers would have ideally been matched to your customer segments (Exhibit 4). For example, Offer 5 would be positioned to target premium customers who wanted the most extensive set of features, whereas Offer 1 would be positioned to target your budget/value customers who were looking for more of a “bang for your buck” option.

A recession changes customer behavior drastically, and once you enter a recession, most offers become obsolete. You cannot ask the same price for features to a customer who is now more price sensitive. The offers that were positioned for pre-COVID-19 segments need to be redesigned to meet new customer needs and expectations (Exhibit 5).

Covid-19 recession itself was short but a complicating factor is that the pandemic resulted in widespread behavioral changes. Agile companies quickly augmented their offerings to set themselves up for success from both a recessionary perspective and from a customer behavioral. For example, Monday.com introduced remote collaboration tools for the same price to meet the new needs of customers. In another example, Shopify extended the length of its trial from 15 to 90 days to incentivize new customers while also creating a platform to provide loans to stores.

STEP 5: Focus on High ROI Promotions

During times of economic growth, consumer spending is high and any promotion run would benefit from the increased willingness to purchase. However, during a recession, promotions need to become more tactical to ensure the investment has a high ROI.

An important aspect of understanding ROI on promotions is decomposing where the incremental volume is coming from. We can categorize incremental volume drivers into 5 key buckets as described below:

expansion

Switching

Switching

+

Promo

(+120%)

A. Category Expansion

Volume gained in a promo due to the growth in the

overall category; Positive volume driver

B. Competitor Switching

Volume stolen from competitor’s product in the same

category; Positive volume driver

C. Retailer Switching

Volume cannibalized from other retailers in the market;

Positive volume driver

D. Cannibalization

Volume stolen from another non-competitive product in

the same category, Negative volume driver

E. Stockpiling

Volume stolen from future weeks as customers stock up

during promotion; Negative volume driver

Ideally you will want your promotions to drive net incrementality (Category Expansion + Customer Switching) while minimalizing cannibalization.

STEP 6: Communicate Price and Offering Changes

To mitigate the risk of losing customers or straining the customer relationship, it is essential to craft a written communication or sell-story that allows the sales team to effectively explain any changes in prices, discounts and offerings to customers.

Some of the key elements to include in the customer’s sell-story EXTERNAL are:

The price/offer change to the customer

When the changes will come into effect

Justification for the changes, including any analysis conducted on:

willingness to pay of consumers

competitive price movements

operating costs

cost of raw materials

any existing market realities (ex. Recession)

Provide a potential financial impact story on how these changes will impact the KPIs your customer cares about, ensuring your customer sees the inherent benefits

Keep in mind that during a recession, your competitors will likely be conducting the same type of communications which can make it easier to convey to your customers the need for changes.

Some of the key elements to include in the sales team’s sell-story INTERNAL are:

Identical information crafted for customers, along with the following:

Retailer funding/margin guidelines

Assortment, distribution and merchandising recommendations

Promotional guideline(s) by customer segment, including:

Discount thresholds

Rebate policies

Flyer support

Ad spend etc.

STEP 7: Build Capabilities

While revenue growth management identifies the insights necessary to grow, secondary levers are needed to execute effectively and fully realize the benefits. It is essential to ensure the appropriate data infrastructure, pricing framework, and experienced people are in place to bring the strategy to life.

Data Infrastructure

Enable data-driven decisions by ensuring:

- Quick access to real-time data

- Incorporating diverse data sets including competitive benchmarks

- There is a seamless input of data into analytical engines

Your team should be spending time on driving insights versus generating manual reporting

Pricing Framework

Streamline the organization’s ability to make the right RGM decisions by:

- Defining roles and responsibilities that clarify who owns pricing and has accountability

- Determining what RGM footprint is required and where it should live within the organization

People

Ensure the right team building blocks are in place via:

- Instilling a value-based pricing culture across the organization to promote alignment

- Quantifying targets that will drive the optimal behavior

Next Steps to Preparing your Revenue Management Strategy for a Recession:

Recessions provide unique opportunities to widen the competitive gap between you and your competitors. The actions taken prior to a contractionary period often determine your success during and after the downturn. The key questions that need to be answered are “how do we reallocate our resources?” and “how do we continue to invest in our growth?”

To best utilize this opportunity, your company must understand where it is in the competitive landscape of the market with respect to its internal cost management practices and external revenue generating streams. From this point, there are many ways to prepare for a recession, however, the fastest and most impactful thing you can do is focus on your pricing strategies.

Success requires early, decisive action. If we have learned anything from previous recessions, it is that only a select few organizations regain their pre-recession growth levels and sustain them in the years thereafter. Contact Revenue Management Labs today to help figure out how you can start preparing for a potential post-Covid recession, and break away from the pack.

ABOUT THE AUTHOR

Avy Punwasee is a Partner at Revenue Management Labs. Revenue Management Labs help companies develop and execute practical solutions to maximize long-term revenue and profitability. Connect with Avy at apunwasee@revenueml.com