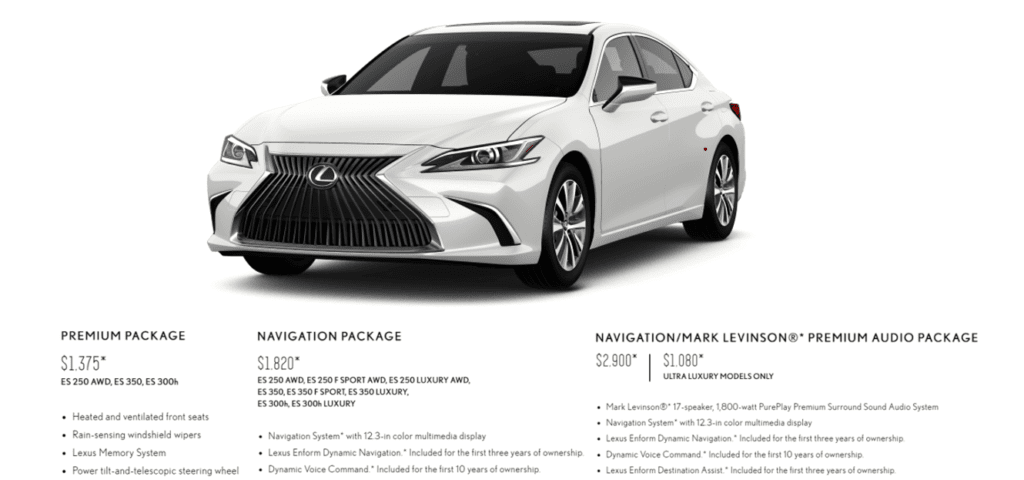

Think about the last time you purchased your car. Your dealership likely offered you various packages containing upgrades for your vehicle for one streamlined price. Take Lexus for example, which offers three types of upgrade packages for their 2021 ES model. That’s bundle pricing.

Source: Lexus

What is Bundle Pricing?

Bundle pricing is a strategy where companies combine complementary products / services together and offer them at a single (often reduced) price. Product bundling pricing has a greater perceived value to customers and bring many benefits to the company such as increased average revenue per user (ARPU) and user engagement. Customers benefit from receiving a suite of products / services for one price while sellers realize more value. A win-win for everyone!

Common Bundle Pricing Examples

Bundle pricing is applied in many industries to incentivize customers to purchase additional products / services that are of value. Some bundle pricing examples may include:

When To Use Bundle Pricing

Bundle pricing is a great strategy for when you have multiple complementary products / services to offer or when you want to increase the perceived value of low-volume items. When sold together, the complementary products / services provide the customer with the most value, improving their purchasing experience, leading to a more engaged and loyal customer base.

Another situation where bundling is useful is if you need to discount certain products / services. Discounting is a necessary part of doing business and can help you stay competitive when the market gets saturated, or customers lose engagement. However, too many discounts may lower your perceived value or can even start a price war. Bundling products / services to provide a discount can help mitigate these risks by capturing more revenue for each purchase and increasing the value add for the customer. It also forces the customer to buy more of your products / services so there is a trade-off in giving them a discount. Moreover, it is harder for competitors to directly react as they would have to create comparable bundles which may not always be possible or drive complexity.

Types of Bundle Pricing Strategies

1. Pure Bundling

Pure bundling gives customers the option to purchase the bundle as-is or not at all. This is the easiest way to bundle as the products / services in the bundle are under your control.

There are also two variations of pure bundling which you can follow – joint bundling and leader bundling.

Joint bundling occurs when two or more products / services are offered together for one price. With joint bundling, customers are not able to buy the products / services individually but will get all of them when purchased in a bundle. Think of Microsoft 365 for Business. You cannot buy SharePoint or Excel as a stand-alone product.

Source: Microsoft

Leader bundling is similar to joint bundling as they both offer two or more products / services together for a single price. The distinction comes from the fact that one of the products / services in the bundle is more valuable than the rest (the “leader” product). When bundled with non-leader products / services, it helps move lower-value inventory.

At the outset, season tickets for the Toronto Raptors were hard to sell, however, Toronto Maple Leaf season tickets remained incredibly scarce. To alleviate the issue, Toronto Maple Leaf season ticket holders were forced to purchase Toronto Raptor season tickets as well. Not much has changed today. You are still obligated to purchase both season tickets, but at least the Toronto Raptors are a much hotter commodity now.

2. Mixed Bundling

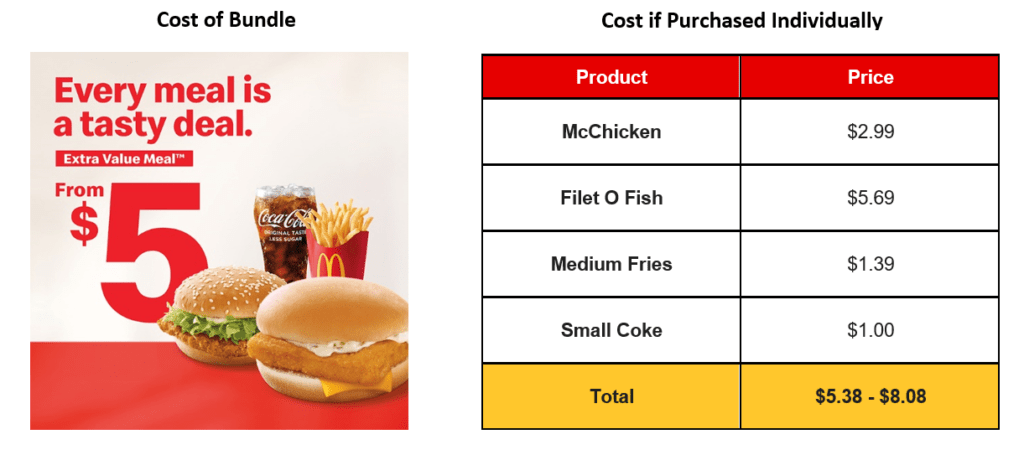

Like pure bundling, mixed bundling does not give customers the ability to dictate what products / services belong in the bundle. However, unlike pure bundling, they do have the option of purchasing each product / service together (at a lower price) or individually (at a higher price). The Value Meal at McDonald’s is a great example of mixed bundling. You can purchase the sandwich, fries, and soda individually, or in a discounted bundle.

Source: Food NDTV

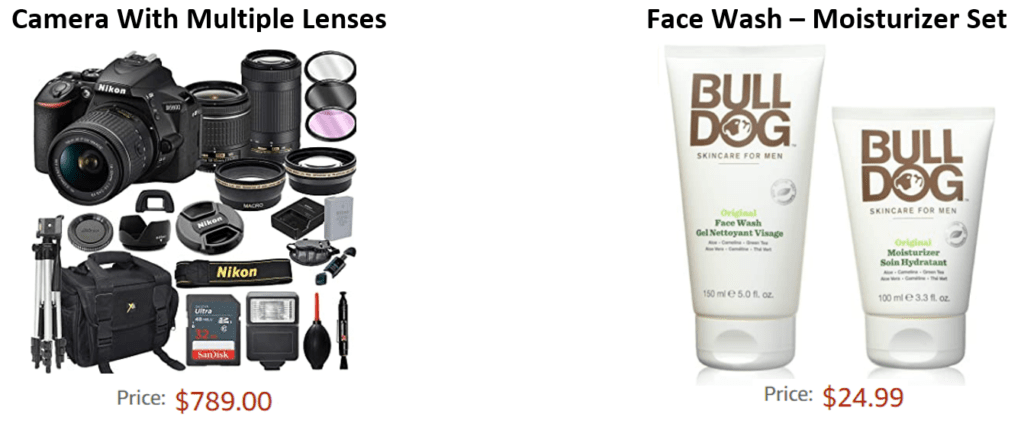

Bundle Pricing Examples:

Advantages & Disadvantages of Bundle Pricing

Every pricing strategy comes with its pros and cons. Though bundling may be a useful pricing tool, not every product needs to be bundled. Here are some of the key advantages and disadvantages of this approach:

Advantages of Bundle Pricing:

Simplifies The Buying Experience: Bundling complementary products / services typically encourages customers to purchase your offering as the value you provide increases. Further, bundles simplify the buying experience by reducing the number of choices the customer needs to make. As a result, your sales and profit margins are likely to increase.

Manscaped simplifies the buying experience for their customers by offering a simple and full grooming solution in one package. How many men would think they needed an exfoliator or lubricating gel when searching for a sensitive spot shaver?

Source: Manscaped

Increases Sales of Low-Volume Products / Services: Not every product you have will be a best seller. In fact, some may even underperform. In this situation, bundle pricing can help you boost low-volume products / services by bundling them with popular products / services. Recall that the products / services should be complementary and increase the value of the bundle. Mixing two contrasting products / services will decrease the value of the entire bundle, so always ensure complementarity.

Returning to the Manscaped example, the company’s most popular product is its shavers. Thus, to move low-volume items (e.g. gels, scrubs, etc.), Manscaped bundled them with their leader product to help drive more sales.

Disadvantages of Bundle Pricing:

Customers May Prefer Individual Products / Services: Some customers value their ability to choose what they buy. With bundle pricing, you are taking that freedom away which negatively impacts their buying experience. This is especially true in industries where customers have greater purchasing power, thus you need to give your customers autonomy.

Customers May Not Need All The Products / Services In The Bundle: The perfect bundle is measured by how much value you add to the customer and your business. Customers who do not need or value certain products / services in the bundle will feel like they are overpaying and look for other options.

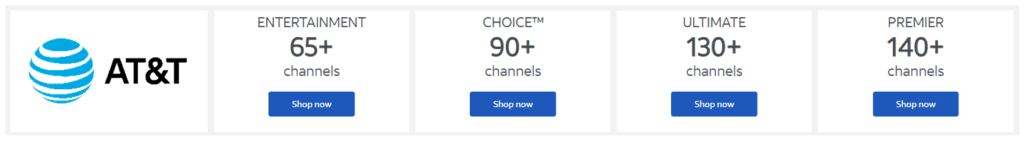

Complex Bundles Increases Cognitive Load: The amount of mental energy it takes to complete a task or make a decision is known as a cognitive load. Complex bundles may increase a customer’s cognitive load to a point where they have “analysis paralysis”, making decisions more difficult. For example, choosing a single AT&T cable bundle can be an onerous task if you really want to do your due diligence and review what channels come with each.

Source: AT&T

If you need help creating your bundles, Revenue Management Labs’ expert pricing consultants will help you identify which of your offerings are optimal for bundling. Moreover, we help determine the right price for every bundle and teach your team how to leverage bundles to grow your business. Get in touch today!

ABOUT THE AUTHOR Avy Punwasee is a Partner at Revenue Management Labs. Revenue Management Labs help companies develop and execute practical solutions to maximize long-term revenue and profitability. Connect with Avy at apunwasee@revenueml.com