Pricing, particularly transaction pricing, is vital to a company’s success. While many companies are familiar with transaction price management, most fail to realize what components actually impact the final price of their product and exclusively focus on the List Price or Invoice Price. Using a price waterfall analysis, a company can leverage existing sales transaction data to grow their bottom-line profitability by identifying margin improvement opportunities.

What is Transaction Pricing?

Transaction pricing is the most detailed, resource-heavy task involved in gaining a competitive advantage for many companies. It involves deciding the exact price for each transaction to arrive at the pocket price. Starting with the list price, transaction pricing management determines which incentives should be applied, such as discounts, rebates, payment terms, and allowances.

What is a Price Waterfall Analysis?

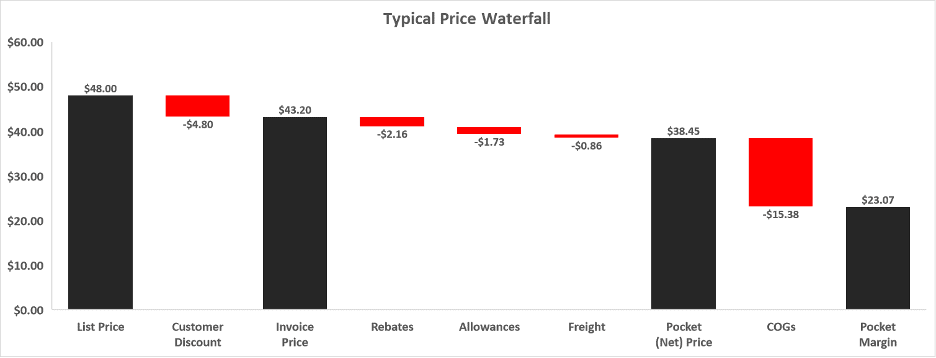

A price waterfall analysis is simply a visual breakdown of the revenue and margin a company makes from each of its transactions. Price waterfalls determine the actual price (referred to as Pocket Price or Net Price) charged to customers for each transaction and reveal hidden costs and leakages or deductions that erode margin (e.g. discounts, allowances and rebates).

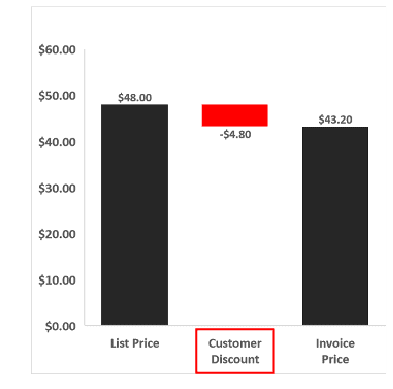

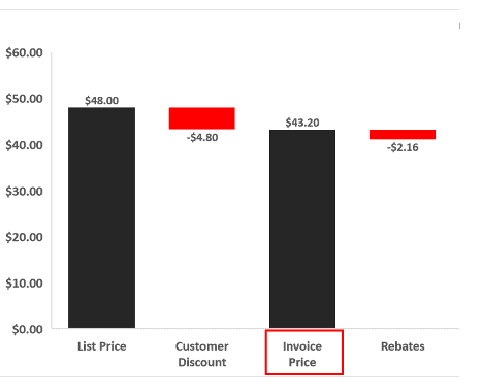

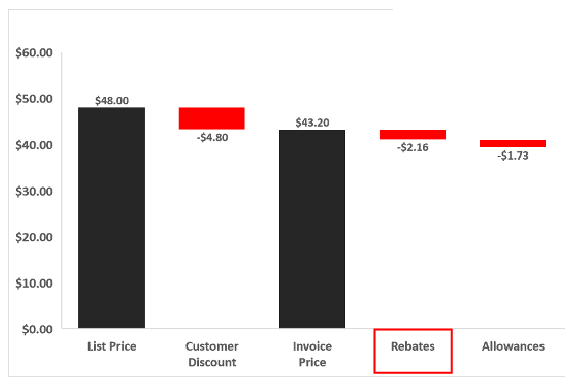

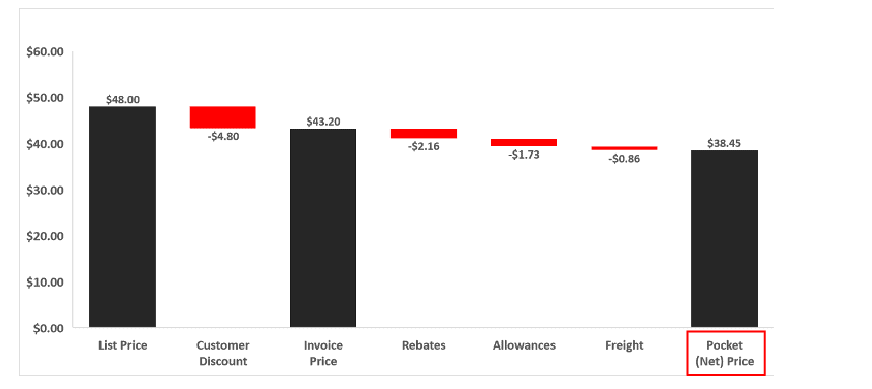

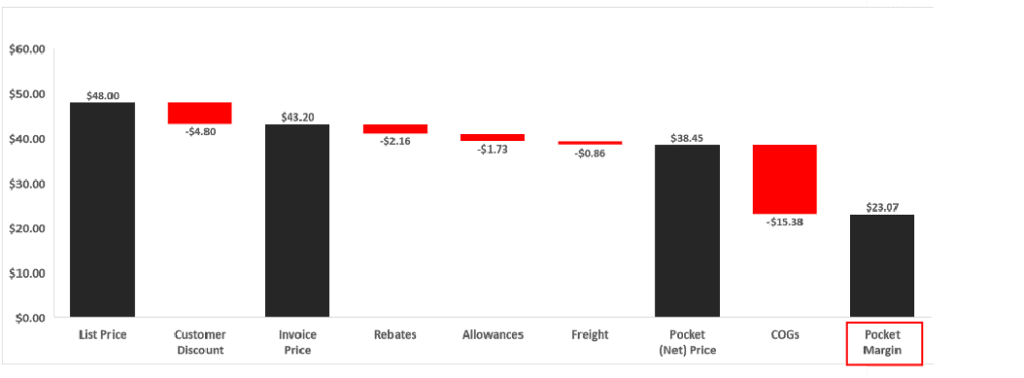

Below is an example of a typical price waterfall analysis.

We begin with the list price and arrive at the invoice price, pocket price and pocket margin after accounting for various deductions shown by the red bars.

Why Do Price Waterfalls Matter?

Price waterfalls tell the real story of pricing – how you came to your margins – and are fundamental to revenue management. They identify opportunities to improve margins through documenting all the components eating away at your profit using your sales transaction data.

By consciously managing each element of the price waterfall, companies can make adjustments to improve prices and margin. Here is a non-exhaustive list of where some adjustments can be made to stop price and margin leakages:

- Discounts and Allowances Strategy: Discounting and allowances can take many forms and occur at any point from manufacturer to retailer and from retailer to customer. After identifying all discounts and allowances that reduce the pocket price, the next step is to identify those that influence buying decisions and drive sales volumes or seal contracts. Some examples include:

- Cash discount: Rewarding the customer for paying during a certain timeframe.

- Cooperative advertising or promotional allowances: Financial incentives given to retailers or distributors for promoting a product

- End-customer discount: Rebates to the retailer for selling to a specific customer or customer segment.

- Giveaways or bundled discounts: These can include buy-one-get-one free (BOGOs) or buy two and get a second discounted.

- On-line order discount: Customers receive a discount for online orders

- Order size discounts: Discounts applied based on spend or volume

- Slotting allowance: An allowance that secures a set amount of shelf space

- Stocking allowance: A volume discount to retailers to make large inventory purchases.

- Customer Segmentation: By combining customer segmentation and price waterfalls, businesses can more effectively target their pricing strategy to different customer groups. Setting explicit pocket price targets based on each customer segment and whether they are new versus returning business can help hold teams accountable.

- Quantify the Financial Impact: Modelling the financial impact of adjusting each component within the price waterfall helps companies to understand which adjustment will have the largest impact.

- Assess profitability of each product and service: Before you can assess your portfolio, price waterfalls can be used to assess which products and services are profitable and which lines are problem areas.

- Mix Management: Price waterfalls can be used as a tool to streamline offerings, removing the least profitable products and services or making adjustments to boost profitability.

- Channel Management: As with mix management, price waterfalls help companies determine which channels provide the most significant opportunity to grow margin.

- Historical Analysis of Prices: Understanding the direction your pricing trends due to changes in deductions and costs.

Being able to execute on the above activities is essential as addressing these issues brings an organization closer to capitalizing upon opportunities to grow the bottom line.

Crucial Note on Leakages/Deductions:

Categorizing the deductions as either investments or leakages is a helpful decision-making tool to understand when to make adjustments. In short, when discounts, allowances and rebates help create value and generate a positive ROI, they function as “trade investments or special pricing.” Another way to think about deductions is whether they serve measurable and appropriate performance target across regions, channels, products and customers.

In contrast, when these deductions reduce the value of the product or service, do not drive measurable, incremental benefit, or generate profit, we categorize them as leakages, and they will either need to be adjusted, eliminated or minimized.

When considering whether to make changes to deductions, several factors may limit your ability to make changes to deductions you have identified as leakages.

- Are the deductions contractual or discretionary? If they are contractual, then any revisions would need approval from all parties to the agreement. If they are discretionary, the company can withdraw these without seeking the customer’s consent.

- Are the deductions conditional or unconditional? If they are conditional, then a discount, allowance or rebate is only provided if the customer meets certain performance (e.g. sales, volume, number of new stores) targets or set KPIs. If unconditional, discounts are provided irrespective of the customer’s performance.

Ideally, the discounts would be tied to the value the customer than unconditionally. It may not be possible to shift deductions immediately. In that case, you will need to develop a roadmap to increase the percentage of conditional vs. unconditional deductions over time. Simultaneously, make it a practice to incorporate conditionality requirements for all deductions in the contracts and agreements going forward.

Read and share An Expert’s Guide to Price Waterfalls as a pdf for your own convenience.

How Do You Create a Price Waterfall Analysis?

Start with the Components of a Price Waterfall

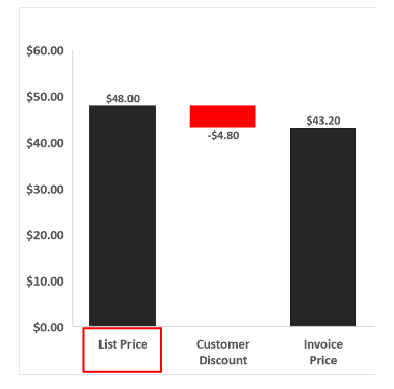

The List Price

Typically, the pricing structure for most companies begins with a reference price often labelled ‘List Price’ or ‘Base Price.’ The list price is the initial price set by the seller or manufacturer before any discounts, rebates, allowances or other deductions have been applied, and represents the maximum price a customer might pay. Also known as the ‘sticker price’ or the ‘manufacturer’s suggested retail price (MSRP), the list price is the starting point for building a price waterfall.

Customer Discounts

After the list price, the reductions that appear on the invoice are subtracted. Here we have deducted customer discounts. Those are customer-specific and set according to the relative size or importance of each customer. Examples of other discounts that may be placed after the list price include order size discounts or discounts in place of returns or warranty.

The Invoice Price

The Invoice Price is calculated by deducting discounts from the List Price. Although this is the price that customers make payments based on, it is not the amount that the seller receives as there are further allowances, discounts and rebates deducted from the invoice price.

Often managers will use the invoice price to understand their pricing strategy but that can lead to overlooked margin leakages.

Office-Invoice Price Deductions

These are often referred to as “off-invoice price deductions” as they aren’t captured on invoice prices. Standard deductions include discounts for timely payments, marketing and partnership allowances, rebates related to distribution expenses and performance incentives such as sales and volume targets.

The Pocket Price

The pocket or net price represents the actual or net revenues generated from each transaction.

The Cost of Goods Sold

The COGs are directly attributable to goods produced by a company that have now been sold. In addition to production costs, COGs include the cost to serve a customer.

The Pocket Margin

This is the amount a company receives after subtracting COGs from the Pocket Price.

A Practical Application of Price Waterfalls

Aftermarket Auto Parts Manufacturer

A leading manufacturer of aftermarket auto parts sells its products manufactured for commercial and personal vehicles to distributors and retailers. The below scenario illustrates how the Price Waterfall can provide useful information.

Scenario: Company XYZ sells a tire (product number: 12345) to a distributor and retailer

As a revenue management professional, it is essential to be able to ask the right questions after examining a Price Waterfall. Below are key observations or considerations that can be deduced based on our example:

- In the above example, Retailer #1 gets a lower marketing rebate but an additional discount of 5% (payment terms) lowering the pocket margin for the aftermarket auto parts manufacturer by 1% or $0.97 less dollars on every transaction.

- Are these discounts and rebates conditional or unconditional?

- Are these discounts and rebates justified for Retailer #1 (e.g. does the retailer need a marketing rebate)?

- Can we make changes to related terms to avoid giving certain discounts/rebates (e.g. reduce the number of days required to pay the invoice price to avoid having to give the payment terms discount)?

- Does Retailer #1 order a large enough quantity for a 3% order size discount?

- How much of the sales volume for this product does each customer account for?

- Which teams need to be approached to investigate the reasons for discrepancies?

- Which mix of products should the company focus on selling to each of these customers to maximize margin?

Keep Up With Market Size and Complex SKUs

Client Story Pricing Strategies for the Complex Environment of Aftermarket Service Parts Pricing Addressing complex product pricing, varying customer needs and values, and market share

The Challenges of Price Waterfalls

Price waterfalls are a powerful analytic tool to identify opportunities to improve margins, but only if the infrastructure is in place to properly leverage the tool. When there are gaps in people, systems, or reporting and planning, the result typically limits access to accurate, frequent, and timely transaction data that is foundational to understanding profitability, and informed decision making.

Structural and Infrastructure Gaps Impacting Price Waterfall Analysis

- Systems: You can ask yourself two questions when evaluating your systems: one, do I have the necessary data and informational capabilities in place to support analysis that track and measure all the components needed for price waterfalls. Second, are my information systems well connected so that the information flows freely and to the people who need it. Systems also don’t manage themselves. Dedicating staff to run and manage the infrastructure will help prevent any gaps from arising in the future.

- People: At the fundamental level, organizations need specialized talent and expertise to optimize transaction pricing, including everything from analysis, insights to implementation. Once the right people are in place, strong organizational support for the pricing function will need to be developed or maintained. Crucially, the right talent and support for pricing usually will fall into place if there is a highly effective leader driving forward the revenue management function. Easier said than done.

- Results, Reporting & Planning: Often, when the necessary systems are in place, organizations struggle to use the data they have to drive insights, and then use that data to adjust and optimize pricing. The first weak link typically occurs when monitoring and tracking transactional data – here’s where systems are essential to benefiting from price waterfalls and need to be designed to gather the critical information. The second weak link occurs at the reporting stage. Either the information is not being reported, or that information is not being used to adjust and adapt pricing.

Price Waterfalls Build a More Accurate Representation of Profitability

It’s cliché but accurate – knowledge does bring power. Understanding the limitations and capabilities of how you model margins will lead to better decision making around revenue management and pricing. What price waterfalls do well is break down all the various components between list price and pocket margin, and give you the information to make considerable improvements in sales and profitability.

What we haven’t discussed in any detail is how price waterfalls can be applied to various specific questions you may have around channel effectiveness, customer segments or products. In your situation, its benefit may lie in answering very specific questions around a particular aspect of your business.

As discussed here, price waterfalls are shown as an average, but there are benefits to going deeper into each of the components and understanding the spread and why that occurs. This is only a hint of how in-depth you can take this tool to make it a powerful part of your decision making and pricing optimization.

ABOUT THE AUTHOR

Avy Punwasee is a Partner at Revenue Management Labs. Revenue Management Labs help companies develop and execute practical solutions to maximize long-term revenue and profitability. Connect with Avy at apunwasee@revenueml.com