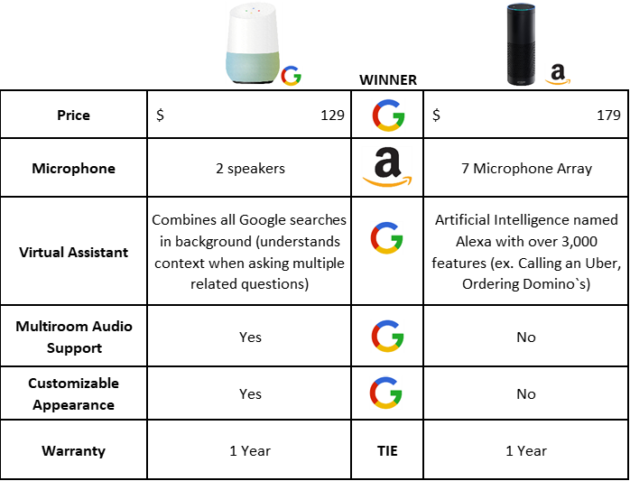

On October 4, 2016 Google announced a host of new hardware products which included Google Home, a stylish, voice-enabled smart speaker. Google Home will be available for sale on November 4, 2016 at a retail price of $129. The new entry provides a competitor to the Amazon Echo, which was launched on June 2015 and is reported to have already sold 3 million US units by Consumer Intelligence Research Partners (April 6, 2016). Interestingly, Google chose to launch their product at a 28% discount to the Amazon Echo, which is priced at $179.

Why would Google have chosen to launch such a hallmark product at a 28% discount? A few possible explanations come to mind, let’s examine each individually.

- Google Home costs less to produce than Amazon Home

- Cost plus pricing

- Google Home delivers less value than Amazon Echo

- Penetration pricing

Google Home costs less to produce than Amazon Echo

Amazon’s core business, internet based retailing, was founded on achieving a sustainable cost advantage versus traditional brick and mortar retailing. Leveraging this advantage, they have been swallowing market share and have competitors such as Wal-Mart struggling to catch up.

Usually, a good proxy for relative manufacturing costs can be discerned using the manufacturer’s location. The Amazon Kindle e-reader is contract manufactured by Foxconn Technology Group. Foxconn manufactures for a host of companies including (Apple iPads, iPhones, & iPods), Sony (PlayStation), Microsoft (Xbox), which allows them to capitalize on economies of scale. In addition, the majority of Kindle production occurs in China. Given these two facts, it would be reasonable to assume that the Kindle has a very competitive cost base and we would expect likewise cost realities for the Echo.

We would expect Amazon Echo to have a comparable cost base to Google Home and therefore not be responsible for the difference in price.

Cost Plus Pricing

Cost Plus Pricing is an antiquated method of setting prices whereby you calculate all the costs associated with producing and delivering your product or service and add a defined profit margin. This method is devoid of all considerations related to customer value and limits potential pricing upside. Also, it is dependent on your cost to produce which may not be market based and fails to consider competition.

Google Home delivers less value that Amazon Echo

In B2C, pricing should always reflect a company’s relative perceived consumer value. Perceived consumer value is a function of Brand, Service, Quality and Price.

For simplicity, let’s consider Google and Amazon’s brand strength and marketing ability on par with one another.

Customer value would then be decided by quality, features and services. When stacking up the two, at a high level, it seems that Google Home comes out on top, putting the discount price positioning into question.

Of note, Google Home is line priced with the Amazon Tap at $129 (a scaled down version of the Echo). In terms of consumer value Google Home is the no brainer choice. This explains the Amazon Tap decreasing its price as of October 6, 2016 to $99.

Penetration Pricing

Sometimes Marketing / Sales organizations have stretch objectives when launching new offerings. They want to capture a dominant market position within a short period of time. When the proper infrastructure is not in place to realize these goals, companies sometimes turn to “penetration pricing” or pricing aggressively to gain customer traction. While this strategy may work well in the short term it has two practical drawbacks.

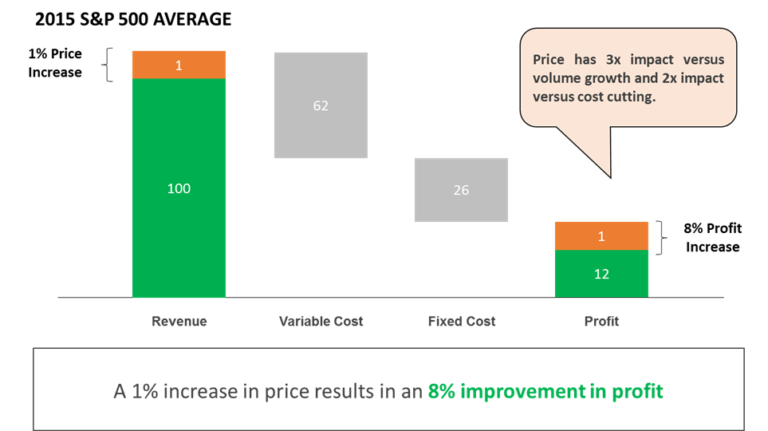

- Pricing has the most leverage on your company’s financials. You cannot have a greater impact on the bottom line by driving volume or decreasing costs in comparison to impact of pricing. As such, any decision to give away long term price positioning results in a substantial missed profit opportunity.

2. Assuming the penetration pricing strategy is successful in capturing share, incumbent market competitors are left with few options. In the long term, they can improve the value of their offering and justify the price premium. Unfortunately, in the short term the easiest lever to pull is a price decrease. Usually this comes in the form of aggressive discounting, which ultimately leads to a downward price spiral. When looking at Google Home’s price positioning it is clear to see that dollars were left on the table and as a consequence market value will be destroyed.

Final Thoughts:

Innovation pricing can be complicated, but it is critical that it is done well given that it dictates your future profit potential. Our team at Revenue Management Labs can help your organization build a pricing strategy that is tailored your market niche and achieve high ROI.

ABOUT THE AUTHOR Avy Punwasee is a Partner at Revenue Management Labs. Revenue Management Labs help companies develop and execute practical solutions to maximize long-term revenue and profitability. Connect with Avy at apunwasee@revenueml.com