Inflation and supply chain disruptions have quickly become the most prominent challenges for the food and drink industry. Gas is nearly $6 a gallon, aluminum has doubled in the last 18 months and corn syrup has increased by 300% over the past 20 years.

Yet, amidst the higher prices, Arizona’s Iced Tea has kept its pre-printed $0.99 price point – much to the surprise of customers, who have been paying 5% – 10% more for other ready-to-drink options such as Coke, Pepsi, and Nestea. Why would AriZona hold prices when costs are increasing exponentially?

Betting On Volume

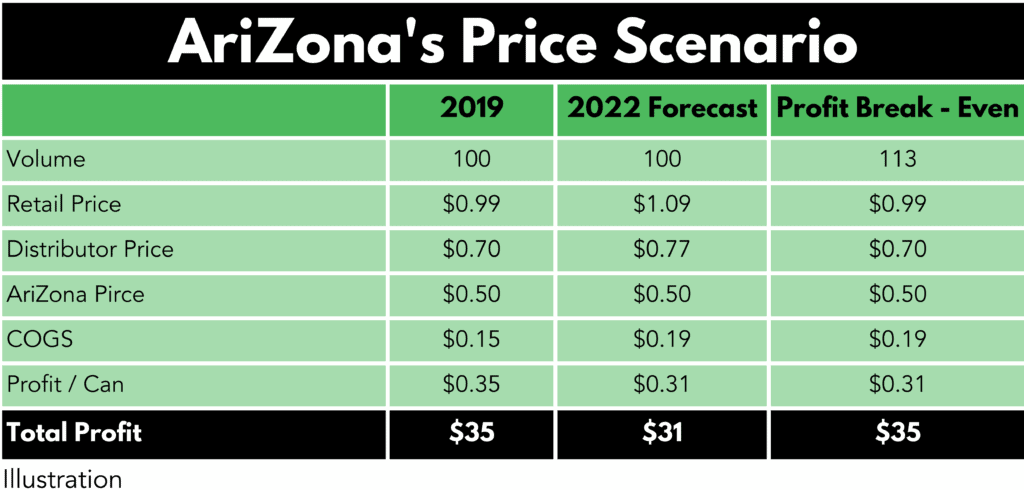

Perhaps Arizona is banking on volume growth, figuring that if prices remain stable while others raise, more people will flock to the brand. Let’s assume AriZona is now generating $0.35 profit per can and is facing $0.04 cost headwinds. To break even, they will need to raise the volume by 13% to ensure profit remains unchanged. This is dangerous since volume is never guaranteed.

Possible Drivers to Hold Price

AriZona’s CEO Don Vultaggio has always been adamant that increasing prices would be the last resort. Instead, they rely on other factors to manage market pressures:

Diverse Product Line

Iced Tea only accounts for 25% of AriZona’s revenue. Other items in their portfolio include fruit drinks, energy drinks, snacks, hard seltzer, etc. which have a substantially higher margin. By having a diverse product portfolio, AriZona can offset margin losses from its Iced Tea with other offerings and identify opportunities to upsell customers.

Cutting Costs

Rather than increasing prices, AriZona manages inflationary pressures by cutting costs. For example:

- Low-cost marketing strategies

- Lean operating model, with only 350 people on staff at its headquarters and 1,500 companywide.

- Using recycled materials to manufacture cans at their own facility cutting down aluminum usage by 40% per can.

- Delivery trucks running at night to save on time and fuel.

What If AriZona Holds Pricing

Impact on Competitors

AriZona’s Iced Tea is the current low-price leader in the ready-to-drink market. Snapple, like AriZona, used to be $0.99 but is now $1.79. Gold Peak, Coke’s brand, costs $1.99 and Pure Leaf, a premium Pepsi-Lipton brand, costs $2.09. If AriZona were to keep the price static and started to substantially grow, competitors would have no other choice but to promote to recapture customers. As expected, as one competitor promotes the rest would follow suit thereby eliminating AriZona’s price advantage but also the incremental profit-driven by pricing.

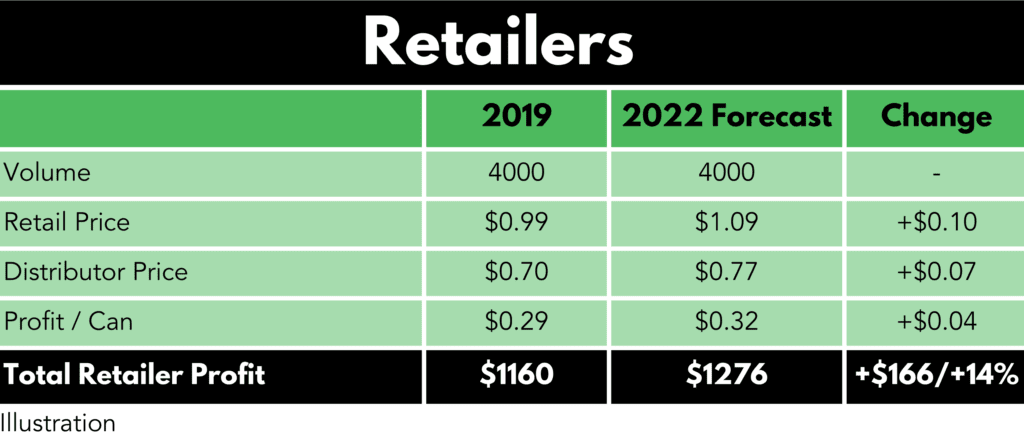

Impact on Retailers

Retailers may want the company to increase the price of iced tea. With inflation kicking in and the cost of running a business rising, retailers can use extra profit. For example, if AriZona decides to increase the price of its iced tea by 10% and retailers follow suit, they could expect an incremental 14% in margin dollars (assuming no volume loss):

Impact on Consumers

AriZona’s strategy to keep the prices stable has created a strong customer base. This stability in the prices has favored the company too. But for how long? With the current volatile market conditions, and prices rising by the day, the company is making less money off every can they sell. In the short term, consumers love low prices, but there is a cost:

- If the prices of raw materials keep rising and the company persists in its current price, it won’t be able to infuse more money into the development of the products i.e., bringing in new flavors.

- The company will have fewer resources available to expand capacity possibly leading to stockouts and short ships

- At some point (in the distant future) they may be forced to trade off on quality versus cost savings

Impact on Financials

For every company, the ultimate gauge of success is the long-term growth of the bottom line. AriZona has been successful in keeping the price of its Iced Tea constant, but for how long can it keep making less money in this ever-changing business world? The lower price has helped AriZona achieve a 16% market share in the ready-to-drink market, but in terms of profit, the company is lagging behind competitors.

Final Thoughts

Often companies stick to psychological / highly visible price points due to emotional versus strong business rationale. While AriZona’s strategy seems to be delivering results in the short term, are you sure yours is? Reach out to Revenue Management Labs where our team of pricing experts can help you create a value-based pricing strategy to deliver long-term sustainable growth.

ABOUT THE AUTHOR Avy Punwasee is a Partner at Revenue Management Labs. Revenue Management Labs help companies develop and execute practical solutions to maximize long-term revenue and profitability. Connect with Avy at apunwasee@revenueml.com