Over time, your company would have chased thousands of leads and proposals either resulting in a new client or a lost prospect. Both outcomes have hidden insights, which can be uncovered using a set of analyses to highlight key areas of focus and help achieve sales excellence for the next thousand deals.

To this end, we introduce Win-Loss Analysis; a key B2B process used where we extract details by interviewing those who were involved in the deal, such as the sales team and buyers.

In this article, we go over:

After reading this article, you should have a better idea of how to leverage a Win-Loss Analysis to iteratively improve your sales process and secure competitive advantage in the market.

What is Win-Loss?

Win-Loss Analysis is the process of critically understanding why some deals are won while others are lost; it is an in-depth review of what your company does well in attempting to gain valuable clients, but also why you may be losing out on important proposals.

The whole process in general consists of determining where you are as a company, asking the right people the right questions, aggregating, analyzing responses, creating an action plan, and finally getting consensus across your organization.

During the analysis, you document reasons for a prospect’s particular purchase decision and then analyze those drivers to understand what you do well and what you need to improve upon.

Ideally, a Win-Loss Analysis should be conducted at the end of each proposal after the buyer has made a decision. Doing this allows the company to quickly gain feedback and adjust to the prospects’ needs for the future.

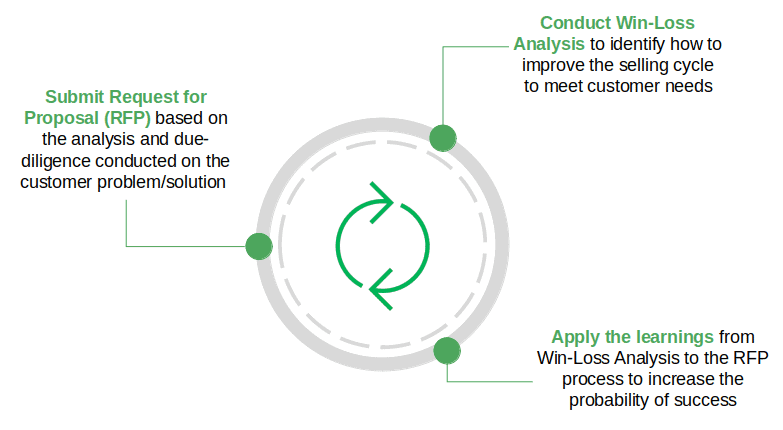

Win-Loss analysis ties in with the RFP process (as shown below). Insights from the Win-Loss Analysis should be leveraged to better understand customer needs resulting in a winning bid. Click here to learn more way to win B2B Bids.

If this is the first time your company is conducting a win-loss analysis, it is highly recommended to perform a batch analysis of your most recent proposals. The purpose here is to gain enough data points to better understand your position and orientation relative to the market.

Win-Loss Analysis is not a catch-all tool to improve all sales related metrics; it is simply a diagnostics tool used to gain multiple perspectives on the outcome of a proposal. Clear insights are not always guaranteed, but when they are achieved, it is important to act on the results.

Why is Win-Loss Analysis Useful?

MARKETING

STRATEGY

SALES

ENABLEMENT

Highlight gaps/opportunities in the sales process as perceived by buyers, personalize sales approach and provide intelligence to drive successful conversations

COMPETITIVE

STRATEGY

Understand competitive offering and value attributes perceived by the buyer compared to your own product and highlight key differentiating value-adds to sales

OFFER

DEVELOPMENT

Uncover what features or values buyers are looking for and develop a roadmap to ensure your solution meets buyer needs in the future

Win-Loss Analysis takes a deep dive into a company’s sales practices to better understand its pros and cons. When done accurately, a company can improve the versatility of their sales process and in doing so, increase its win-rate. Without a proper Win-Loss Analysis process in place, it is easy for a sales team to continue investing in the same mistakes and not capitalize on key winning strategies. Below we outline a few key benefits of Win-Loss Analysis:

- Improved Sales Conversion Rate: The goal of Win-Loss Analysis is to convert more leads and increase revenue. When done properly, Win-Loss Analysis improves sales practices and increases your bottom line.

- Improved Customer Retention: Repeat business is important for most companies. By implementing Win-Loss Analysis, you can determine which components of your offering negatively affect customer retention and work towards improving your offerings.

- Product/Service Development Guidance: Client traction is highly dependent on your offerings’ capabilities and features. Win-Loss Analysis can help you determine which of your offerings’ capabilities and features are most important for your customers allowing you to differentiate yourself from competition.

- Employee Performance Guidance: During the interview portion of a Win-Loss Analysis, buyers will dive into the interactions they shared with your sales team. We can use this to gain insight into employee performance and bridge the gap or share best practices where needed.

- Enhanced Competitiveness: Continuing with interviews, you will also learn firsthand how your clients and prospects compare you with your competitors. Leveraging this information, you can create/update your competitor landscape to better understand how to remain competitive from a pricing and non-pricing perspective.

- Marketing Insight: Often, prospects may not fully understand or be aware of all your offerings or benefits. Win-Loss Analysis can help you determine where the gap exists and which communication channels can be leveraged to efficiently share this information.

- Cost Reduction: Win-Loss Analysis can determine which practices are not important or relevant to your clients and prospects thereby helping you remove any redundancies and inefficiencies.

Why do Organizations Overlook Win-Loss Analysis?

Despite the numerous benefits, 58% of companies still do not implement Win-Loss Analysis choosing to leave money on the table. Furthermore, only 5% of companies thoroughly invest in and regularly conduct Win-Loss Analysis, and even then, many of those companies only focus on losses. Below we discuss common scenarios in which companies passively choose to forgo Win-Loss Analysis:

- Bias: The point of Win-Loss Analysis is to better determine why an outcome of a deal occurred, be it favourable or not. If a company already believes it knows why a deal played out the way it did, then it will not be investigated further. This creates an issue as the company will certainly miss out on all the factors/drivers that affected the way the deal played out, thereby missing out on critical drivers.

- Priority: The number of RFPs/contracts won is generally the number of proposals sent multiplied by the sales conversion rate. Win-Loss Analysis aims to iteratively increase the conversion rate by improving sales practices. When faced with the problem of where to allocate additional time and resources. However, most companies choose to only invest in increasing the number of proposals sent. This is driven by sales psychology and passive practices.

- For instance, psychologically speaking, it is easier to simply move on to a new prospect after losing an old one since most people tend to avoid focusing on negative outcomes

- Additionally, after winning a prospect, many salespeople may interpret this outcome as “I already know how to do this, so I do not need to further improve”

Again, this creates an issue because it reinforces bad practices in the sales team to only focus on quantity at the cost of quality.

How To Conduct Win-Loss Analysis

Now that we have seen the importance and benefits of Win-Loss Analysis, we need to understand how it is conducted and become mindful of best practices concerning it.

Step 1: Collect and Clean Data

Any type of analysis requires data and more importantly clean data to ensure the calculations made are accurate and any conclusions/insights drawn make sense. An ideal situation would involve the sales team tracking all leads via a CRM software like HubSpot or Salesforce (some of which automatically calculates the Win-Loss ratio for you). This, however, is not a requirement. Below, we show what type of data is needed and how we can use it to calculate Win-Loss ratio manually.

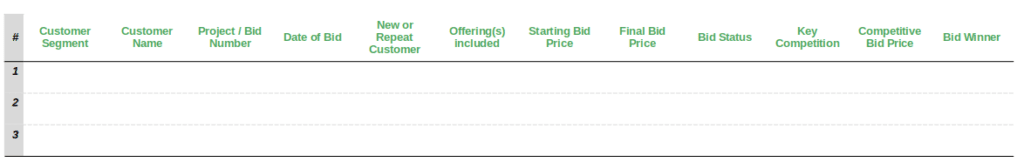

To perform the analysis, the following fields (populated by the sales/marketing team) are required:

These are simple KPIs you can track on a regular/periodic basis to see any improvements or gaps in terms of our sell cycle.

The data can be tedious to create and maintain, but it will serve as an important source to run multiple analyses apart from our Win-Loss Analysis, which can be leveraged by multiple stakeholders across the organization

Step 2: Establish Trackable Goals

In step 1 we introduced baselines to understand where we were; in step 2 we introduce goals to understand where we want to go. As with any analysis, it is imperative that you have an idea of what the end goal should resemble so that you can properly leverage the results of the outcome to solve a particular problem or improve certain metrics and KPIs.

For example, your end goal could be one or more of the following:

- Improve Win Rate or Win-Loss Ratio

- Improve product features or service benefits

- Understand and strengthen your value proposition to better cater to buyers

- Improve customer retention

- Collect ideas around future product developments

There can be multiple goals for the Win-Loss Analysis especially with different stakeholders aiming to drive different objectives. It is important, however, for all the stakeholders to align on the key objectives to ensure there are no competing KPIs and everyone is aligned on the expectations

Step 3: Create a List of Specific Interview Candidates

This is one of the most important steps when conducting a Win-Loss Analysis, as the selection of interviewees will heavily influence the insights which can be uncovered.

Ideally you will want to conduct internal and external interviews to ensure you have visibility across the selling process, enabling you to identify gaps and opportunities between the internal and external perception of your offering.

Below we outline a few best practices when deciding who to interview from an external point of view:

- Invite 4x-5x more people than you plan to interview as the response rate can be low and you want to ensure you are getting sufficient responses

- Aim for a fair split of won and lost prospects to capture proportionate data on both sides

- Ensure you have good representation from all your customers segments

- Make sure the participants are decision makers as they are the ones who are responsible for accepting, rejecting or modifying deals

- Consider offering incentives like gift cards to entice people who may not otherwise want to participate in the interviews

- Ensure you reach out to people within 4-5 weeks of the deal/bid decision as the proposal will be fresh in the minds of the buyer

- Emphasize to potential interviewees that the conversation is strictly around feedback to ensure the organization can improve its offerings going forward

From an internal standpoint, your best bet would be forming a small focus group of 5-8 people whose functions touch the objectives and goals of your Win-Loss Analysis. Key functional groups include:

- Sales Team

- Customer Success

- Product Marketing

- Product Management

- Senior Leadership

- Business Intelligence

These best practices offer a good starting point for conducting Win-Loss Analyses, but can be improved upon iteratively accounting for any business nuances present within your industry

Step 4: Determine Interview Logistics

Apart from selecting the interview candidates, it is also important to determine the logistics of the interview. Some key questions to ask yourself when finalizing the logistics are:

- How will the candidates be contacted?

- How long will the interviews take? (Limit it to 30 minutes)

- How will the interview take place? Virtual or in-person?

- How and when will the data/results be communicated to the rest of the company after the interviews?

Knowing these logistics will be important as it affects who can be contacted, how many questions can be asked and which tools will be needed to complete the interviews and share the results.

Step 5: Create Questionnaire/ Interview Questions

This is the most important step within the Win-Loss Analysis as the responses to these questions will help uncover the actionable insights you are looking for.

A few things to keep in mind when preparing the questions:

- Make sure the initial questions are easy to answer in order to develop a relationship with the interviewee and make them feel comfortable

- Ensure the questions enable you to directly meet the goals/objectives from step 2

- Ensure the questions are open-ended enough to warrant a discussion

- Ensure the questions are targeted to the respective customer segment

- Limit the number of questions between 10 – 12 as you only have about 30 minutes to complete the interview

- The questions should emphasize continuous improvement without soliciting further business

A few sample questions could be:

- What was the reason you were in the market to purchase this product or service?

- During our sales conversation, did you feel we addressed your unique business needs?

- What made you consider us in the purchasing process?

- What other companies did you consider during the purchase cycle?

- Why did you ultimately choose to go with/not go with our company?

- What impressed you the most about our offering? What was not up to your expectations?

- What are the top 3-5 factors you look for when making a purchase decision?

- When in a market for a new product or offering, how are decisions made?

- Would you recommend our company to other people?

- Any other thoughts on what we can do to improve going forward?

Ensure to frame the questions in a manner that allows you to completely understand the purchase process and the decision-making process of the buyer (i.e. how did they finally select a solution to the problem they were trying to solve).

Step 6: Select the Interviewers and Prepare Them

You have created a list of interview candidates, and developed the questionnaire, but the next big question is who will do the interviews? The knee-jerk reaction would be the sales team since they are usually the first point of contact for the prospects. However, this is not optimal as there will be inherent bias during the interviews from both seller and buyer, which would result in inaccurate information.

An ideal interviewer is someone external from the proposal process (3rd party; internal or external) who can create a neutral environment during discussions without any underlying bias to truly meet the goals of the Win-Loss Analysis. Of course, it is still important that the external team or individual completely understands the business and the industry you are in, as they will be able to continue the interview if the conversation goes beyond the script.

If your organization wants to go the in-house route, then your marketing team or revenue management team would also make pretty good candidates since they are not directly tied to the products and therefore less likely to take criticism personally or introduce bias.

Once you have decided on the interviewer(s), review the questions together to ensure what the goals of the Win-Loss Analysis are, in order to guide the conversations effectively.

Step 7: Reach Out to Interview Candidates

Once you have the interview list ready, send out an email to the candidates inviting them for an interview.

Below we outline some best practices around how the invitation should look and feel:

- Try to make the email personal (ex. quoting or citing something they might have said during the initial sales conversation)

- Do not make it an automated email. Give them the means to reply to the email if they have any questions or want to set up some time for the interview.

- Emphasize that the purpose of the interview is purely a means of continuous improvement

- Mention any incentives (if available) for participating in the interview.

- Make sure to follow-up no more than 2 times after the first reach out email

Step 8: Conduct the Interviews

Start the interview by introducing yourself and thanking the prospect for their time. Reiterate that the purpose of the interview is continuous improvement and give them an overview of how the interview will go including all the topics which will be covered. Ensure the candidates that the interviews will be confidential so they can be completely honest.

When conducting the interview ensure you have an easy-to-fill-out sheet or form that would allow you to note down the answers. If allowed, record the interview to review later and ensure nothing was missed during the conversation.

Go through the questions, ensuring that you avoid selling, arguing, getting defensive, interrupting, or correcting them (especially if the interviewer is internal to the organization).

Wrap up the interview by thanking them again and asking them to reach out if they want to add or change any of their responses. If an incentive was promised, you may give it to them now.

Step 9: Aggregate Responses and Drive Insights

Once all the interviews are conducted, aggregate all the responses and aim to bucket all the key points into overarching themes which were highlighted across all interviews. Share the results with the different stakeholders within the organization (ex. Sales, Marketing, Customer Success, and Product Teams).

These key themes would form the basis of further action to close any highlighted gaps. For example, if one of the key themes was that the price is too high, this might warrant a discussion around the following questions:

- Is the price justified for the value compared to the competition?

- Are we targeting the wrong customer segment?

- Should we launch a new product with fewer features at a lower price point?

The key themes and their possible causes and solutions should be shared across all key stakeholders, including the executive team to give them visibility on where the organization needs to prioritize its resources to meet its goals.

Next Steps: Process Integration

Congratulations! You have conducted your first Win-Loss Analysis. While conducting the Win-Loss Analysis for the first time is a massive feat, it is important to build the infrastructure to conduct this analysis on a periodic basis to ensure you have up-to-date feedback on your offerings and prices and your competitions’ offerings and prices. This iterated process will allow continuous improvement as the organization moves towards achieving its goals.

How to Use Win-Loss analysis to Gain Competitive Advantage?

So now that you have gathered the data and gained insights from the Win-Loss Analysis, what should the next steps be to ensure you are able to translate the insights to gain competitive advantage.

The areas of focus can be different based on the key themes identified, but in general, you should have the answers to the following questions:

- What key value attributes does a customer segment care about?

- How important is price to a particular customer segment?

- Who are the key competitors by customer segment?

- Are the competitive offerings performing better on the value attributes compared to your offering?

- How are competitor offerings priced by customer segment?

The answers to these questions can be leveraged to create a calculator that determines the win probability based on historical data and the following price and non-price factors:

Price Factors

- Bid Price

- Service Discounts

- Volume Discounts

Non-Price Factors

- Customer Segment (ex. Industrial, Government, K-12 etc.)

- Value attributes they care about (ex. Customer Service, Quality, Relationship)

- Competitive offerings

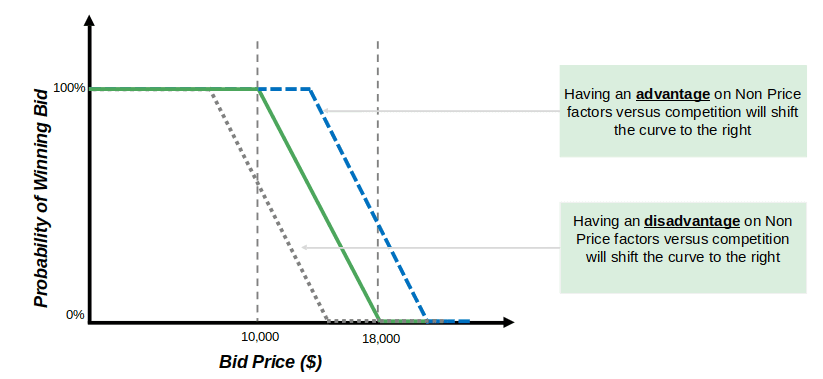

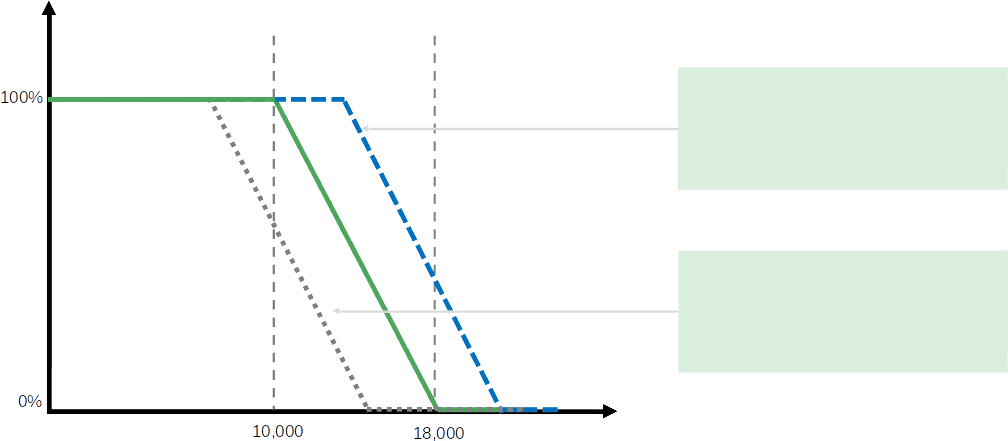

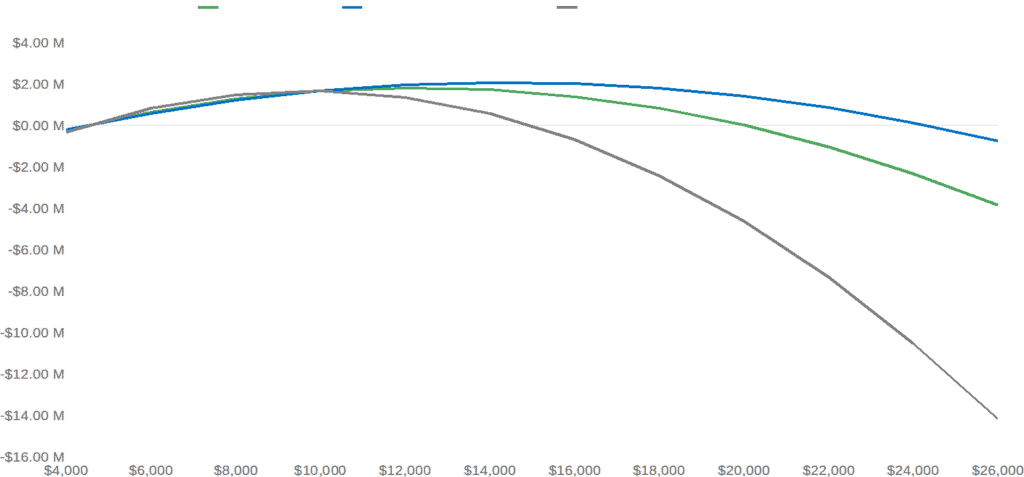

At the most basic level, your offerings’ price and non price factors would result in the following graph regarding the probability of winning the bid:

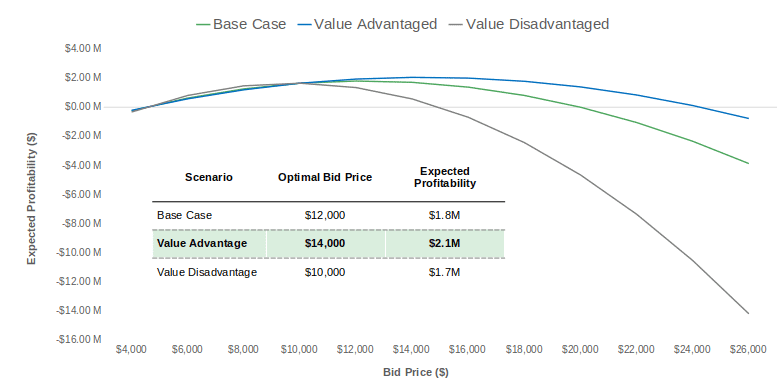

Profitability

Having a robust tool that allows you to input the price and non-price factors which outputs a bid-range gives the sales team guidelines around their conversations with the prospects. It also allows them to not only present a bid price, but also present justifications as to the value being delivered versus competition to increase the probability of success.

Final Thoughts

In general, Win-Loss Analysis consists of asking the right people the right questions, continuously updating your competitive landscape, improving your offering to match buyer needs, and aligning stakeholders to a common goal.

By implementing Win-Loss Analysis, your company can act on critical buyer and salespeople’s opinions. Those who choose to conduct a Win-Loss Analysis can expect to achieve higher sales quota, improve customer retention rates and increase annual revenue growth meeting organizational objectives.

Win-Loss Analysis is a key tool within the revenue management toolbox to help you optimize pricing in the next thousand deals to maximize revenue and margin. Click here to discuss how Revenue Management Labs can help you conduct your Win-Loss Analysis, improve your bid process and help close more deals.

ABOUT THE AUTHOR Avy Punwasee is a Partner at Revenue Management Labs. Revenue Management Labs help companies develop and execute practical solutions to maximize long-term revenue and profitability. Connect with Avy at apunwasee@revenueml.com