Insights for execution in an increasingly price-led growth environment

Scroll down to view a concise summary and download the full 2026 Executive Pricing Benchmarks, including how senior leaders are using pricing to drive revenue and margin performance amid cost pressure, demand volatility, and tighter discount discipline.

You can also request a custom report tailored to your industry, pricing maturity, and growth priorities.

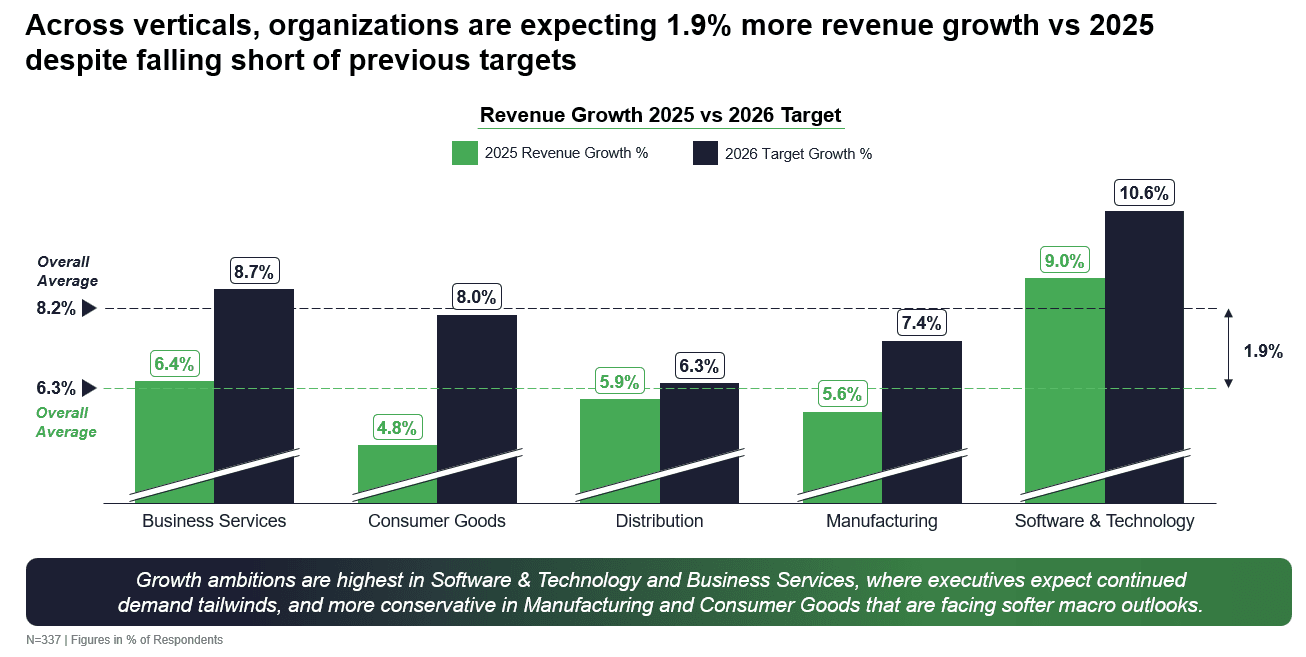

Based on input from 330+ senior executives across Europe and North America, the 2026 Executive Pricing Benchmarks compare 2025 pricing performance with 2026 pricing, revenue, and margin targets. The benchmarks highlight a clear shift toward pricing as the primary growth lever, even as many organizations struggle to fully translate pricing actions into financial outcomes, revealing where ambition is accelerating and where execution gaps persist.

What differentiates a high performing company in 2026? This benchmark report lays out pricing insights from over 330 senior executives across North America and Europe, highlighting how organizations are planning price, discount discipline, and margin recovery to improve pricing performance and drive revenue growth.

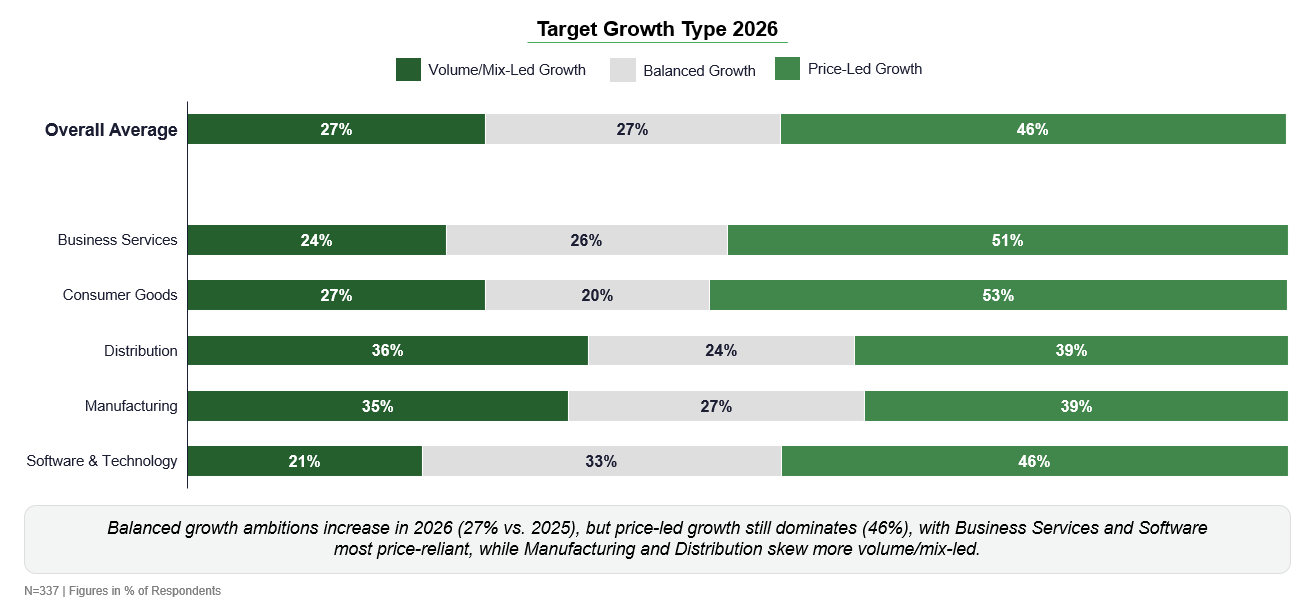

The data shows a clear shift toward pricing as the dominant growth lever heading into 2026. While more organizations aspire to balanced growth, most continue to rely on price actions rather than volume or mix to drive topline performance.

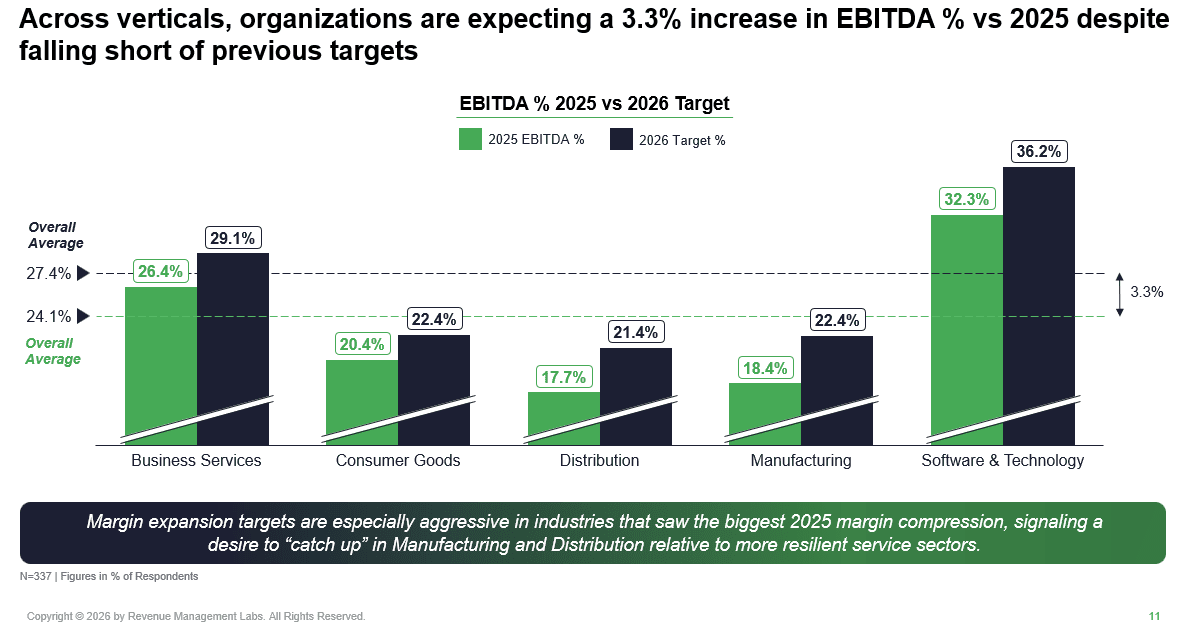

Margin recovery expectations are rising sharply for 2026, reflecting executive pressure to rebuild profitability after sustained cost inflation. However, the gap between actual and targeted margins underscores the challenge of translating pricing actions into sustained EBITDA improvement.

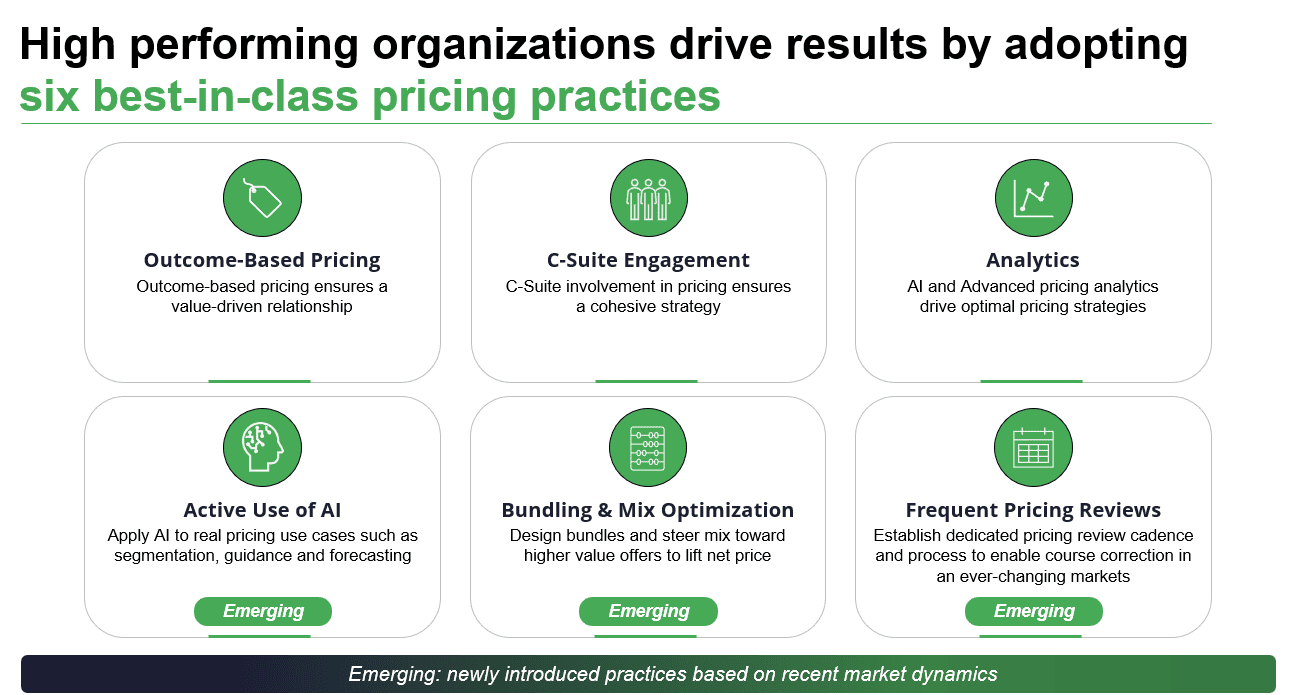

Pricing approaches are becoming more sophisticated, with greater emphasis on value-based pricing, mix optimization, and discount discipline. Execution capability, however, continues to lag strategy, limiting the financial impact of these more advanced pricing models.

Revenue Management Labs conducted the 2026 Executive Pricing Benchmarks Survey through an online survey between November and December 2025, gathering insights from 330+ senior leaders across Europe and North America. Respondents included Vice Presidents, Directors, and C-suite executives, all with direct responsibility for pricing strategy and financial performance.

The survey benchmarks pricing performance from 2025 alongside revenue, pricing, and margin targets for 2026. Questions were designed to assess how organizations are using pricing to drive growth, manage margin pressure, and adapt to changing demand and cost conditions across industries.

In addition to financial outcomes, the survey captures pricing strategy maturity, including value-based pricing adoption, discount discipline, bundling, analytics capabilities, governance models, and the growing use of AI in pricing decision-making. Results are analyzed both in aggregate and by industry to highlight where pricing ambition is accelerating and where execution gaps remain.

58% of respondents represent companies with annual revenues of US$500 million or more*.

We will cover the full results from our 2024 Executive Pricing Survey. See how you compare to your competitors both in past performance and for 2024 pricing strategy.