Case Study: Why Bid Price Optimization Matters

For industrial manufacturers, the bid process is where strategy becomes reality. Every quote is a balancing act between winning the business and maintaining profitability. Too often, sales teams rely on aggressive discounting as the easiest way to secure business. The result is inconsistent margins, shrinking profits, and a lack of pricing discipline across the organization.

Bid price optimization changes this equation. By combining segmentation, win-probability modeling, and profitability analysis, companies can identify the sweet spot where win rates and margins align. This structured approach empowers sales teams, builds customer trust, and creates long-term competitive advantage.

Challenges

This manufacturer, known for technical expertise and service, faced issues common across B2B industries:

- Margin erosion from inconsistent and aggressive discounting

- Low win rates from chasing price-sensitive contractors

- Sales resistance, with reps relying on gut feel over data-driven insights

- Lack of visibility into which customer segments truly drove profitable growth

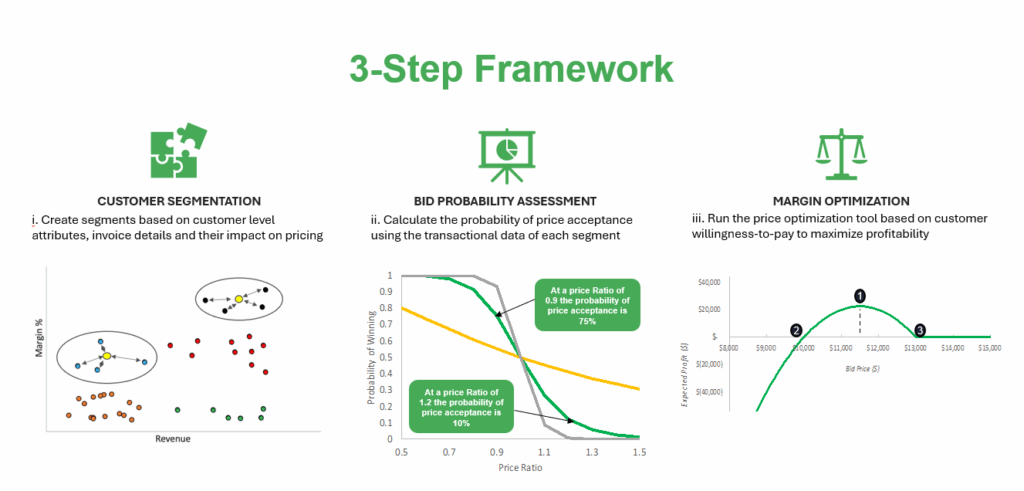

The 3-Step Bid Price Optimization Framework

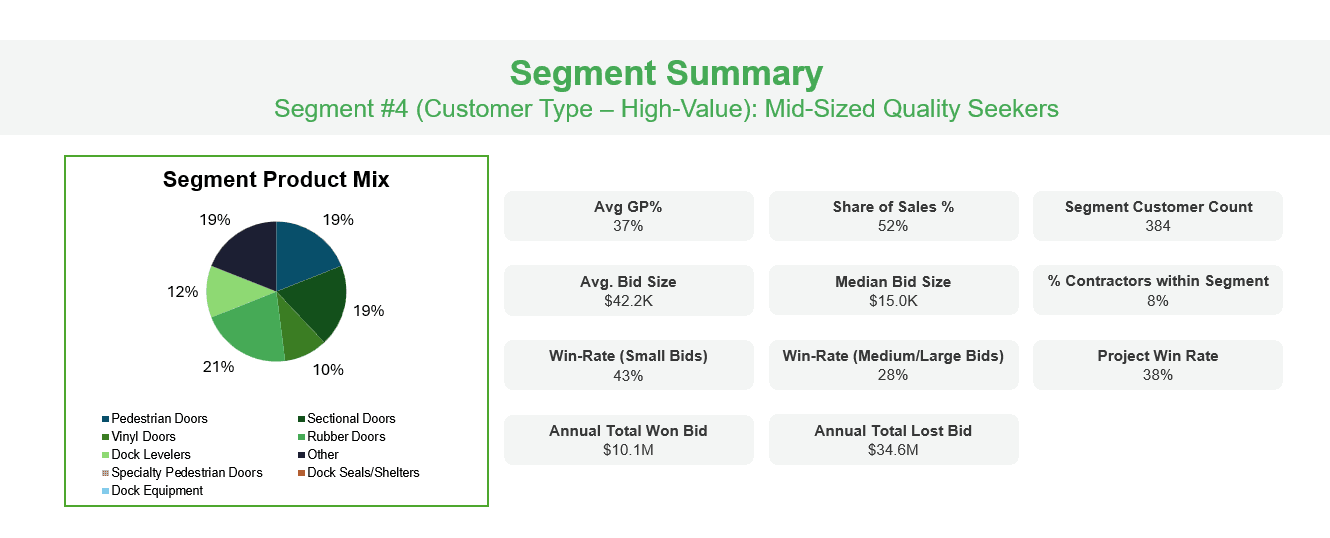

1. Create Price Segments

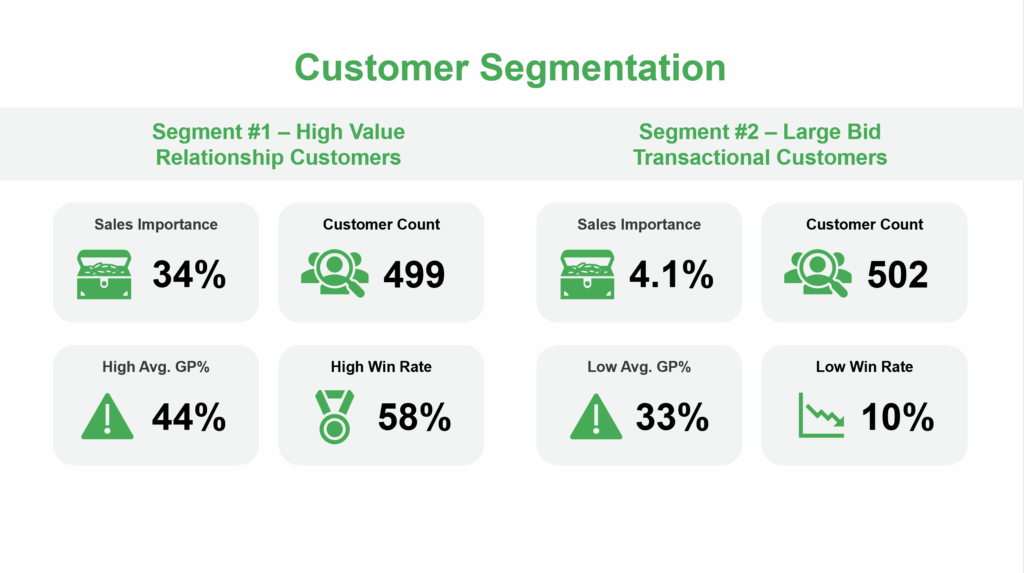

Instead of simple channel-based segmentation (retail, distributor, contractor), customers were grouped using financial and behavioral KPIs such as spend, tenure, discount size, win rate, and margin.

- Relationship customers (≈70% of sales) showed strong loyalty, higher win rates (31–47%), and responded to value-based messaging.

- Transactional customers (≈30% of sales) consumed resources, demanded heavy discounting, and delivered low win rates (10–19%).

This shift revealed where investment created sustainable growth and where resources were being wasted.

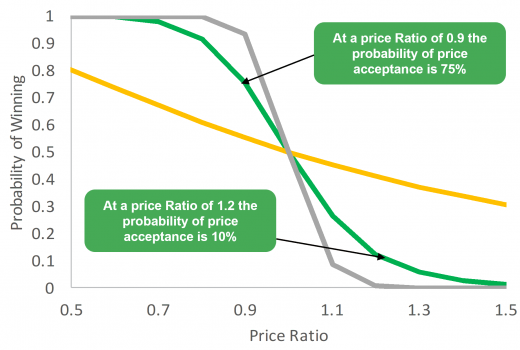

2. Bid Probability Modeling

Historical win/loss data was modeled to calculate the probability of success at different price points.

- Transactional bids: Even with deep discounts, win rates rarely exceeded 15%.

- Relationship-driven bids: Higher win rates were achievable at healthier margins and higher prices when value propositions were reinforced.

The insight: not all customers are equally sensitive to price. Segmenting bids allowed the company to avoid unnecessary discounting.

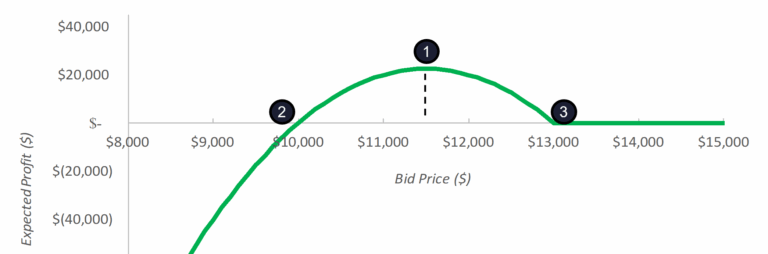

3. Profitability Analysis & Guardrails

Margin data was combined with bid probability to identify optimal bid prices that generate the highest estimated profit for each deal. Discount guardrails and playbooks gave sales reps clarity and confidence.

- Relationship-driven segments saw a 2–4 margin point uplift once discount leakage was reduced.

- Leadership was able to deprioritize transactional bids and double down on loyal, profitable accounts.

Aligning the sales team

A critical success factor was the adoption of a new framework across sales representatives. Instead of positioning analytics as a ‘black box,’ leadership emphasized transparency and explained how the framework supported—not replaced—rep decision-making.

Sales teams were shown:

- Faster approval cycles

- Clear visibility into profitability drivers

- How recommendations tied to customer behavior patterns

This alignment built trust, leading to stronger adoption across the organization.

Results

- 14% year-over-year profit improvement

- 11% increase in win rates

- Clearer customer focus, prioritizing long-term relationship accounts over transactional distractions

- Cultural shift: Sales moved from reactive discounting to evidence-based bidding

Key Takeaways

- Segmentation unlocks growth: Not all customers warrant equal investment.

- Sales adoption depends on trust: Transparency builds confidence in analytics.

- Discipline drives results: Structured frameworks transform pricing into a proactive growth driver.