Pricing, particularly transaction pricing, is vital to a company’s success. While many companies are familiar with transaction price management, most fail to realize what components actually impact the final price of their product and exclusively focus on the List Price or Invoice Price. Using a price waterfall analysis, a company can leverage existing sales transaction data to grow their bottom-line profitability by identifying margin improvement opportunities.

What is a Price Waterfall Analysis?

A price waterfall analysis is simply a visual breakdown of the revenue and margin a company makes from each of its transactions. Price waterfalls determine the actual price (referred to as Pocket Price or Net Price) charged to customers for each transaction, and the margin they make factoring in leakages or deductions (e.g. discounts, allowances and rebates).

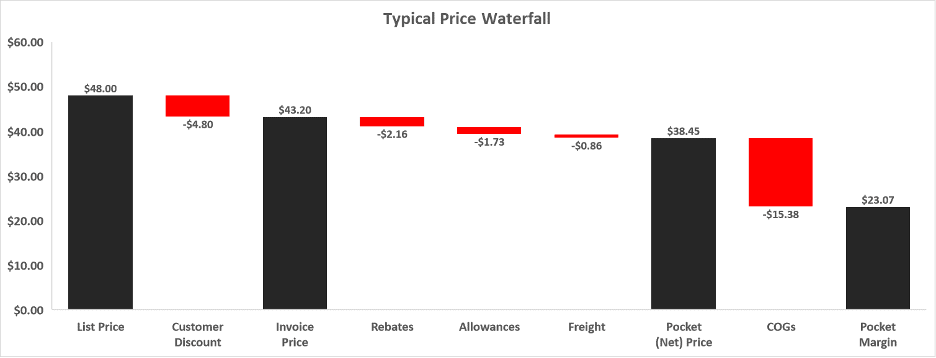

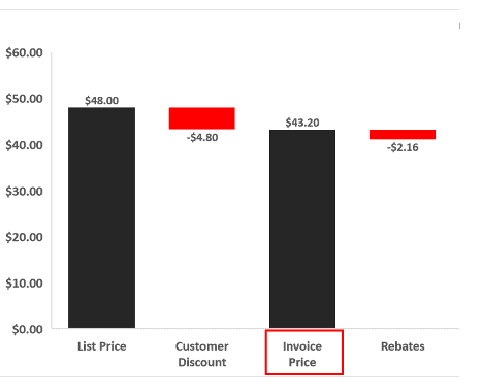

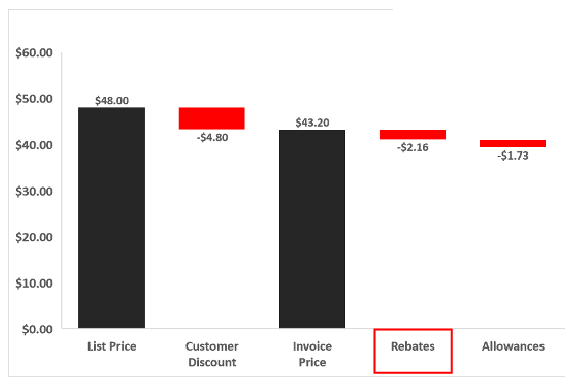

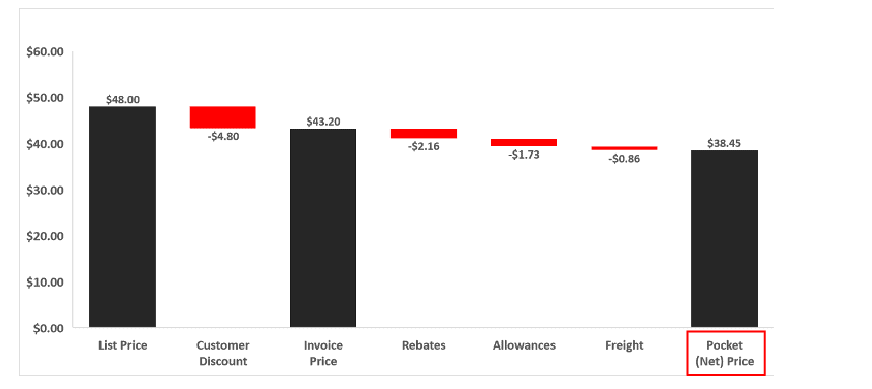

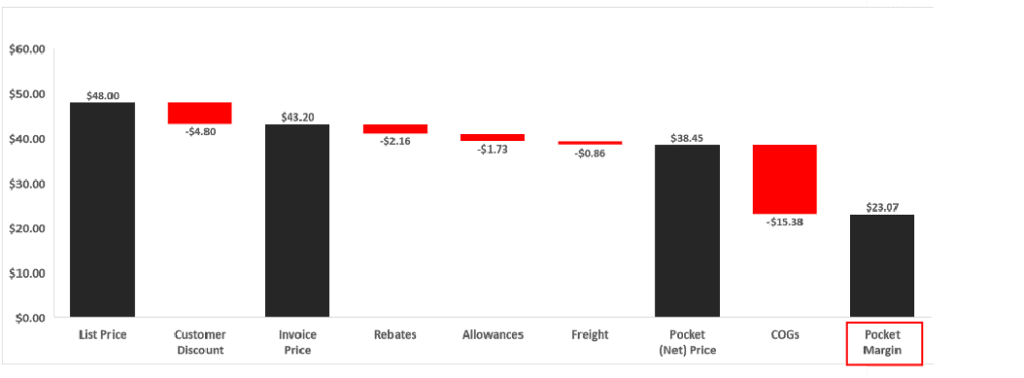

Below is an example of a typical Price Waterfall.

We begin with the List Price and arrive at the Invoice Price, Pocket Price and Pocket Margin

after accounting for various deductions shown by the red bars.

Why Do Price Waterfalls Matter?

The Price Waterfall matters in revenue management because it provides a useful way to leverage your company’s existing sales transaction data to identify margin improvement opportunities. Each leakage or deduction represents an area where adjustments can be made, such as:

- Determine which discounts and allowances are suboptimal and need to be revised or replaced

- Determine which discounts and allowances customers care about most and can influence their buying decisions

- Quantify the financial impact of changing deductions

- Segment customers within a channel

- Determine which products and services are least profitable

- Determine the mix of products and services to sell to customers to augment margin

- Determine which channels provide the most significant opportunity to grow margin

- Determine how actual prices have evolved due to changes in deductions

Being able to execute on the above activities is essential as addressing these issues brings an organization closer to capitalizing upon opportunities to grow the bottom line.

Crucial Note on Leakages/Deductions:

It is vital to understand that these deductions can be broken down into two major groupings: investments and leakages. When executed correctly, discounts, allowances and rebates often characterized as “trade investments or special pricing” help create value and generate a positive ROI. However, when executed poorly, these deductions lead to the destruction of value, do not drive incremental benefit or generate profit and should actively be eliminated or kept to a minimum.

1. Are the deductions contractual or discretionary? If they are contractual, then any revisions would need approval from all parties to the agreement. If they are discretionary, the company can withdraw these without seeking the customer’s consent.

2. Are the deductions conditional or unconditional? If they are conditional, then a discount, allowance or rebate is only provided if the customer meets certain performance (e.g. sales, volume, number of new stores) targets or set KPIs. If unconditional, discounts are provided irrespective of the customer’s performance.

3. To ensure deductions are investments and not expenses, consider the following:

- Deductions should focus on appropriate performance targets across regions, channels, products and customers.

- If unable to shift from partial to full conditionality immediately, develop an approach to increase the percentage of conditional vs. unconditional deductions over time.

- Make it a practice to incorporate conditionality requirements for all items in the contracts and agreements.

How Do You Create a Price Waterfall Analysis?

Components of a Price Waterfall

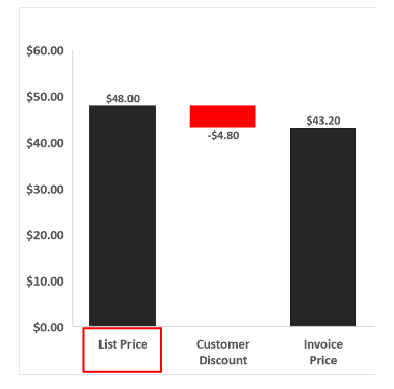

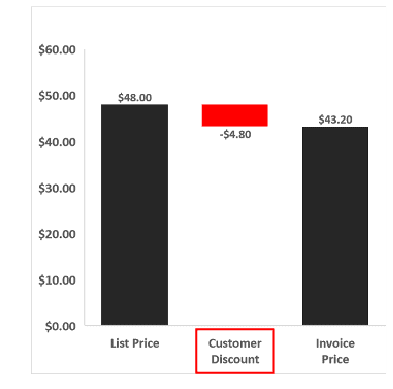

In a B2B scenario, the pricing structure for most companies will begin with a reference price often labelled ‘List Price’ or ‘Base Price,’ which is the starting point for our price waterfall.

These are generally customer-specific discounts that are set considering the relative size/importance of each customer. Examples of other discounts include order size discounts or discounts in place of returns or warranty.

Calculated by deducting discounts from the List Price. Although this is the price that customers make payments based on, it is not the amount that the seller receives as there are further allowances, discounts and rebates deducted from the invoice price.

These are often referred to as “off-invoice price deductions” as they aren’t captured on invoice prices. Standard deductions include discounts for timely payments, marketing and partnership allowances, rebates related to distribution expenses and performance incentives such as sales and volume targets.

This price represents the actual or net revenues generated from each transaction.

These are costs directly attributable to goods produced by a company that have now been sold. In addition to production costs, COGs include the cost to serve a customer.

This is the amount a company receives after subtracting COGs from the Pocket Price.

Contact Us To Learn More About Price Waterfalls!

A Practical Application of

Price Waterfalls

Aftermarket Auto Parts Manufacturer

A leading manufacturer of aftermarket auto parts sells its products manufactured for commercial and personal vehicles to distributors and retailers. The below scenario illustrates how the Price Waterfall can provide useful information.

Scenario: Company XYZ sells a tire (product number: 12345) to a distributor and retailer

As a revenue management professional, it is essential to be able to ask the right questions after examining a Price Waterfall. Below are key observations or considerations that can be deduced based on our example:

- In the above example, Retailer #1 gets a lower marketing rebate but an additional discount of 5% (payment terms) lowering the pocket margin for the aftermarket auto parts manufacturer by 1% or $0.97 less dollars on every transaction.

- Are these discounts and rebates conditional or unconditional?

- Are these discounts and rebates justified for Retailer #1 (e.g. does the retailer need a marketing rebate)?

- Can we make changes to related terms to avoid giving certain discounts/rebates (e.g. reduce the number of days required to pay the invoice price to avoid having to give the payment terms discount)?

- Does Retailer #1 order a large enough quantity for a 3% order size discount?

- How much of the sales volume for this product does each customer account for?

- Which teams need to be approached to investigate the reasons for discrepancies?

- Which mix of products should the company focus on selling to each of these customers to maximize margin?

Challenges of Price Waterfalls

Common roadblocks that hinder an organization’s ability to leverage Price Waterfalls generally stem from infrastructure or structural gaps, such as systems, people, and reporting. These gaps limit access to accurate, frequent and timely transaction data. Even if accurate data is available, it is not routinely accessible.

Structural and Infrastructure Gaps

- Systems: Insufficient data and analytics capabilities in place to support analysis and create well-connected information systems that can measure data at the correct price levels. A good starting point to avoid a systems gap is dedicating staff members to run and manage dedicated infrastructure.

- People: Missing the necessary talent and expertise to facilitate optimized transaction pricing and, once in this is in place, develop support for the pricing function within your organization to drive analysis and garner insights. Companies must ensure a competent leader heads their revenue management function.

- Results, Planning & Reporting: Often, when the necessary systems are in place, organizations fail to use these to monitor and track results effectively. Also, these results, when monitored, are not reported. To ensure monitoring and reporting is happening, it is essential to design or reconfigure your infrastructure, specifically for monitorability.

Conclusion

A deeper understanding of the Price Waterfall and a focus on the Pocket Price or Net Price, as opposed to the Invoice Price, is essential to optimize margin opportunities and make considerable improvements in sales and profitability.

Organizations can benefit from the Price Waterfall’s function of making clear the relative importance and attractiveness of the different channels, customers, segments or products. As shown, a price waterfall analysis allows companies to leverage existing sales transaction data to identify margin improvement opportunities and grow their profitability.

ABOUT THE AUTHOR Abdullah Calafato is an Associate at Revenue Management Labs. Revenue Management Labs help companies develop and execute practical solutions to maximize long-term revenue and profitability. Connect with Abdullah at acalafato@revenueml.com.